China Auto Sales Fall 5.6% YOY In April Despite Sizeable Bounce Back From March

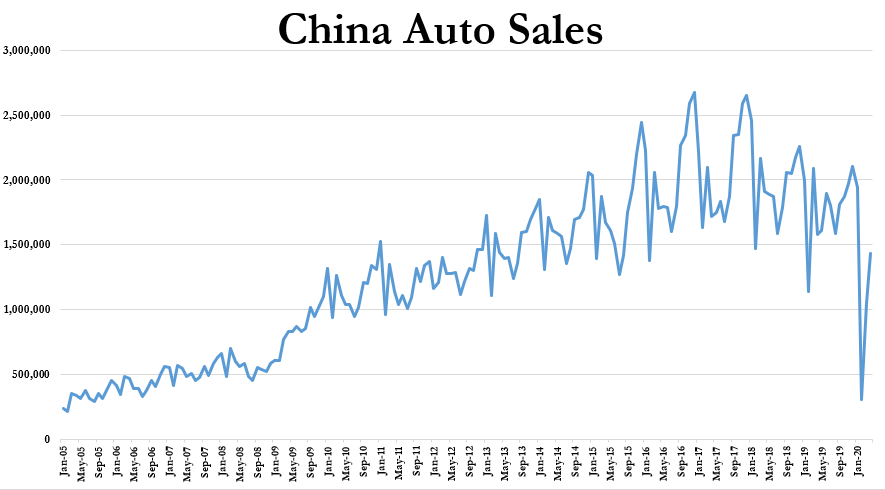

The auto market in China is a widely watched economic gauge and leading indicator for the rest of the world, not only because the country is the number one seller of vehicles worldwide, but now also as a litmus test as to how the country’s coronavirus re-opening is faring.

For now, despite a questionable miraculous-looking rebound, sales are still falling.

April’s auto sales numbers came in down 5.6% compared to last year, despite rising 37% from March numbers, according to data released Sunday by the China Passenger Car Association and MarketWatch.

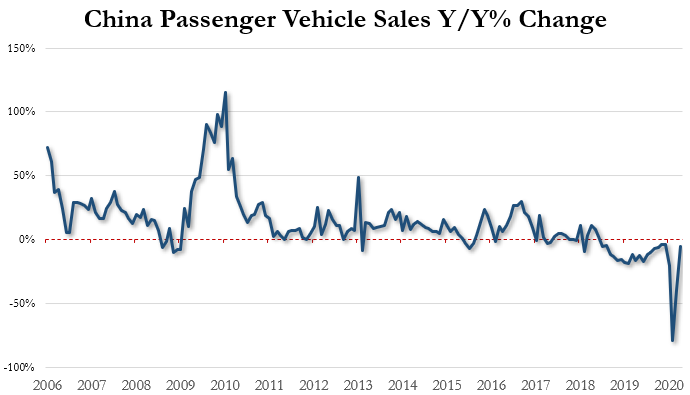

The CAAM claims that declines are moderating although we have a tough time believing (pardon our skepticism of China) that such a V-shaped recovery is possible in the country where the outbreak first began.

According to China’s data, the YOY growth rebound is pronounced and April’s drop pales in comparison to a 40% YOY drop in March and a 79% YOY drop in February.

The Chinese government is going to attempt to spur demand with new policies aimed at enticing buyers, according to Bloomberg, citing an unnamed automotive industry group in China.

Recall, we have recently noted that U.S. auto manufacturers are teeing up sizeable incentives to get buyers back into showrooms. Europe is following suit, with Volkswagen starting a sales initiative to revive demand, including improved leasing and financing terms.

Meanwhile, optimism for May in China is already muted.

Not only is the country still struggling with lockdowns, but the first five days in May were a labor holiday that could have a negative impact on sales.

Outlook for the year is also less-than-optimistic. The CAAM predicts that sales will drop 15% to 25% for the year, depending on whether or not the country is able to further slow the spread of the virus.

Tyler Durden

Tue, 05/12/2020 – 21:05