Wall Street Bonuses Set To Drop By Up To 30%

Tyler Durden

Thu, 05/14/2020 – 14:00

A chaotic year for finance professionals, which has seen their routine upended with many forced to work from home and unable to frequent their favorite watering holes and strip clubs with buddies after work, is about to get even worse. According to a report published Wednesday by compensation consulting firm Johnson Associates, Wall Street bonuses for 2020 could fall by as much as 25%-30% due to the deep cuts to revenues recorded by banks and hedge funds earlier this year as a result of the novel coronavirus.

While most compensation is expected to be down, 2020 is likely to be a year with “wide, wide variations in incentive outcomes between stronger and weaker competitors,” according to the report whose predictions are closely watched by financial professionals and HR departments, which set compensation benchmarks across the industry.

Commercial and retail bankers of many large banks could see the largest year-over-year declines in their incentive pay of up to 30%, as those banks have had to set aside billions for loans that could potentially go bad in this economy. Investment bankers in advisory roles could receive 20%-25% cuts to incentive pay, while their investment bank colleagues who work in underwriting would see smaller declines of 10%-15%, thanks to a record surge in bond underwriting.

Johnson writes that this is because investment banking advisory revenues were down in the first quarter of the year, with most deals stalled, while debt underwriting has soared as corporations sought to build up their cash, and the Fed backstopped investment grade corporate bonds.

The report also finds that asset managers could receive 20%-25% reductions in bonuses, while hedge fund workers could see 15%-20% declines.

It’s not all gloom, however, as bonuses for equity and fixed-income traders could jump as much as 20% this year:

“This is their heyday” after several years of virtually no change in compensation, Johnson told Bloomberg in an interview. “Sales and trading now is mainly a customer business, so you’re benefiting from the flows.”

Wall Street trading desks posted their best quarter in eight years in the first three months of 2020 on surging demand from customers responding to the most volatile market on record. That helped the industry’s largest firms remain profitable even as the coronavirus pandemic forced them to set aside more for bad loans in three months than they did in all of last year.

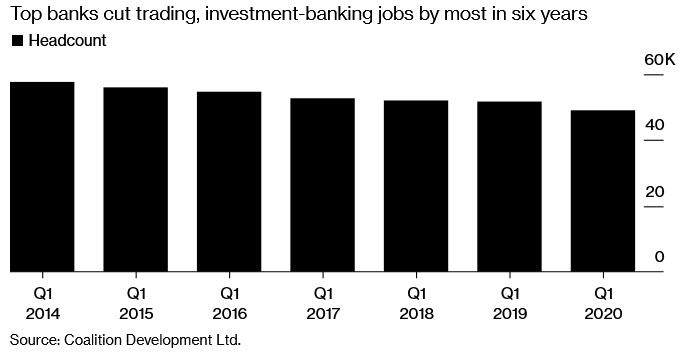

This is good news… for those traders who are still employed. The world’s biggest banks cut trading and investment-banking jobs by 5% in the first quarter, the most in six years, according to Coalition Development Ltd.

“The reliance on big headcount has gone down,” particularly in equities, said Amrit Shahani, research director at Coalition in London. “That is a theme across banks.”

The reduction in front-office revenue producers came even as investment-bank revenue surged 12% to a five-year high, Coalition said in a report Wednesday. Stock-trading divisions reduced headcount 10%, particularly in institutional cash equities, while bond-trading divisions shrank 6%, letting go of employees in Group-of-10 rates and commodities.

The result is that those workers who are still employed have a relatively larger pot to split, or at least that’s the theory. As Bloomberg adds, some think the revenue gains won’t translate into higher pay because fallout from the pandemic has been too severe. New York’s bankers and traders are likely to see bonus payments “fall sharply” this year as the economic slump crimps earnings in the finance industry, the state’s comptroller said in March.

The decline in staffing contrasts with rising revenue, according to data from the 12 largest global investment banks tracked by Coalition. In fixed income, currencies and commodities, revenue jumped 20%, driven by macro products. Investment-banking revenue increased 7%, helped by equity and debt capital markets.

At the end of the day, it all depends on whether there is a second wave or if the reopening does not work out as expected.

“If this opening up turns out to be a real problem, and then we have further shutdowns,” Johnson said, “then things could get a lot worse.”