Facebook Shares Explode Higher After Big Q1 Beat, Warns Of “Significant” Slowdown In Last Few Weeks

Facebook shares are soaring after hours – back above $200 – after beating top line as well as better than expected daily- and monthly-active users, as engagement improved…

-

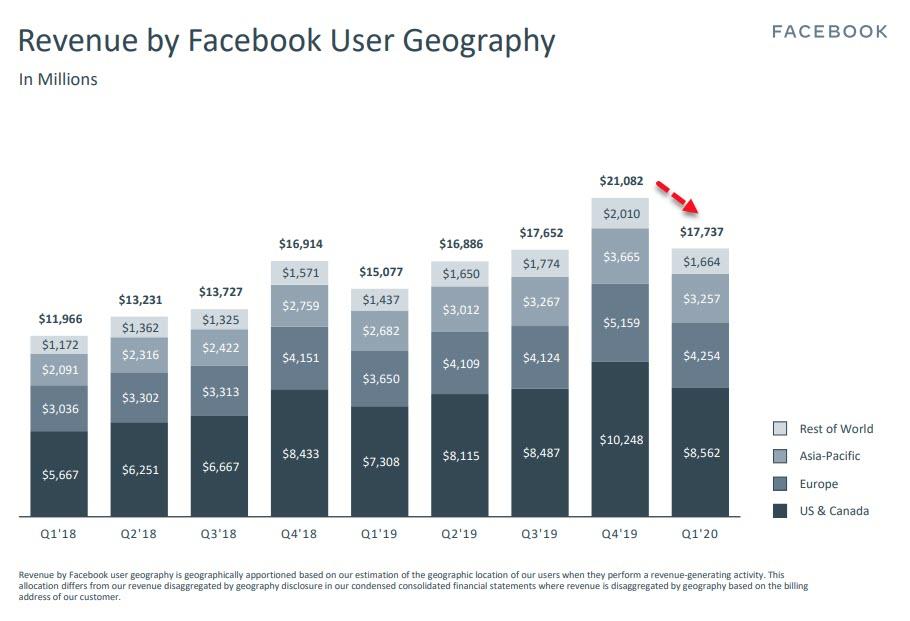

1Q Rev. BEAT $17.74B, Est. $17.27B (up 18% YoY)

-

1Q Ad Rev. BEAT $17.44B, Est. $17.10B (Up 17% YoY)

-

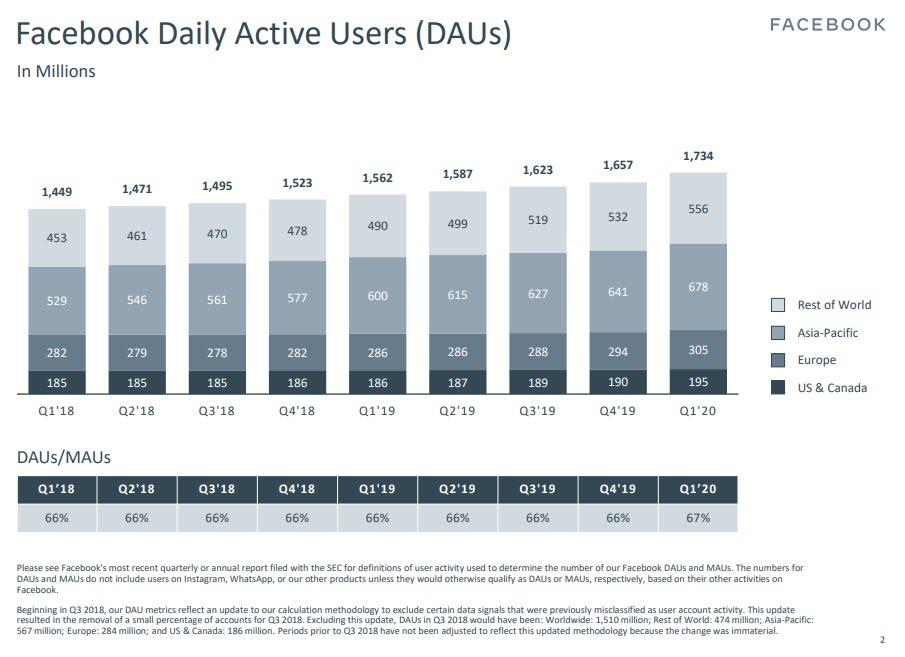

1Q Daily Active Users BEAT 1.73B, Est. 1.68B

-

1Q Monthly Active Users BEAT 2.60B, Est. 2.34B

All good news, but they do warn on revenues going forward (though do not offer guidance)…

We experienced a significant reduction in the demand for advertising, as well as a related decline in the pricing of our ads, over the last three weeks of the first quarter of 2020. Due to the increasing uncertainty in our business outlook, we are not providing specific revenue guidance for the second quarter or full-year 2020, but rather a snapshot on revenue performance in the second quarter thus far.

After the initial steep decrease in advertising revenue in March, we have seen signs of stability reflected in the first three weeks of April, where advertising revenue has been approximately flat compared to the same period a year ago, down from the 17% year-over-year growth in the first quarter of 2020. The April trends reflect weakness across all of our user geographies as most of our major countries have had some sort of shelter-in-place guidelines in effect.

But the market doesn’t care – it’s panic-buying…

…maybe we should have a pandemic-driven global lockdown more often? However, Facebook isn’t immune to coronavirus.

“Like all companies, we are facing a period of unprecedented uncertainty in our business outlook. We expect our business performance will be impacted by issues beyond our control, including the duration and efficacy of shelter-in-place orders, the effectiveness of economic stimuli around the world, and the fluctuations of currencies relative to the U.S. dollar.”

Finally, on expenses, Facebook slightly decreases its expense range for 2020, to be between $52 billion and $56 billion, but said it’s committed to continuing to invest in product development and the recruitment of technical talent. Also the amount towards coronavirus recovery spend, around $300 million, will have an impact on earnings.

Tyler Durden

Wed, 04/29/2020 – 16:15