This Is What New Normal Looks Like After The Pandemic

Authored by Bloomberg macro commentator Ye Xie

The biggest market news Wednesday was the steepening of the Treasury yield curve as the government boosted planned sales of long-term debt to fund a $4 trillion deficit this year.

With short-term rates possibly staying near zero for the next few years, curve steepening seems to be a natural response to more debt sales. Still, it’s hard to see how much yields can back up when the Fed is gorging on debt. Bond vigilantes are nowhere to be seen, at least for the time being.

In the stock market, the Nasdaq Composite Index outperformed the S&P 500 again. It’s more evidence that the pandemic has accelerated the pre-existing trend: lower rates for longer and the secular rise of tech companies.

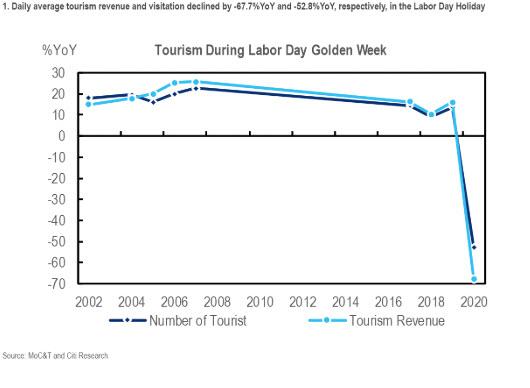

For those who are looking forward to the re-opening of economies, the past Golden Week holiday in China offered a sneak peek of reality: consumer spending remains sluggish, two months after the country cut its daily new confirmed virus cases to below 100.

During the five-day holiday, tourism revenue shrank 68% compared with last year. Among those operating restaurants, daily average revenues fell 46% below the levels at the beginning of the year, according to Nomura, citing a report from a catering industry information provider.

One silver lining is that e-commerce has flourished at the expense of brick-and-mortar shops. Sales of mobile phones, laptops and tablets at Tmall, one of China’s largest online shopping platforms, surged by 70%, 100% and 250% year-on-year, respectively, according to Nomura.

Debt, Digital and De-globalization. Welcome to the post-pandemic world.

Tyler Durden

Wed, 05/06/2020 – 21:48