Morgan Stanley Braces For “Overdue” 10% Correction In Stocks

Two weeks after Morgan Stanley’s former equity bear Michael Wilson, who led Wall Street strategists by first turning bullish in mid-March at the depths of the coronacrisis, turned “tactically” bearish warning that “stocks are now overbought”, Wilson is back with a repeat warning, expecting an overdue 10% correction which, however, is not the start of another crash, but rather a “necessary pause that refreshes.”

But to make sure he isn’t accused of flip-flopping back to being a bear, Wilson explains that his “bullish view has not changed, nor has the narrative – a severe recession acknowledged by all, the bottoming rate of change in economic data/earnings revisions, seemingly unlimited central bank support, unprecedented fiscal stimulus that we believe is likely to become structural in nature and that leads to rising inflation expectations sooner than the consensus expects.”

And so, with Wilson’s bullish reputation safe and sound, here’s why the Morgan Stanley strategist sees some pain in the immediate future:

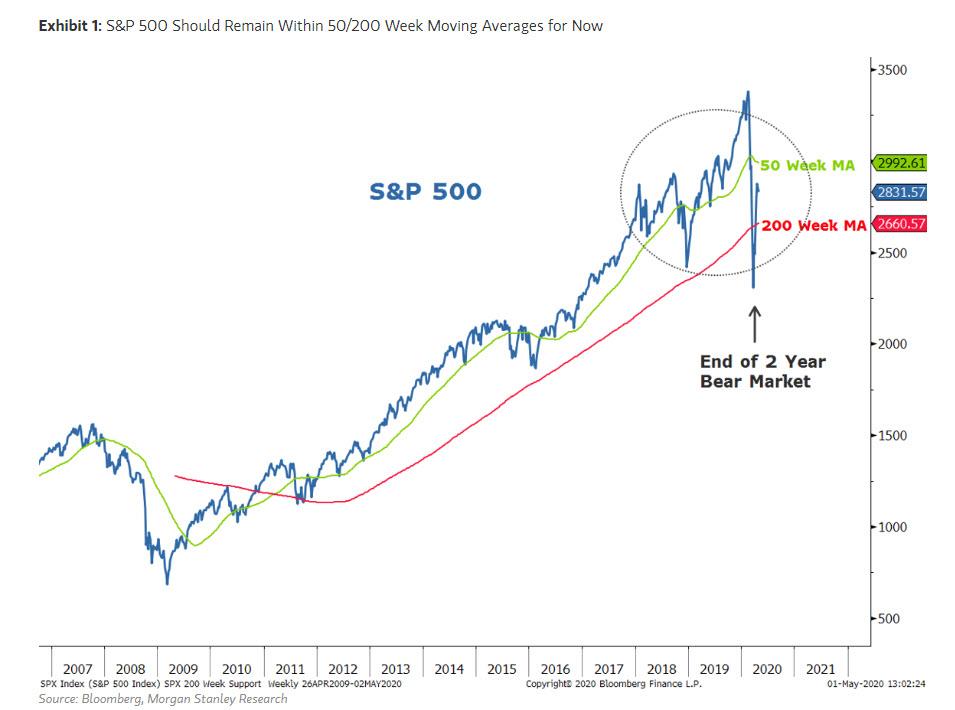

After a torrid 35% rally from the lows, equity markets appear to be taking their first real break. We continue to think 2650 (200-week moving average) on the S&P 500 will be vigorously defended, with the 2-year bear market having ending in March while the 50-week moving average (currently 2992) provides resistance.

In the end, Wilson – unlike 13D’s Kiril Sokoloff who sees the stock market following the part of the Great Depression over the next 3 years…

… believes this correction will be a “pause that refreshes and necessary for the higher prices we expect later this year.”

In keeping with its cyclically bullish view, Morgan Stanley has tilted its recommendations toward higher beta, cyclical and smaller capitalization stocks. While this is a change in the bank’s strategy from the past few years to be more defensive, Wilson explains that “it is not an abandonment of high quality and/or growth stocks.”

For the past few years, we have recommended high quality/growth, large cap, and defensive factors. This strategy was reflected in our sector recommendations and Fresh Money Buy List and led to significant outperformance versus the S&P 500. Since March, we have downgraded Utilities, upgraded Health Care and added several smaller cap, lower-quality cyclical stocks to our Fresh Money Buy List.

Wilson then adds that he will look to do more of this into what we think could be a “2-3 week correction in the overall market.”

Bottom line, the bank strategist thinks “a barbell of high quality growth (best of the best) + lower-quality cyclicals (best of the worst) continues to be the right strategy as we begin the uncertain recovery from the worst economic downturn in our lifetimes.”

While such a rotation is difficult to trust while the data remain so weak and the outlook unclear, history suggests it’s exactly what one needs to do at this stage of the cycle.

Another thing that Wilson is bullish on is dividend futures, where he sees pricing as “too bearish”:

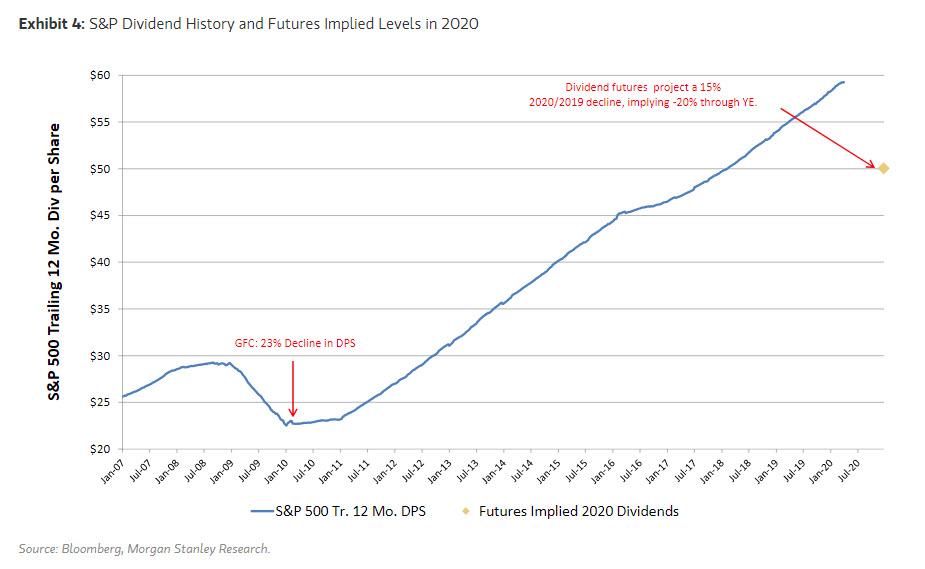

S&P dividend futures are pricing in a full year decline of ~15% compared to 2019 and 20% through the rest of 2020; we think that is too bearish. We appreciate that the current period of economic stress will weigh on cash flows, which will in turn create potential pressure on dividends. S&P dividend futures are currently pricing in about a 15% decline y/y, which implies about a 20% reduction through the remainder of 2020 (Exhibit 4).

Looking at the chart above, Wilson sees a number of reasons this forecast may be too bearish, and provides several reasons why he is more positive on index level dividends than futures markets:

Our detailed cash flow stress test model suggests lower cuts. An update on our cash flow and dividend stress test model suggests y/y dividend declines of 23%/14% in 2Q/3Q for the S&P 500. Importantly, these are bear case declines that are the result of highly stressed cash flows that give no credit to the willingness of companies to use their cash on hand to pay dividends. We suspect many management teams will be reluctant to cut dividends and be willing to use some cash on hand to support dividend payments.

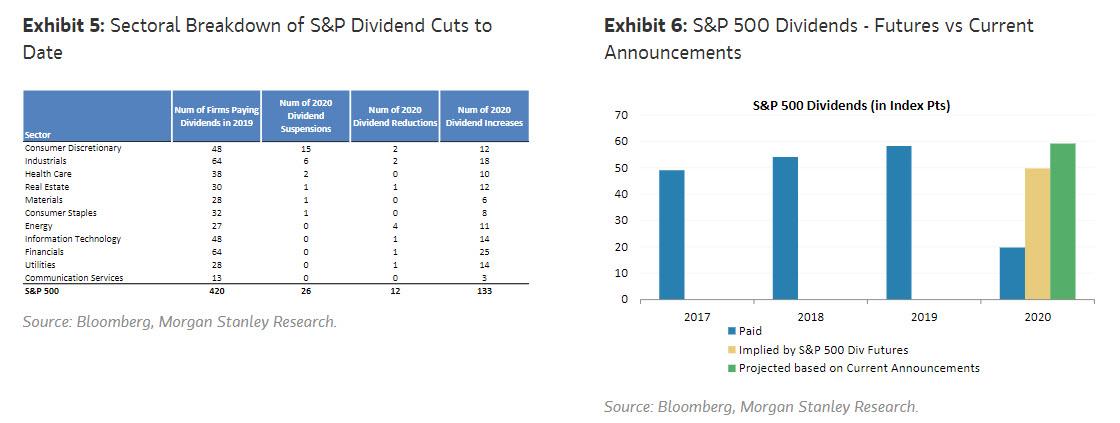

Cuts to date have been fairly limited and more companies have raised dividends than cut them. Year to date, 133 S&P 500 companies have increased dividends while only 38 have suspended or reduced dividends (Exhibit 5). Extrapolating cuts and increases to date suggests about a 2% increase in 2020 dividends relative to 2019 (Exhibit 6).

Dividends have been running ahead of last year. Dividend payouts to date are running about 4% above 2019 levels over the prior period. A 4% growth rate through the first 4 months of the year is only a modest cushion to further full year declines, but does provide some offset to the currently priced declines through the rest of the year.

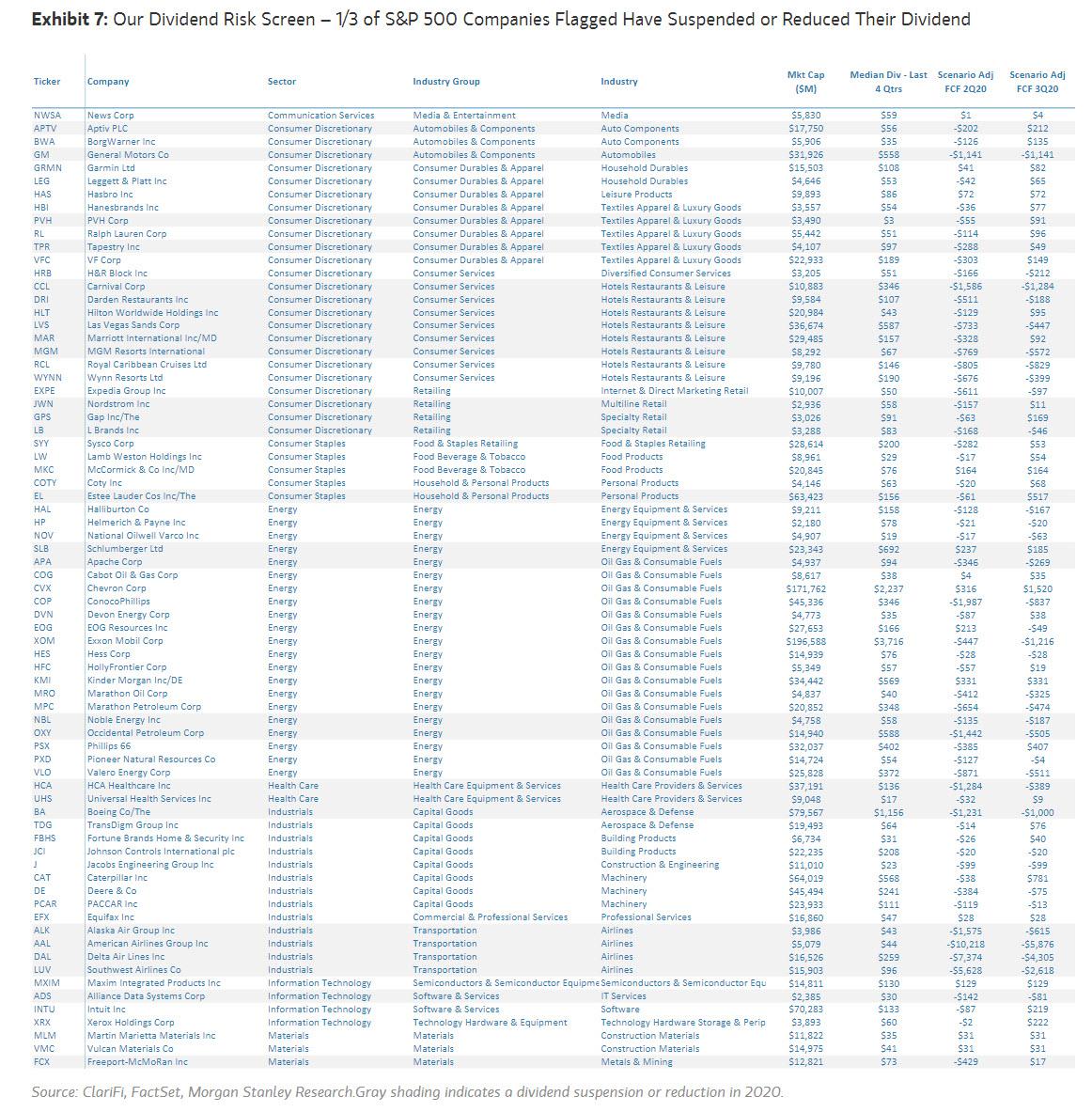

There is still risk of course, and as Wilson concludes, there is dividend cut risk is higher at the single stock level which of course is an understatement since a third of the S&P has suspended dividends. To the extent more S&P 500 firms do reduce or eliminate their dividend, there is negative alpha ahead for those stocks.

Finally, to avoid nasty surprises, Morgan Stanley concludes with a list of companies that make its dividend risk screen.

Tyler Durden

Mon, 05/04/2020 – 12:20