With Nobody Having Any Idea What’s Going On, One Bank Says SPX Fair Value Is From 1,900 To 3,000

Tyler Durden

Fri, 05/15/2020 – 13:26

With the chart of the forward S&P500 P/E making the rounds – and rising by the day as consensus EPS decline even as stocks keep rising – Deutsche Bank has come up with a new chart to “normalize” for the near term earnings noise, and is now looking at 2-year forward earnings instead of only 1 year. Unfortunately, it fails to show a more reasonable result, with the resulting P/E at an all time high of just below 23x (time to look at a 36 month forward P/E ratio then?)

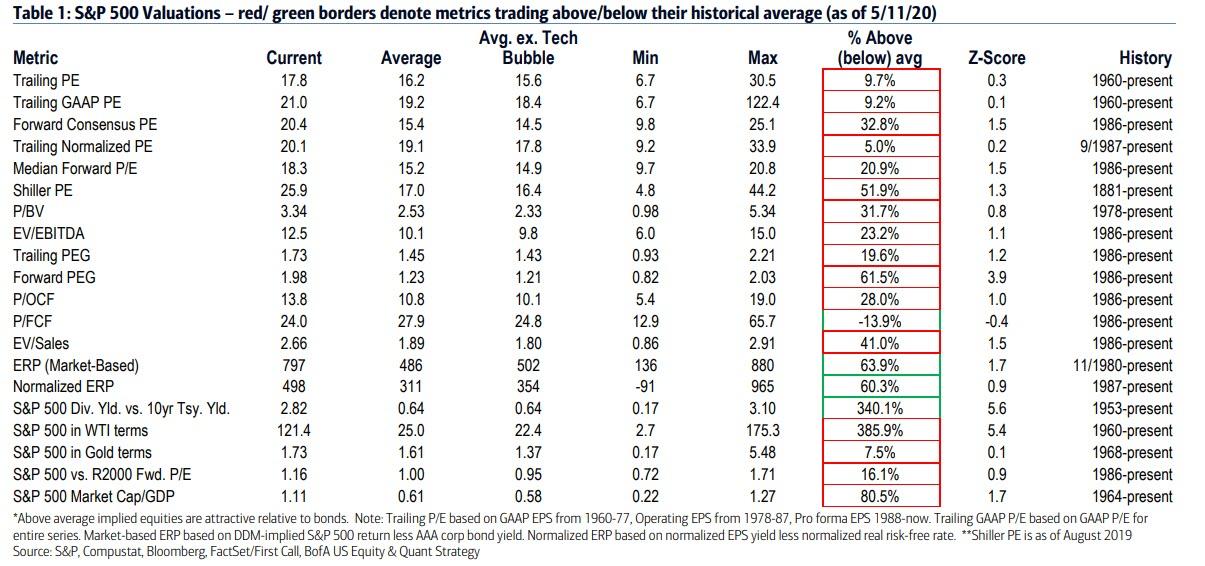

But even if one uses just the “cheaper” 1 year forward P/E, as Bank of America has done, the 20.4x S&P 500 forward P/E puts the market over 1.5x standard deviations above the average of 15.4x and three-quarters of the way to the Tech Bubble high of 25x.

This means that as BofA’s Savita Subramanian notes, “stocks are trading above average on every valuation metric we track except bonds”, which of course are also in a bubble as central banks are buying industrial quantities of global debt.

Bullish traders – being an inquisitive, hard-working lot – have found a “solution” to the market’s overvalution. Just ignore it.

As Subramanian notes, “we hear the complain that “P/E ratios are growing increasingly irrelevant” a lot – that comparing today’s market multiple to historical averages (an exercise that we have found to be useful for a long-term outlook) is not a worthwhile exercise, since we have veered off the grid in terms of comparable periods.” Actually, the “solution” is not new at all: humans have always ignored any data that invalidates their priors or jeopardizes their intellectual echo chamber. And let’s not forget that, as BofA reminds us “the irrelevance of P/Es was a refrain of the early 2000s, right before the Tech Bubble burst.”

That said, never before have rates been so low, even as the US is set to issue over $5 trillion in new debt this calendar year…

… skewing return incentives and forcing yield-starved investors into the guaranteed disaster that are equities.

Which is why as BofA concludes, a “fair value” market approach should incorporate today’s ultra-low rate environment.” The problem is that fair value analysis is very sensitive to inputs, especially the equity risk premium (ERP). During the post-Global Financial Crisis period, the S&P 500 ERP has ranged from 394 – 695bp, which would yield a range from 1882 to 2958 using normalized 2021 earnings of $155 The median ERP since 1986 excluding the Tech bubble is about 350bp, which would yield 3269 for the S&P500.

And, as the sensitivity table below laying out different 2021 EPS and ERP assumptions shows…

… the fair value of the S&P, based on how overvalued bonds are – thanks to record central bank buying and a global economic depression – is anywhere between 1900 and 3000, according to Bank of America.

And with that, good luck to all traders who hope to best the algos and make money in a market where the fundamentals have now lost their mind.