Gundlach Stunned To Learn Fed Hasn’t Purchased A Single Corporate Bond Yet

Yesterday, when discussing the Fed’s latest $6.66 trillion balance sheet, we said that more than one month after the Fed announced its backstop for investment grade bonds and ETFs (followed shortly after by an expansion into fallen angel junk bonds), “what is most interesting is that so far the Fed has not yet purchased a single corporate bond, whether investment grade of fallen angel junk. In other words, without lifting a finger, the Fed’s “whatever it takes” jawboning managed to inject trillions “in value” in countless debt and credit products.”

Today, none other than the bond king Jeff Gundlach made this discovery, tweeting that “the Fed has not actually bought any Corporate Bonds via the shell company set up to circumvent the restrictions of the Federal Reserve Act of 1913. Must be the most effective jawboning success in Fed history if that is true.”

I am told the Fed has not actually bought any Corporate Bonds via the shell company set up to circumvent the restrictions of the Federal Reserve Act of 1913. Must be the most effective jawboning success in Fed history if that is true.

— Jeffrey Gundlach (@TruthGundlach) May 1, 2020

He’s right: the Fed – or rather Blackrock which is doing the Fed’s bidding in the open market as part of operation Covid bailout- has indeed not purchased a single bond, whether IG or HY.

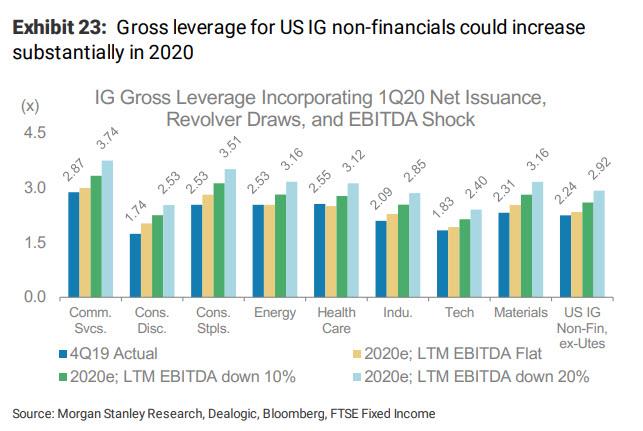

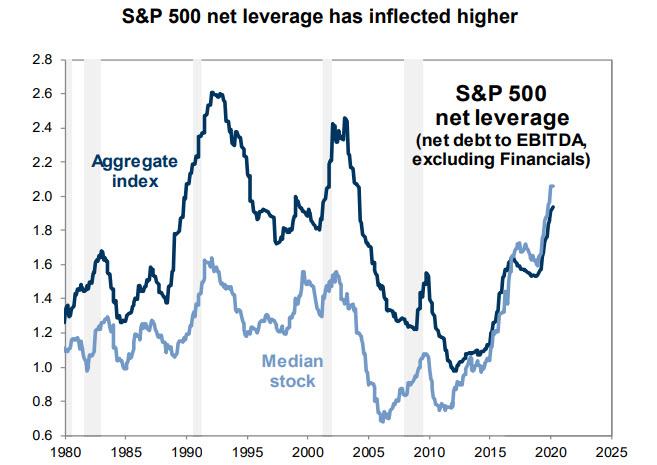

And why should the Fed get its hands dirty and enter the corporate bond market if all it takes is a promise that it could enter the market. There is just one problem: if the lack of purchases comes as a surprise to Gundlach, what about the rest of the market, where the majority of investors appear rather confident that they are merely flipping bonds to the Fed when in reality they are just trading among each other in piece of paper that are already massively overvalued as we discussed last weekend in “Unprecedented Pace Of Corporate Debt Issuance Has Crippled Corporate Fundamentals“, and where as Morgan Stanley pointed out, leverage is already exploding even as bond prices soar!

However, now that the Fed’s unwillingness to enter the market is a “thing”, it may leave Powell with no other choice than to start buying.

In fact, as Bank of America writes today in “A Note To Fed” – a report apparently meant to precipitate the Fed’s decision to get off the fence and to start waving it in “a lot of investors (including non-credit ones) have bought IG corporate bonds the past two months on the expectation they can sell to you. So would be helpful if you soon began buying broadly and in size.”

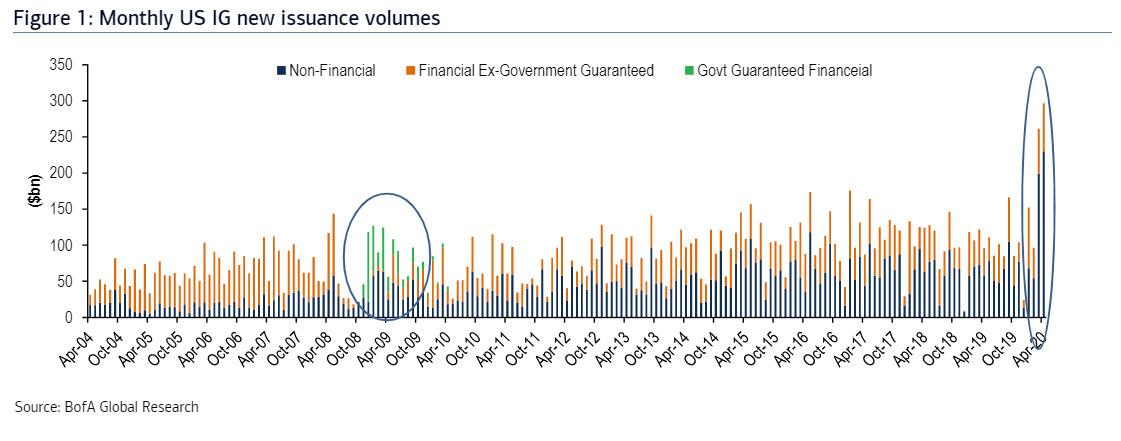

The problem, if the Fed does not start “buying broadly and in size” is that the bond market may soon suffer from a very painful indigestion of the record IG bond issuance that has taken place in the past two months, first profiled here.

And, as BofA updates, new investment grade issuance reached another monthly record of $296.6bn in April following a $261.4bn tally in March – significantly above the previous record of $175.5bn from January 2017 – bringing the YTD cumulative to $807.1bn, the fastest start to the year ever and 82% ahead of the pace in 2019.

Some more details on what all this new debt is being put to use for:

Refinancing-related issuance remains high at $100.6bn, including $52.4bn going towards commercial paper and credit revolver repayments. In addition we estimate $104.1bn of COVID-19 liquidity-related issuance from banks and companies that drew credit lines or mentioned liquidity in the use of proceeds language, and $58.6bn of frontloaded issuance for M&A, share buybacks, dividends, and capex (some deals fit multiple categories). New issue performance improved in April. With $59.4bn of redemptions in April, net issuance totaled $237.2bn when defined as gross issuance minus maturities, calls, tenders and open market repurchases.

Use of funds notwithstanding, the bigger issue is that so far the record supply glut has only been made possible due to the seemingly endless IG demand that has enabled this unprecedented issuance flood. However, if investors start asking when and how they will be able to flip all this massively overpriced paper to the dumbest, price-indiscriminate buyer in the room – i.e., the Fed – first the demand and then the supply could collapse.

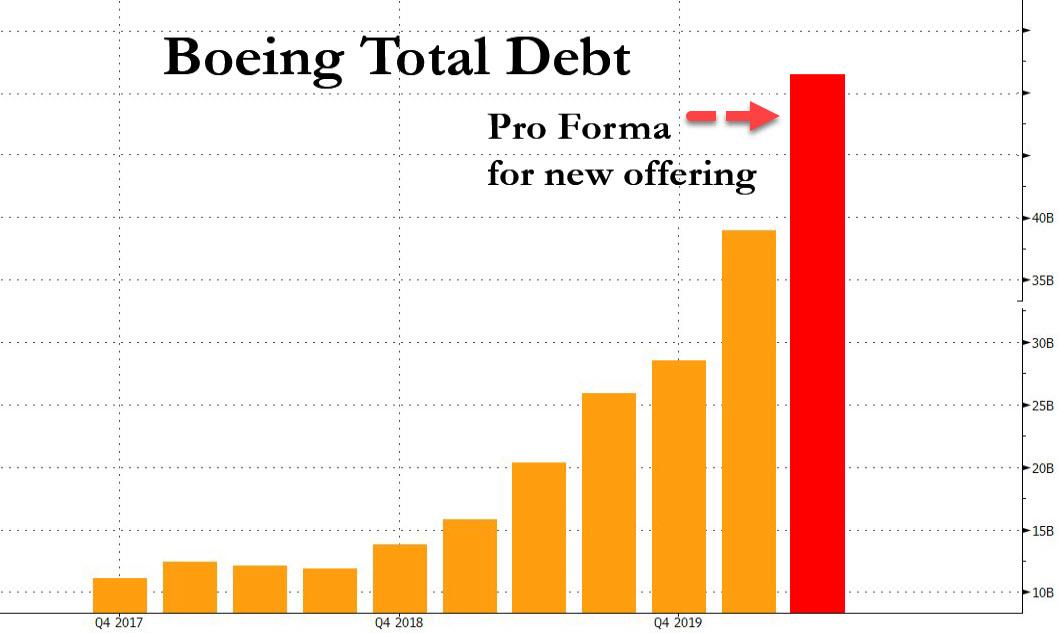

Which begs the question: while Mario Draghi managed to get away for years with merely vowing to do “whatever it takes” to restore confidence in the euro, will Powell be able to repeat the ECB veteran’s record and cause another massive bond bubble a la what Boeing has managed to do in just a few short weeks with its latest $25BN bond issuance…

… without lifting a finger, and instead let his successor deal with the even bigger debt crisis that is guaranteed to follow as the average IG credit metric is now smack in the middle of what was one junk bond territory?

Tyler Durden

Fri, 05/01/2020 – 19:59