Goldman Turns Bullish On Oil, Sees Brent Rallying Back To $30 In Q3

Now that the USO has been terminally crushed and all those 220,000 Robin Hood BTFD chasers have suffered catastrophic losses, Goldman – which several weeks ago correctly predicted that the price of landlocked oil such as WTI could turn negative – is turning bullish.

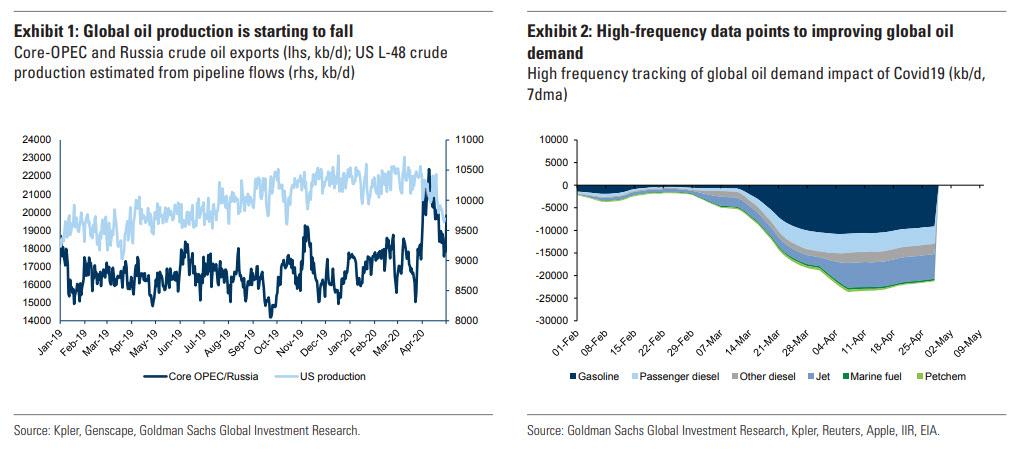

In a note from Goldman’s Damien Courvalin, the energy strategist writes that “oil fundamentals are finally showings signs of improvement, likely accelerated by the recent historic collapse in prices” as “supplies are declining quickly, with signs of demand improving even ahead of lockdown measures being eased.” And while the inflection into a deficit is still a few weeks away, “it now appears likely that the market is passing its test on storage capacity.”

Some more details from the Goldman note on the key topic of storage:

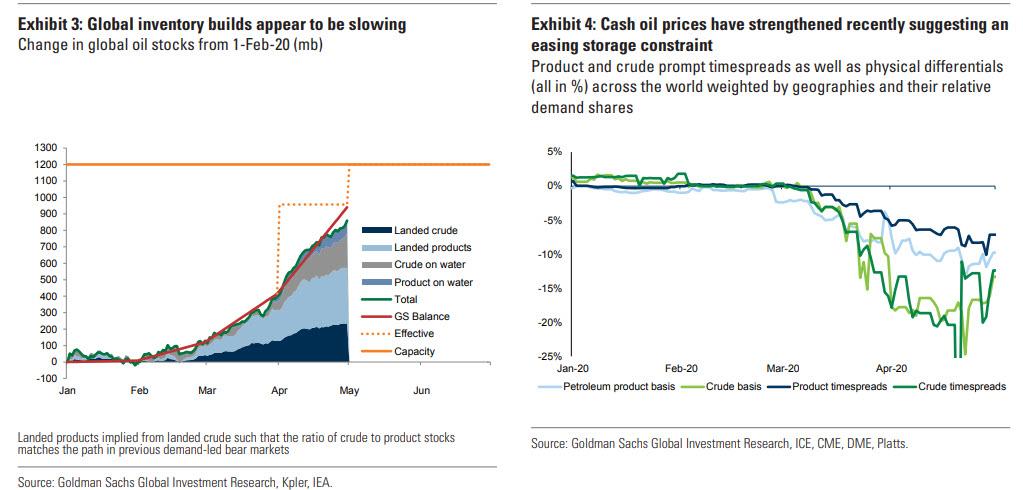

To be clear, the physical oil market is still in surplus and the inflection into a deficit is still a weeks away in our view. But, it now appears likely that the market is passing its test on storage capacity, due to improving fundamentals (inventory builds appear to be slowing), new creative forms of storage being put in place (rail cars, old pipelines, more boats) and a likely c.1 mb/d smaller May surplus than previously expected (mostly due to a faster demand rebound). As we have shown previously, physical prices typically offer the best insight in periods of extreme fundamental uncertainty, and strengthening cash assessments for US crudes suggests that production cuts are likely staving off local storage saturation. With the market rebalancing now in motion, we expect a three-stage oil price rally, from relief, to cyclical tightening, and finally structural repricing.

And so, with the market’s rebalancing now in motion, Goldman expects a three-stage oil price rally, from relief, to cyclical tightening, and finally structural repricing. With financial crude futures markets set to trade July barrels in just a couple weeks, Goldman thinks that the recent rally can extend further in May, back to cash-cost levels ($25/bbl for WTI), albeit with still-high price volatility. It wasn’t clear if this volatility potentially includes another negative price moment this month when the prompt contract again goes negative if there is incremental supply and no storage to put it in.

That said, beyond this relief rally, Goldman cautions that the oil bull market that we forecast will take time and require patience. The key issue, as everyone saw on April 20, is that oil remains a physical asset and will therefore need to first price to clear the substantial inventory overhang through 2H20, leaving the commodity to lag the rally in related anticipatory financial assets like equities.

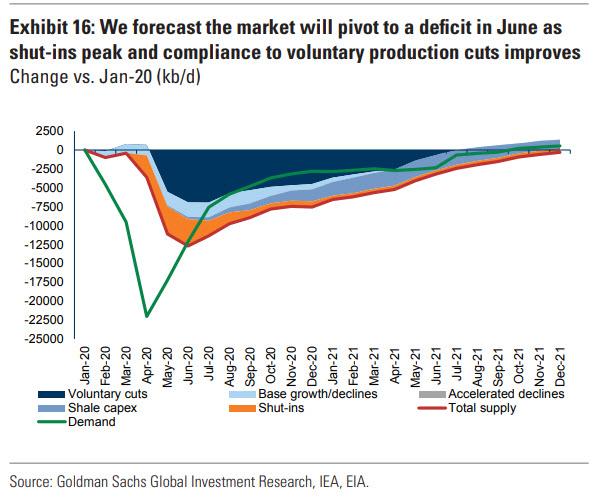

Looking further ahead, Goldman’s updated 2020 and 2021 global oil supply-demand balance continues to point to a record large surplus in 2Q20 of 8.6 mb/d and an unprecedented peak build in global oil inventories to its effective maximum capacity of c.1,200 mb. However, in a change from its previous dismal projections, the bank now forecasts that lower supply in 2021, due to higher decline rates, will more than offset a more cautious demand outlook, putting the global oil market in a persistent deficit from 3Q20 onward.

With OPEC initially leaning into this deficit, we expect that the inventory overhang will normalize by the end of 2Q21. At that point, we forecast that core-OPEC and Russia production will finally exceed their 1Q20 level with a restart in shale activity also needed as the 4Q21 deficit reaches 1.2 mb/d and inventories fall well below average levels.

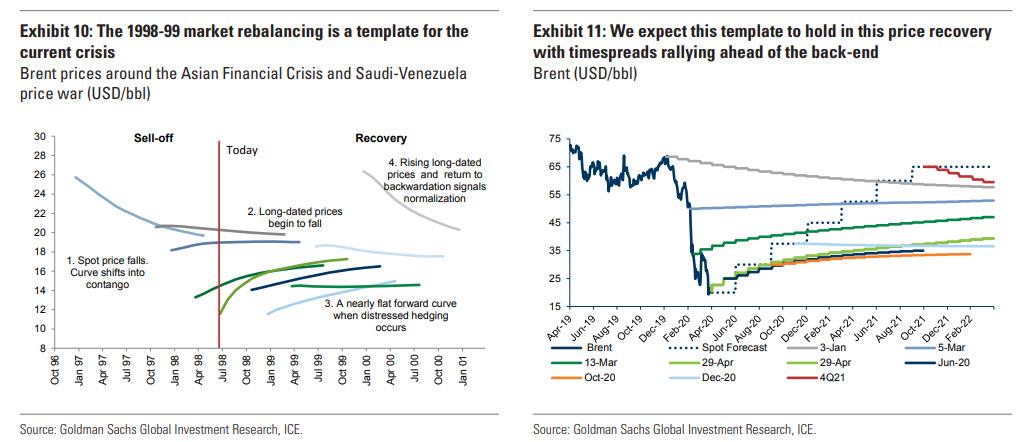

In many aspects, this fundamental path is similar (although faster and more violent) to that which occurred in 1998-99 (when an OPEC market share battle occurred as the Asian crisis hit global demand). In particular, the lasting impacts of the sharp upstream capex cuts in 2020 should finally enable OPEC to both increase production and market share in 2021 and presages a return of a necessary new investment phase in upstream capacity in coming years.

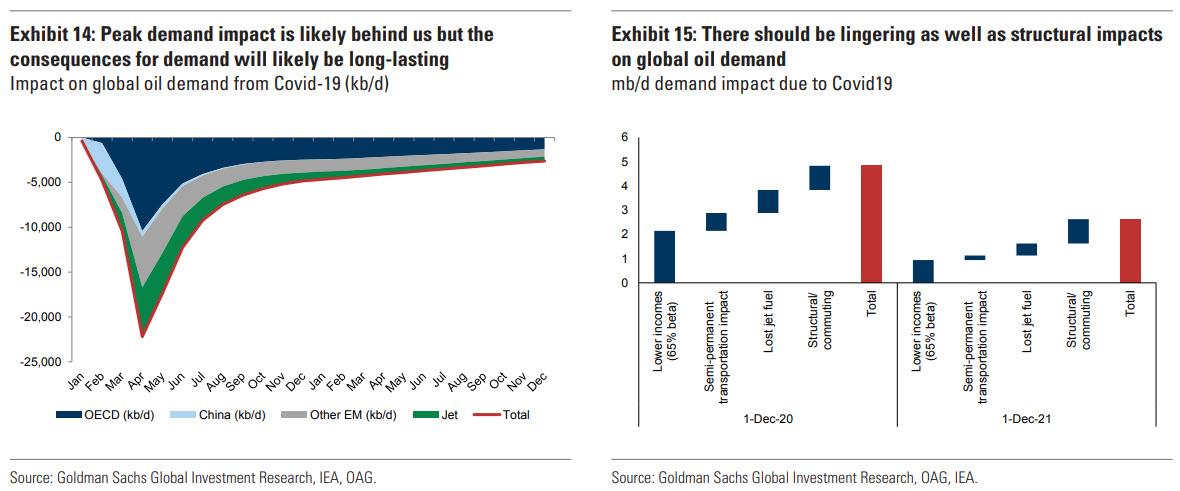

Surprisingly, while Goldman is clearly turning more bullish on oil after the “violent rebalancing”, it is are downgrading its 2H20

and 2021 demand forecasts despite observing a “demand restart which is surprising to the upside.” Goldman now expects 4Q20 demand to still be down 5 mb/d from pre-virus levels (with 2021 demand still 3.6 mb/d impaired). Beyond: (1) the impact of lower incomes (assuming a normal relationship between GDP and oil demand), Courvalin now also assumes persistent demand impacts from (2) the disproportionate transportation hit (over GDP) of lingering isolation measures, (3) a

lasting impact on cruises and jet demand (consistent with SARS and 9/11 with half of jet demand also business-related), and finally (4) a permanent change in behavior such as working from home (with c.9 mb/d of oil demand for commuting). The impact of each of these four factors is -2.1/-0.75/-0.95/-1 and -0.9/-0.2/-0.5/-1 mb/d in late 2020 and 2021 respectively.

Yet while demand will demand depressed, what is more important is that supply cuts are finally kicking in:

Public announcements of global production shut-ins (outside of the OPEC+ cuts) amount to c.2.2 mb/d, with the actual number likely larger given the lack of disclosure by NOCs and private producers. This suggests that the market is progressing towards our estimate of 3.5 mb/d of shut-ins required at the binding effective storage constraint in April-May. This shut-in target is 0.5 mb/d smaller than previously, given slightly higher estimated demand and storage capacity (with evidence of marginal forms of storage being created due to extremely low prices).

As expected, shut-ins are mostly occurring among inland producers (US, Canada) where storage constraints have been the greatest due to the decline in local refinery intake. Key to the market rebalancing in 2021 will be which fields remain impacted, as this would reduce global production capacity. For example, shut-in production in low pressure conventional reservoirs may be vulnerable to damage, requiring either prohibitively expensive workovers or leading to higher GORs. As we await greater clarity on such permanent impacts, we conservatively assume that only 500 kb/d of these shut-ins is lost in 2021, with the remaining 3.5 mb/d of shut-ins unwinding mostly through 3Q20

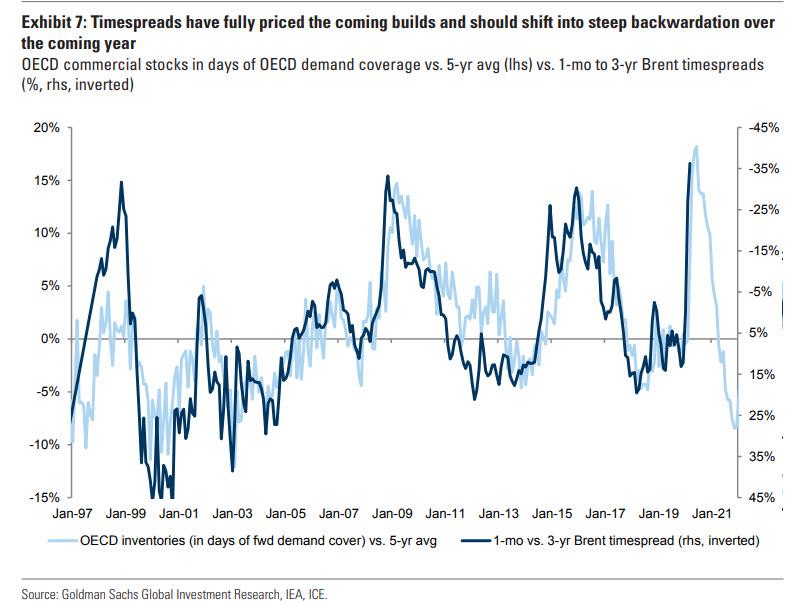

In any case, once we get to the cyclical stage of the recovery, Courvalin expects the inventory normalization process to first drive a flattening of the Brent forward curve around $30/bbl in 3Q20. As the deficit grows, this will be followed by a steady move higher in spot prices due to a steepening level of backwardation through 2Q21.

Eventually, in a world where the only cure for high oil prices are low oil prices, the higher decline rates, sticky shut-in capacity losses (then again one wonders just how “sticky” shale shutdowns are) and a much higher cost of capital for the industry will finally set the stage for both higher OPEC market share and prices, the structural consequence of the ongoing violent rebalancing, leading Goldman to raise its 4Q21 Brent forecast to $65/bbl (from $60/bbl).

Meanwhile, to patiently trade the oil recovery, Goldman recommends entering two new trades. First, a long Dec-20 vs. Dec-21 Brent timespreads position, to capture the shift of the forward curve into backwardation.

Second, it recommends entering a long 3Q21 RBOB gasoline position which should also benefit from consumers’ preference for cars over subway, buses, and planes.

Tyler Durden

Fri, 05/01/2020 – 12:58