2Y Treasury Yield Plunges To Record Low, Gold Spikes As “Fatal” NIRP Reality Dawns

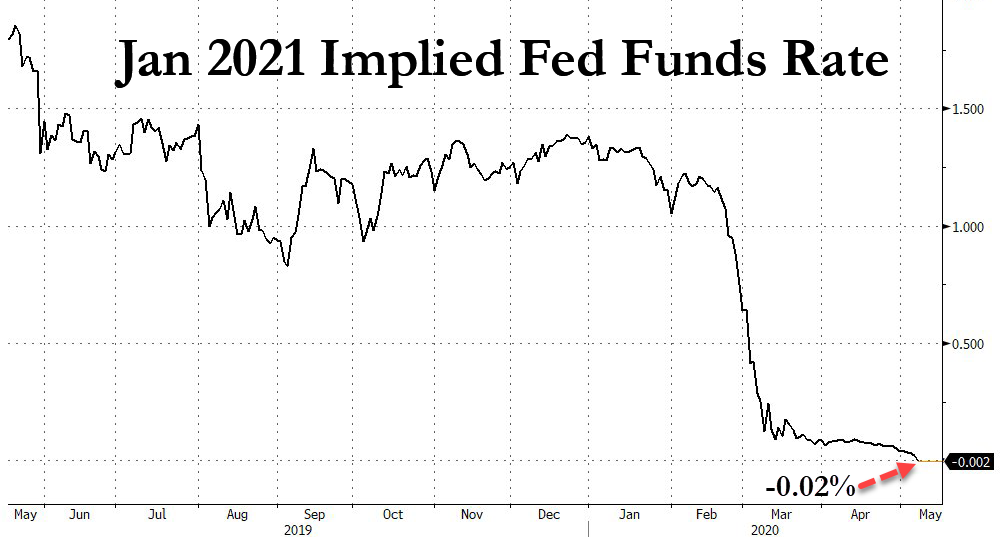

With short-dated futures now signaling negative-rates…

Source: Bloomberg

…the Treasury curve is tumbling with the short-end breaking down to record lows.

Source: Bloomberg

That is below the lowest 2Y rate in US history…

Source: Bloomberg

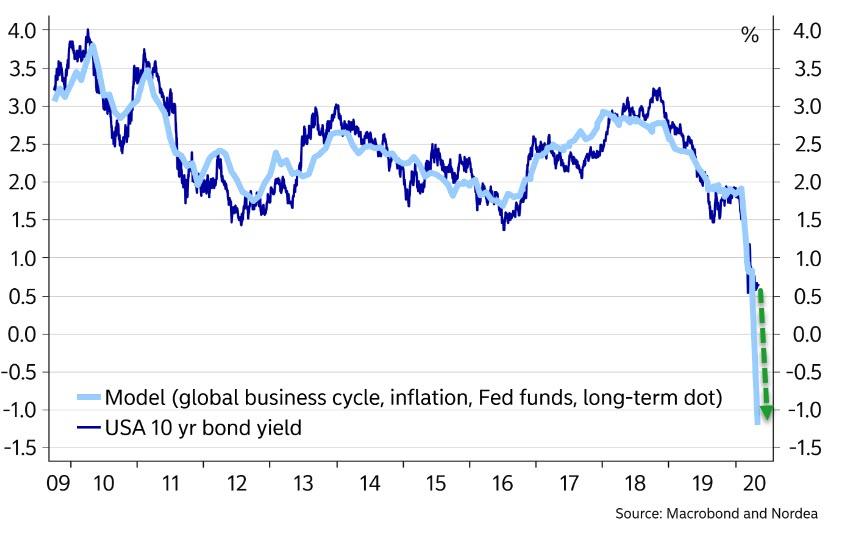

And Nordea’s simple OLS-model has even started to ponder whether negative long USD yields could be the name of the game. It both sounds and looks far-fetched and we don’t really trust the below signal, which to a large extent is the result of an unprecedented low in the Global PMI, but none the less it showcases the growth-based downside pressure that long bond yields face.

Overall, we tend to think that the Fed will have to re-increase the daily purchase tempo to really reignite the global credit cycle, since USD scarcity will remain an issue (in particular in the EM space) unless the Fed outprints the US Treasury issuance.

The dollar is diving (for now)…

Source: Bloomberg

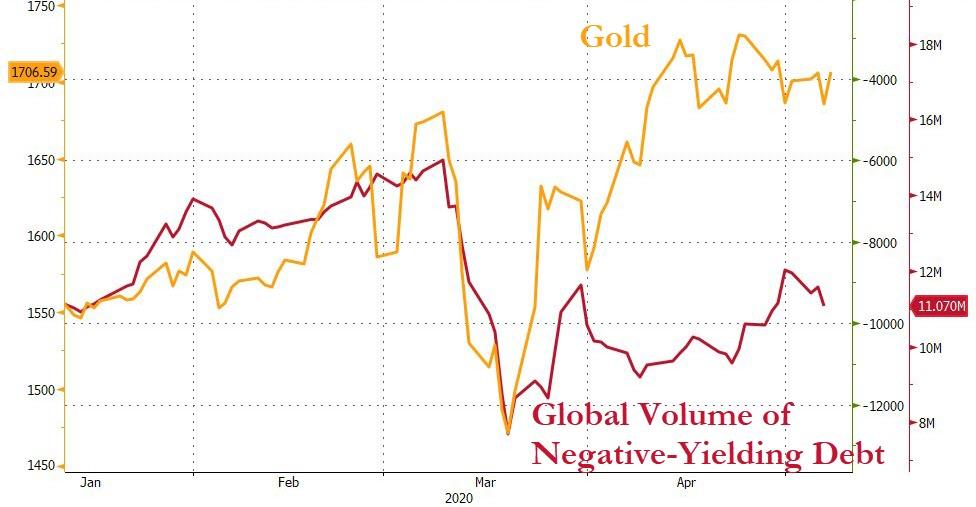

And as rates re-plunge and negative rates resurge, gold is bid…

Source: Bloomberg

Suggesting negative yielding debt is about to explode again…

Source: Bloomberg

Of course, the Ivy League academics know better, as Ken Rogoff recently demanded “deeply negative rates” and “controls on hording cash” as the ‘final solution’…

For those who viewed negative interest rates as a bridge too far for central banks, it might be time to think again. Right now, in the United States, the Federal Reserve – supported both implicitly and explicitly by the Treasury – is on track to backstop virtually every private, state, and city credit in the economy. Many other governments have felt compelled to take similar steps. A once-in-a-century (we hope) crisis calls for massive government intervention, but does that have to mean dispensing with market-based allocation mechanisms?

…

A number of important steps are required to make deep negative rates feasible and effective. The most important, which no central bank (including the ECB) has yet taken, is to preclude large-scale hoarding of cash by financial firms, pension funds, and insurance companies. Various combinations of regulation, a time-varying fee for large-scale re-deposits of cash at the central bank, and phasing out large-denomination banknotes should do the trick.

…

Emergency implementation of deeply negative interest rates would not solve all of today’s problems. But adopting such a policy would be a start. If, as seems increasingly likely, equilibrium real interest rates are set to be lower than ever over the next few years, it is time for central banks and governments to give the idea a long, hard, and urgent look.

We give the last word to DoubleLine CEO Jeff Gundlach who summed things up perfectly if this is really the plan…

These Trillions Treasury is borrowing is heavily in T-Bills. Chair Powell has stated in plain English he is opposed to negative interest rates. Yet the pressure to go negative on Fed Funds will build as short term borrowing explodes and dominates. Please, no. Rates < 0 = Fatal.

— Jeffrey Gundlach (@TruthGundlach) May 6, 2020

Fatal, indeed. Bank stocks and the rest just haven’t realized it yet!

Tyler Durden

Thu, 05/07/2020 – 11:48