Ignore Dismal Retail Sales Report: Latest Daily Spending Data Shows 2020 Is Now Higher Than 2019

Tyler Durden

Fri, 05/15/2020 – 10:49

One month ago, when looking at the March retail sales report – which only captured the last two weeks of the US shutdown- and comparing it to the Bank of America real-time credit and debit card spending data, we concluded that “Retail Sales Were Bad; The Reality Is Catastrophic.”

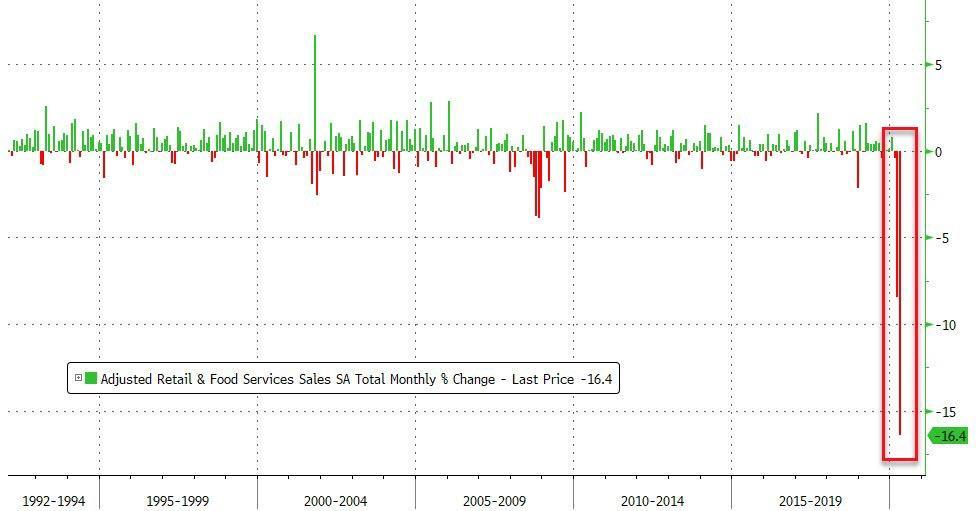

Fast forwarding to today, when this morning the Commerce Dept published its snapshot for retail spending in April, which as we duly noted saw the biggest drop on record, with a total collapse in auto and clothing sales.

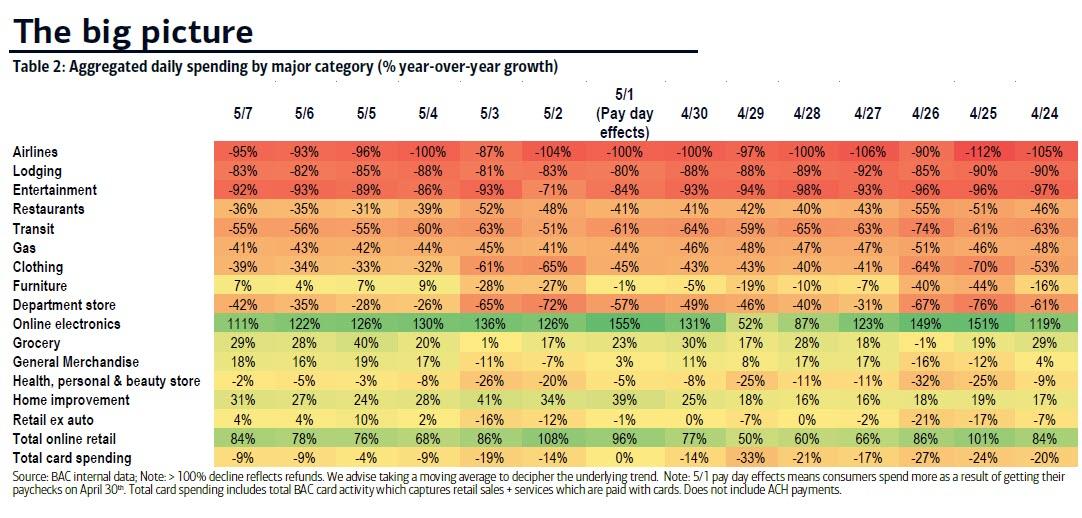

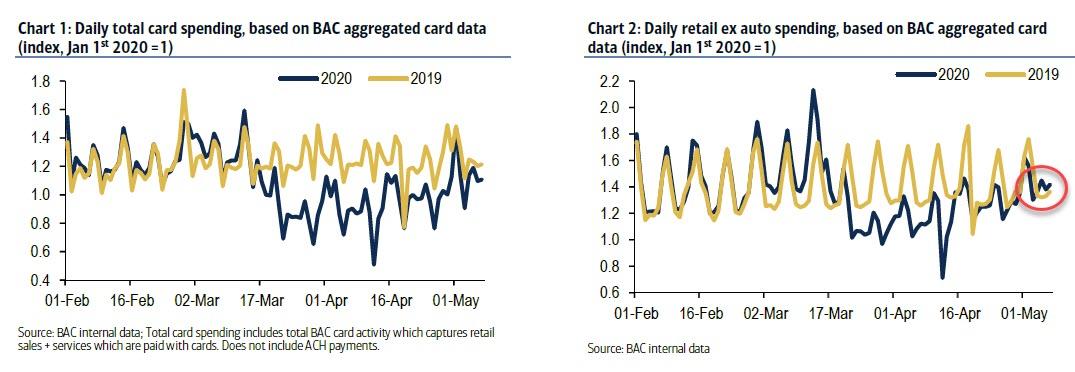

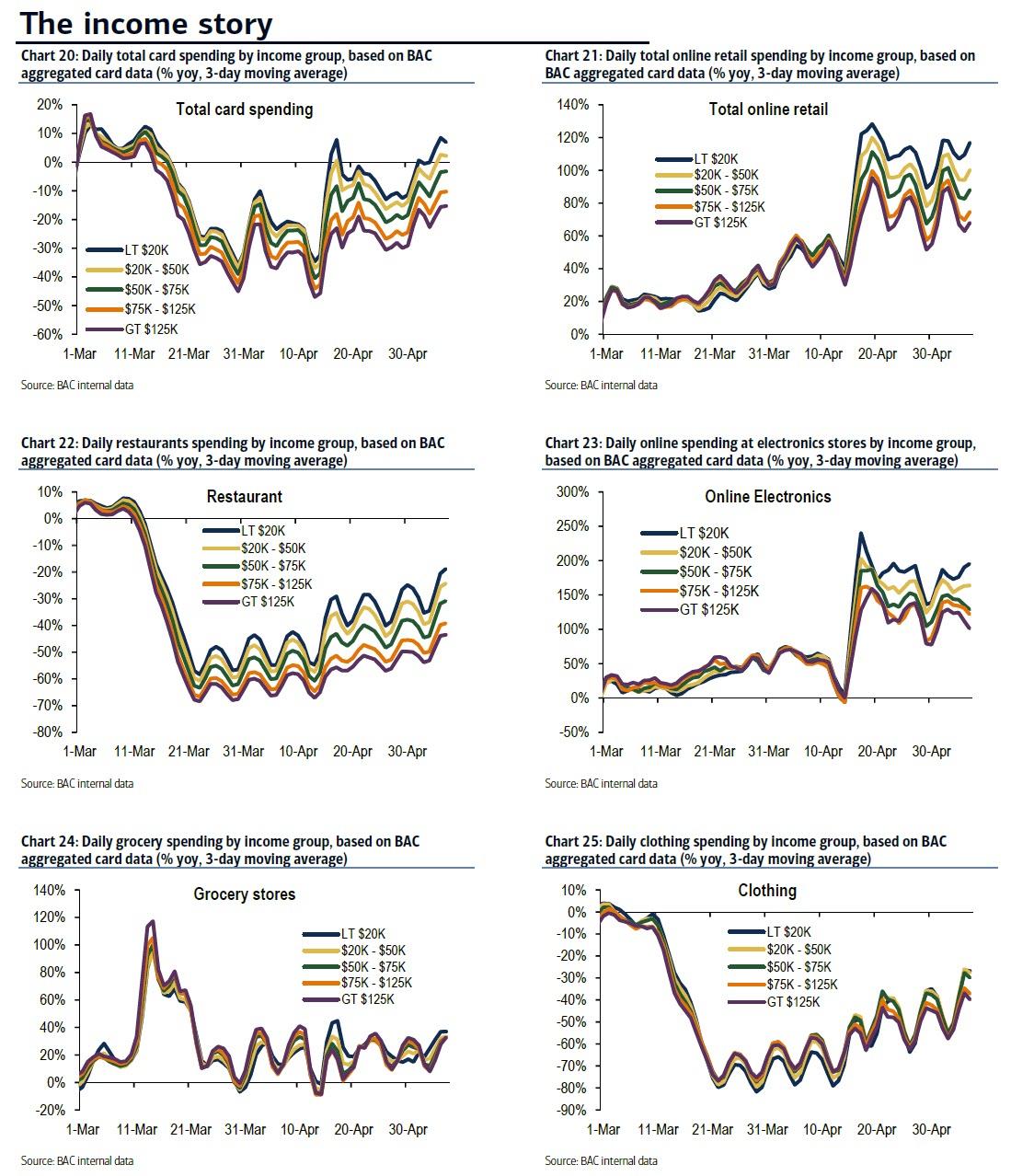

However, in a mirror image of last month, while the government’s April “snapshot” report was indeed terrifying, a daily series tracking day-to-day outlays shows that consumer spending bottomed in mid/late-April and has since rebounded vigorously. As Bank of America writes in its latest consumer spending report which tracks BofA credit and debit car spending, “the daily data show meaningful improvement in spending into May, driven by the lower income population. Total card spending is now running at a pace of -10% yoy over the 5-day period of May 3- May 7, a big shift from the low of -36% yoy during the last 5 days of March.

And in a remarkable reversal, retail sales ex-auto spending is now actually increasing, running at a 1% yoy rate over the same 5-day period.”

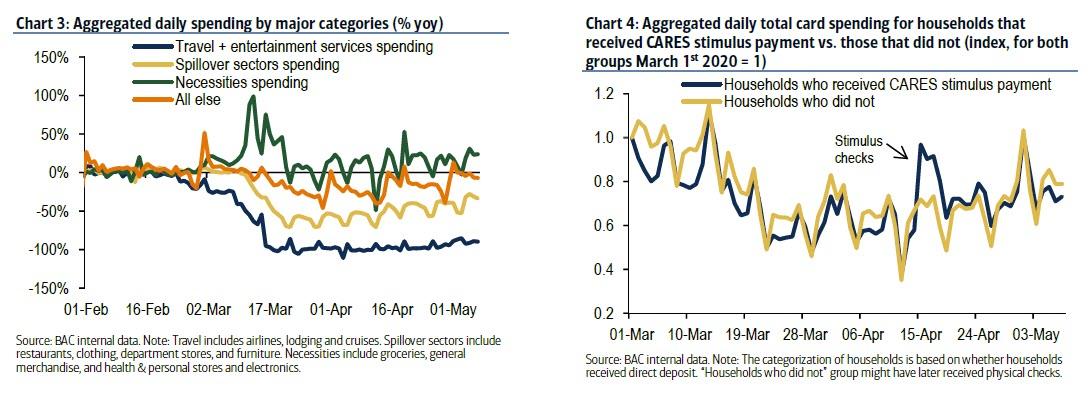

There are two critical reasons for the improvement in consumer spending: stimulus payments and phased reopening of the economy. Stimulus payments started to filter in on April 15th through direct deposits which was followed by physical checks.

These have boosted incomes for the lowest population quintiles, which have the highest propensity to spend, and that’s precisely what they are doing, as retail spending surges led by those making less than $20K.

In addition, an increasing number of unemployed have successfully filled jobless claims. This combined stimulus has helped to backstop income and make people more confident about the future, according to BofA, and sure enough one can see that in the spending data.

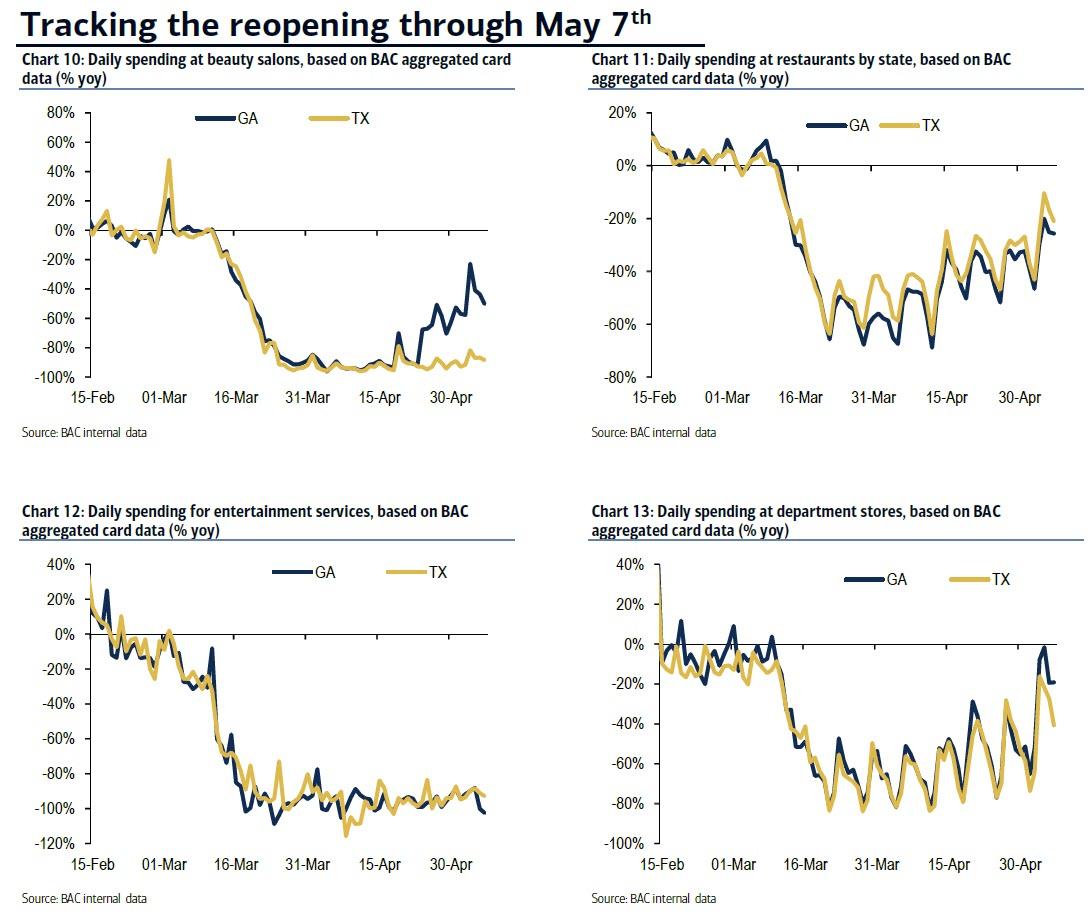

Meanwhile, the impact from the reopening is more recent – we zero in on spending in GA and TX given that both states have begun the reopening process. Spending at beauty salons in GA averaged -46% yoy between May 1- 7th, up from the low of -96% in the beginning of April (TX didn’t open beauty salons until May 8th). Both states also saw a pickup in spending at restaurants and department stores.

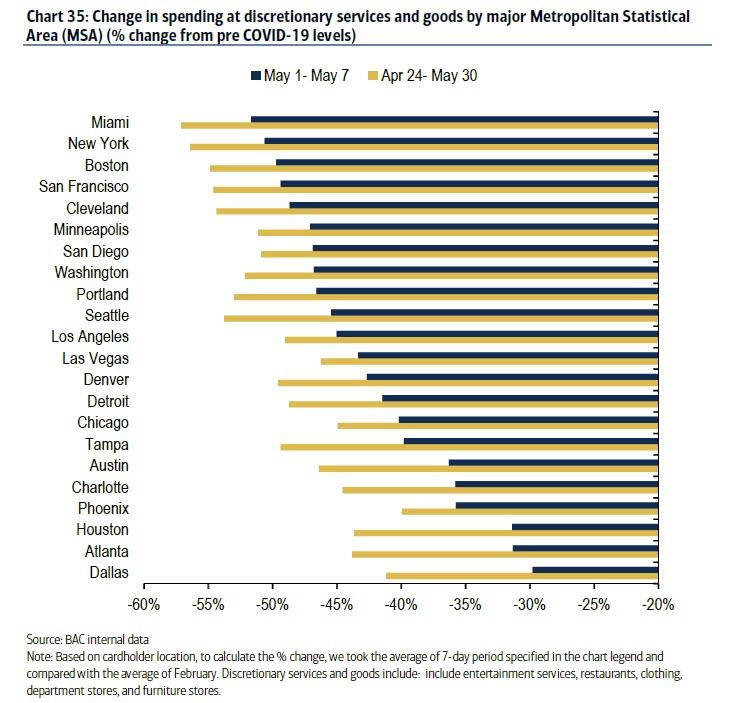

Looking at overall discretionary spending by major Metropolitan Statistical Area (MSA), we found the biggest relative improvement over the week in Dallas, Atlanta and Houston.

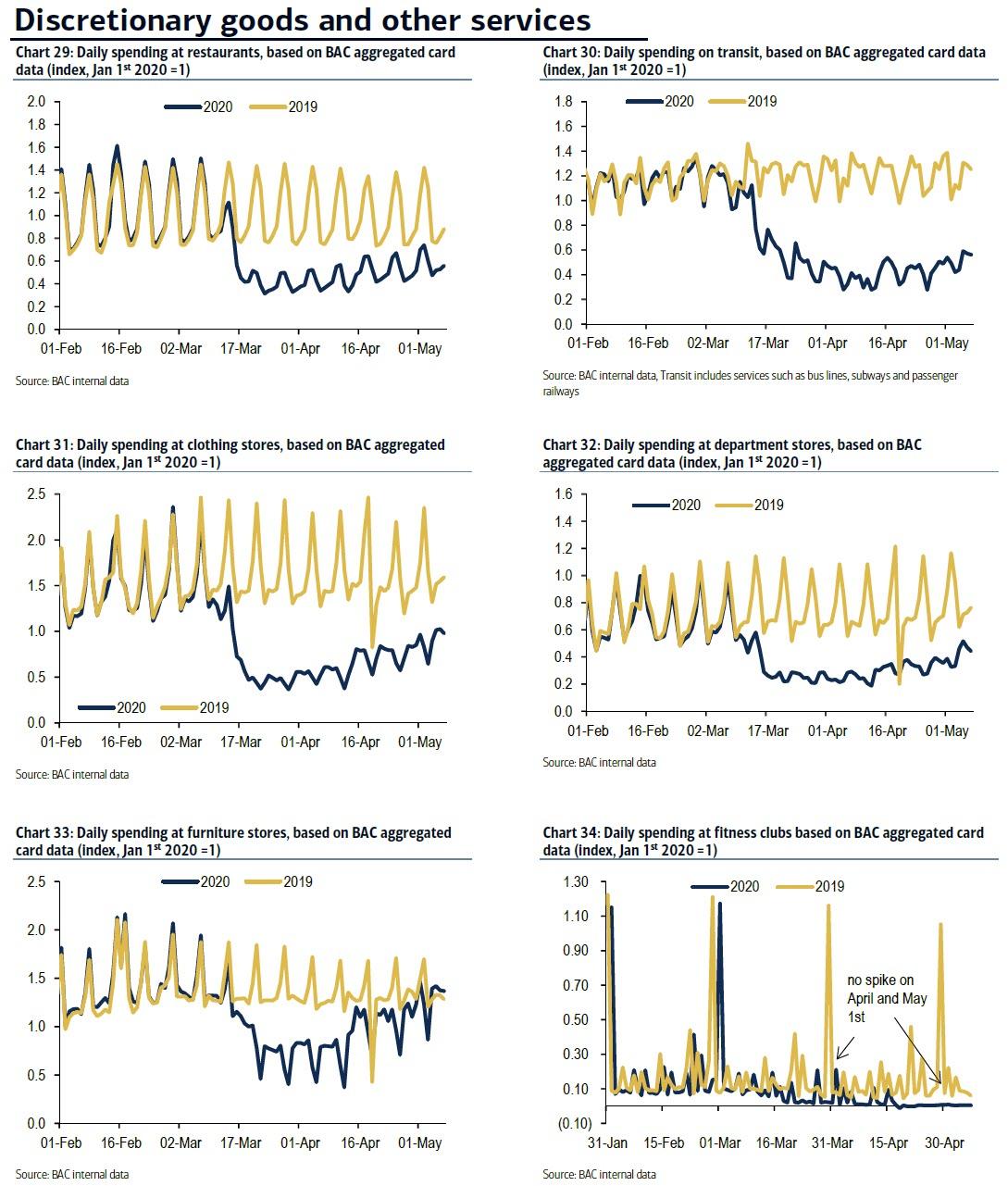

The picture is more mixed when looking at spending on discretionary goods, where the strong rebound in furniture store spending continues, offset by weaker restaurant, transit and department store trends.

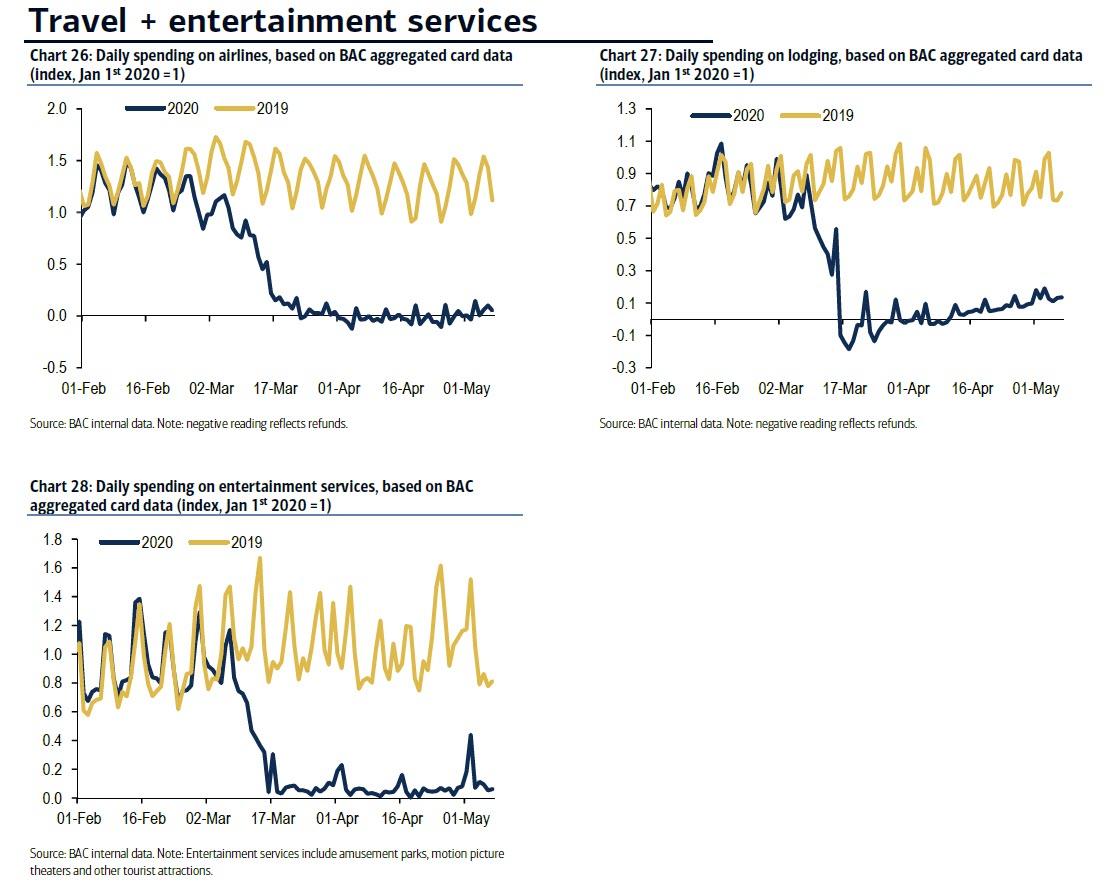

Despite the overall recovery, spending on the “socially intensive” travel and entertainment categories remains near all time lows.

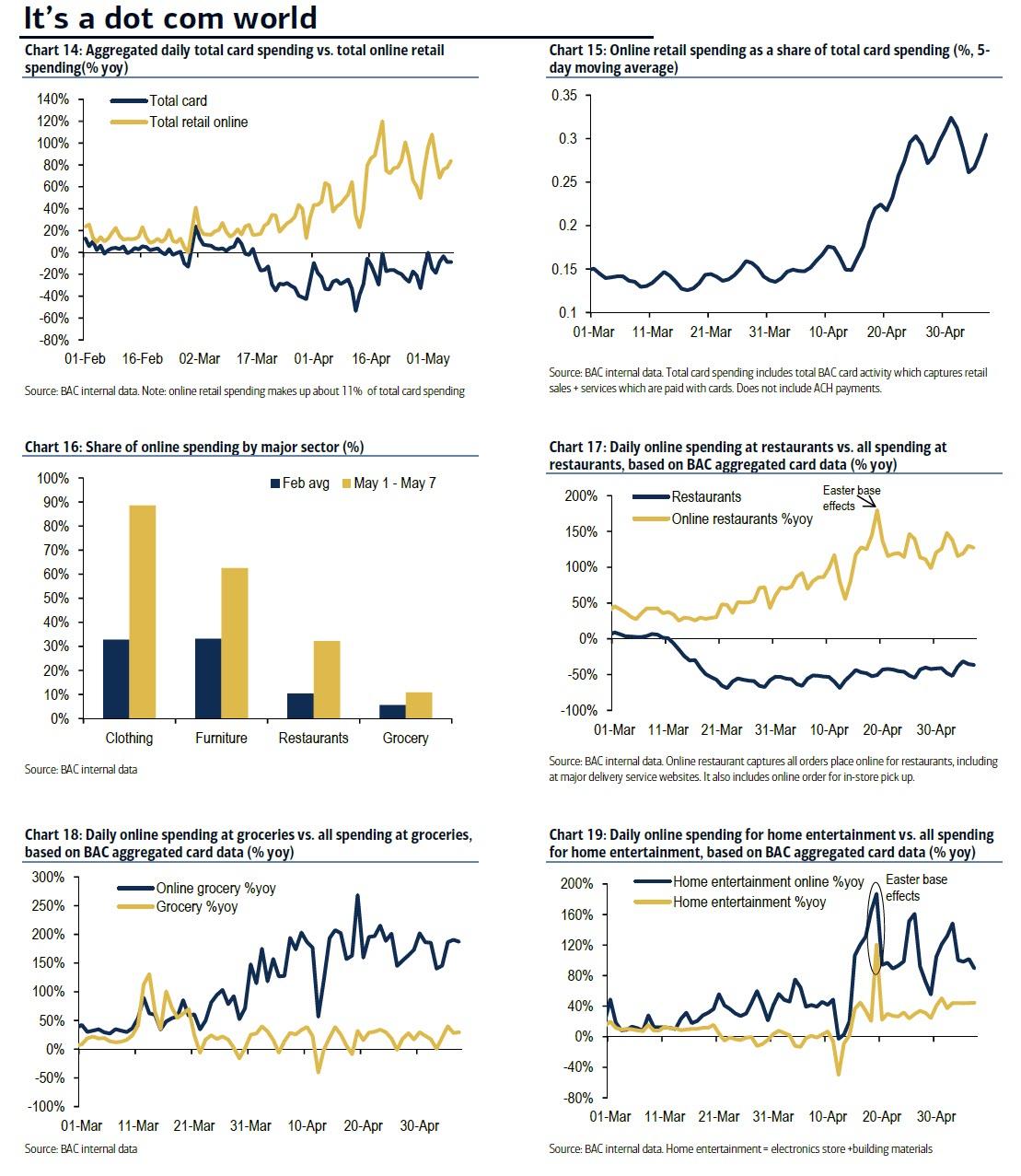

However, no matter what the trends are “out there”, one persistent winner is online spending, which continues to grow by leaps and bounds, as the following series of charts shows.

It appears that not even a global viral pandemic can keep the US consumer down even during the biggest economic shock in history.