Key Events In This Just As Busy, Event-Filled Week

While last week saw an unprecedented pace of newsflow with a non-stop barrage of corporate earnings repots, economic data and central bank announcements, the news deluge continues for another week.

The main highlight this week, according to DB’s Jim Reid, will be Friday’s US job numbers. We’ll also see PMIs in the early part of this week, more companies reporting, more central bank meetings (including the BoE Thursday), and another Euro Area finance minister’s videoconference. We could also get a potential black swan curveball event then the German Constitutional Court issues its final verdict on the ECB’s PSPP program tomorrow. Consensus expects a begrudging acceptance of the ECB’s involvement in financing member states and we all move on. However, one to keep a little attention on.

Ahead of payrolls Friday, DB’s US economists are forecasting an unprecedented -22 million fall in nonfarm payrolls, which would by far be the biggest monthly decline in the data going back to 1939, with the previous record being ‘only’ a -1.959m decline back in September 1945 just as WWII ended. They’re also forecasting a rise in the unemployment rate to 18.0%, which would be the highest unemployment rate for the US since the same war. With the jobless numbers set to reach unprecedented levels, investors will also be paying attention to the more up-to-date weekly initial jobless claims from the US on Thursday, which will cover the week up to May 2. The previous 6 weeks have seen a total of over 30m claims, though the last 4 weeks in a row have seen a decline from the peak, offering hope that the most rapid period of job losses may have passed.

The other data that will gain attention this week are the PMI releases from around the world. Thanks to various public holidays, the releases will be more scattered this week, with PMIs from various G20 countries coming out each day. See the day-by-day calendar at the end for the full run down (along with all the other releases) but today sees the manufacturing numbers from those on Labor Day holiday on Friday.

Earnings season continues apace over the coming week, with 159 S&P 500 companies reporting and a further 104 in the STOXX 600.

Highlights include AIG and Tyson Foods today, followed by Disney, Total, BNP Paribas and Fiat Chrysler tomorrow. Wednesday then sees reports from Novo Nordisk, PayPal, TMobile, General Motors, Credit Agricole, UniCredit and BMW. On Thursday, we’ll hear from Bristol Myers Squibb, Danaher, Raytheon Technologies, Linde, ArcelorMittal, AB InBev, Nintendo, Uber, IAG and Air France-KLM. Lastly on Friday, Wirecard, Siemens and Nomura will be announcing.

So far, 55% of S&P 500 companies have reported Q1 earnings, and in aggregate earnings are missing by -2.5% (vs. beating by 3.4% in an average quarter) and have fallen 16.6% year-over-year. Blended EPS growth for the index looks set to contract by -13%, which would be the worst quarter since 2009. However this is driven by a large downside skew, with median company growth on track to be only modestly negative at -0.9%. Much like GDP earlier last week, these numbers are likely to be worse in Q2 because most of the shutdowns were enacted at the end of March.

Courtesy of Deutsche Bank, here is a day-by-day calendar of events

Monday

- Data: April Manufacturing PMIs from Indonesia, South Korea, India, Turkey, Italy, France, Germany Euro Area, South Africa, Brazil and Mexico, US March factory orders, final March durable goods orders, nondefence capital goods orders ex air, Italy April new car registrations

- Earnings: AIG, Tyson Foods

Tuesday

- Data: April Services and composite PMIs from Australia, UK and US, UK April new car registrations, Euro Area March PPI, Canada March international merchandise trade, US March trade balance, April ISM non-manufacturing index

Central Banks: Reserve Bank of Australia monetary policy decision, Fed’s Evans, Bostic and Bullard speak - Earnings: Disney, Total, BNP Paribas, Fiat Chrysler

Wednesday

- Data: April Services and composite PMIs from India, Italy, France, Germany, Euro Area and Brazil, Germany March factory orders, UK April construction PMI, Euro Area March retail sales, US weekly MBA mortgage applications, US April ADP employment change

- Central Banks: Brazilian central bank monetary policy decision, Fed’s Bostic speaks

- Earnings: Novo Nordisk, PayPal, T-Mobile, General Motors, Credit Agricole, UniCredit, BMW

Thursday

- Data: April services and composite PMIs from China and Russia, China April trade balance, UK final April GfK consumer confidence, Japan April monetary base, Germany March industrial production, April construction PMI, France March industrial production, trade balance, Italy March retail sales, US weekly initial jobless claims, preliminary Q1 nonfarm productivity, unit labour costs, March consumer credit

- Central Banks: Bank of England and Norges Bank monetary policy decisions, Fed’s Harker speaks

- Earnings: Bristol Myers Squibb, Danaher, Raytheon Technologies, Linde, ArcelorMittal, AB InBev, Nintendo, Uber, IAG, Air France-KLM

- Other: EU Commission releases latest economic forecasts

Friday

- Data: Japan March labour cash earnings, final April services and composite PMIs, Germany March trade balance, Canada April housing starts, net change in employment, unemployment rate, March building permits, US April change in nonfarm payrolls, unemployment rate, average hourly earnings, final march wholesale inventories

- Central Banks: RBA releases quarterly statement on monetary policy

- Earnings: Wirecard, Siemens, Nomura

- Politics: Eurogroup video conference taking place

* * *

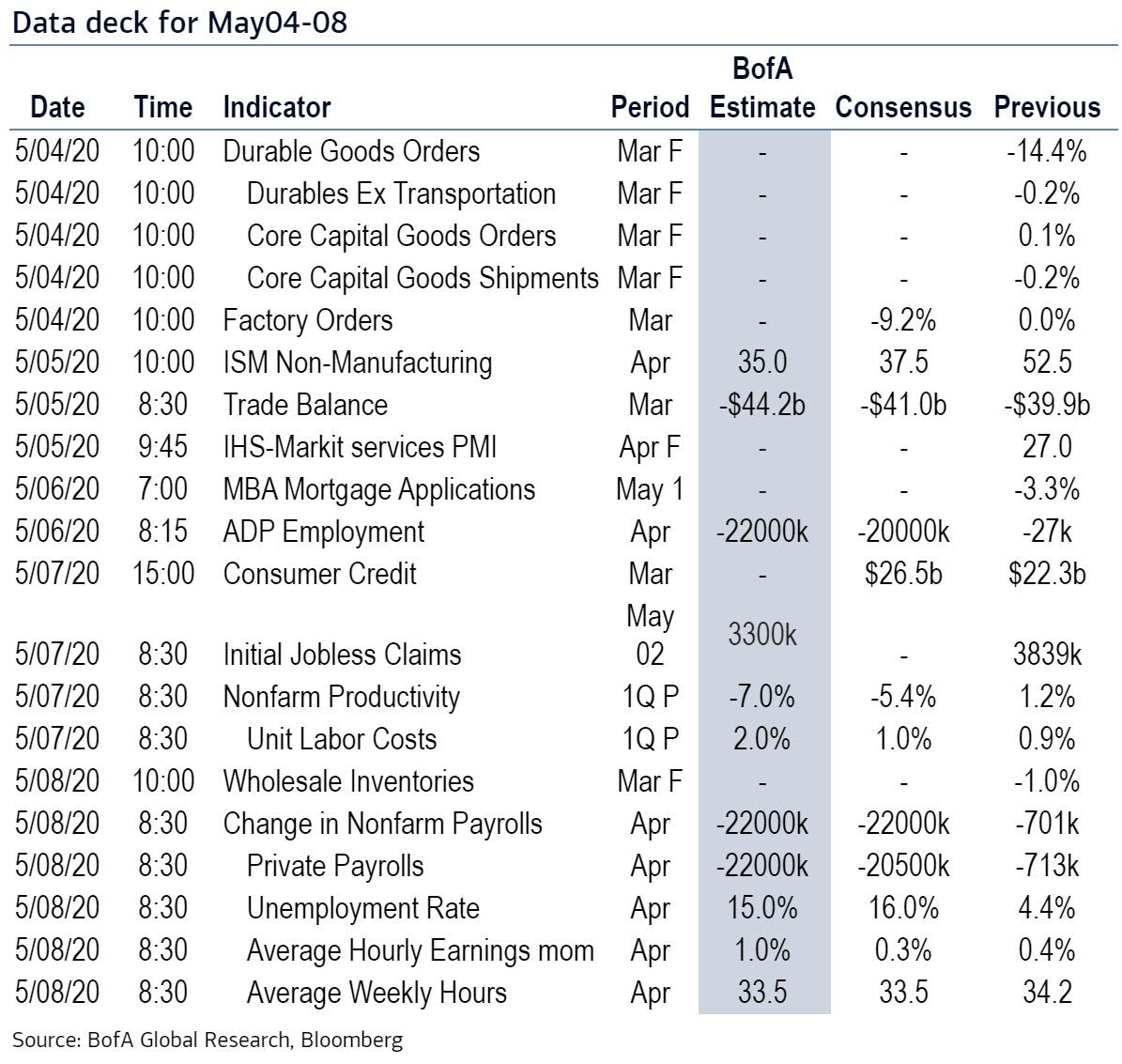

Focusing on just the US, the most important economic data releases next week are the ISM non-manufacturing index on Tuesday, the jobless claims report on Thursday, and the employment report on Friday. There are several scheduled speaking engagements by Fed officials this week. Here are the US-focused key events on a day by day basis:

Monday, May 4

- 10:00 AM Factory Orders, March (GS -9.5%, consensus -9.2%, last flat); Durable goods orders, March final (last -14.4%); Durable goods orders ex-transportation, March final (last -0.2%); Core capital goods orders, March final (last +0.1%); Core capital goods shipments, March final (last -0.2%): We estimate factory orders declined by 9.5% in March following a flat reading in February. Durable goods orders fell in the March advance report.

Tuesday, May 5

- 08:30 AM Trade balance, March (GS -$44.9bn, consensus -$44.2bn, last -$39.9bn); We estimate the trade deficit increased by $5.0bn in March to $44.9bn, reflecting a sharp widening in the goods trade deficit and our estimate of fewer services exports.

- 10:00 AM ISM non-manufacturing index, April (GS 38.0, consensus 37.0, last 52.5); Our non-manufacturing survey tracker fell by 10.9pt to 34.7 in April, following soft regional service sector surveys. We expect the ISM non-manufacturing index to drop by 14.5pt to 38.0 in the April report.

- 10:00 AM Chicago Fed President Charles Evans (FOMC non-voter) speaks; Chicago Fed President Charles Evans will provide a briefing to reporters on a conference call. Prepared text is not expected. Q&A is expected.

- 02:00 PM Atlanta Fed President Raphael Bostic (FOMC non-voter) speaks; Atlanta Fed President Raphael Bostic will participate in a virtual discussion on affordable housing and aid for low-wage earners during and beyond the coronavirus pandemic. Prepared text is not expected. Audience Q&A is expected.

- 02:00 PM St. Louis Fed President James Bullard (FOMC non-voter) speaks; St. Louis Fed President James Bullard will take part in webinar hosted by the National Association for Business Economics on the coronavirus pandemic. Prepared text is not expected. Media and audience Q&A is expected.

Wednesday, May 6

- 08:15 AM ADP employment report, April (GS -19,000k, consensus -20,500k, last -27k); We expect a sharp drop in ADP payroll employment (-19mn, mom sa), reflecting the impact of higher jobless claims, lower oil prices, and other ADP model inputs. However, we believe the ADP report is likely to significantly understate the true pace of job loss due to model-fitting and the ADP employment panel structure itself (barring a change in methodology in the upcoming report). While we believe the ADP employment report holds limited value for forecasting the BLS nonfarm payrolls report, we find that large ADP surprises vs. consensus forecasts are directionally correlated with nonfarm payroll surprises.

- 01:30 PM Atlanta Fed President Raphael Bostic (FOMC non-voter) speaks; Atlanta Fed President Raphael Bostic will participate in a webinar hosted by the USC Lusk Center for Real Estate on the Fed’s reaction to the coronavirus pandemic. Prepared text is not expected. Audience Q&A is expected.

Thursday, May 7

- 8:30 AM Nonfarm productivity (qoq saar), Q1 preliminary (GS -5.7%, consensus -5.5%, last +1.2%); Unit labor costs, Q1 preliminary (GS +4.5%, consensus +3.8%, last +0.9%): We estimate non-farm productivity growth fell by 5.7% Q1 qoq saar (-0.6% yoy). This reflects relatively larger declines in business output than in hours worked in Q1. We expect Q1 unit labor costs—compensation per hour divided by output per hour—to increase to +4.5% qoq ar (+1.7% yoy).

- 08:30 AM Initial jobless claims, week ended May 2 (GS 2,800k, consensus 3,000k, last 3,839k); Continuing jobless claims, week ended April 25 (consensus 19,600k, last 17,992k); We estimate initial jobless claims declined but remain elevated at 2,800k in the week ended May 2.;

- 08:30 AM Atlanta Fed President Raphael Bostic (FOMC non-voter) speaks; Atlanta Fed President Raphael Bostic will participate in a webinar hosted by the South Florida Business Council on the financial implications of the coronavirus. Prepared text is not expected. Audience Q&A is expected.

- 12:00 PM Minneapolis Fed President Neel Kashkari (FOMC voter) speaks; Minneapolis Fed President Neel Kashkari will speak with North Dakota Commerce Commissioner Michelle Kommer about the economic effects of the coronavirus. Prepared text is not expected. Audience Q&A is expected.

- 04:00 PM Philadelphia Fed President Patrick Harker (FOMC voter) speaks; Philadelphia Fed President Patrick Harker will speak in a virtual discussion with the Chicago Council of Global Affairs on the Fed’s response to the coronavirus pandemic. Prepared text is expected. Audience Q&A is expected.

Friday, May 8

- 08:30 AM Nonfarm payroll employment, April (GS -24,000k, consensus -21,300k, last -701k); Private payroll employment, April (GS -24,000k, consensus -21,700k, last +228k); Average hourly earnings (mom), April (GS +1.0%, consensus +0.3%, last +0.4%); Average hourly earnings (yoy), April (GS +4.0%, consensus +3.3%, last +3.1%); Unemployment rate, April (GS 14.0%, consensus 16.0%, last 4.4%): We estimate nonfarm payrolls declined by 24 million in April, reflecting a surge in business closures and temporary layoffs related to the coronavirus. Employment surveys have fallen sharply, and initial claims during the April payroll month rose by 23.4 million versus a year ago despite major filing delays in some states. Alternative data also indicate sharp declines in commuting patterns across the country. We also believe the BLS is likely to impute zero employment for many of the “non-essential” businesses that were unable to complete the survey this month—echoing the approach adopted in the aftermath of Hurricane Katrina.

- While declining self-employment due to the virus suggests an even larger drop in the household survey measure of employment, we expect some individuals to classify themselves as “employed but not at work.” Additionally, we expect the participation rate to decline several points on account of the virus, which should also limit the magnitude of the increase in the jobless rate. Taken together, we estimate the unemployment rate rose almost 10 points to 14%. We estimate average hourly earnings increased 1.0% month-over-month and 4.0% year-over-year, reflecting a composition shift towards higher-paid workers that is partially offset by negative calendar effects.

Source: Deutsche Bank, Goldman, BofA

Tyler Durden

Mon, 05/04/2020 – 09:10