Gold, Dollar, & Bonds Jump; Stocks Slump On Fauci Fearmongering, China Trade Turmoil

Tyler Durden

Fri, 05/15/2020 – 16:00

US equities suffered their worst weekly drop in two months…

Shock horror…how did that happen?

Fauci Fearmongering started the ball rolling down-hill:

“The reality is [Fauci] is scared the crap out of Americans,” House Freedom Caucus Chairman Andy Biggs, R-AZ, said. “That’s what he’s done. And with his co-folks in the left wing media, they’ve scared people. You’ve got businesses that are afraid to open. They’re scared to death to open because someone is going to get sick or they get sick. He has scared people who have children and he is gone back and forth. I mean now you don’t wear a mask, people look at you. But it was just a month ago, when they were saying don’t wear a mask because that’s the perfect way to get sick, if you wear a mask. You don’t wear a mask if you are sick. So now this is gone to everybody supposed to wear a mask. Fauci has relied on bad models.”

He added, “He himself says we can’t rely on the models, Fauci said in his testimony two days ago, he’s responding to Rand Paul, ‘I don’t look at all this other stuff that you that you’re talking about. I’m just a scientist. I’m just looking at this data and this science.’ That means he’s not looking at the public health consequences of poverty, of stress, of people not getting treatments they need to get, who are afraid to go in and get screened for cancer or whoever had heart attacks and strokes. He doesn’t care about that. I shouldn’t say that. I don’t know if he cares or doesn’t care. But he doesn’t look at it.”

The truth is hard to swallow for a 79-year-old career fearmonger – as BofA details COVID-19 has a low case fatality rate (<0.3%) for the median age (38) US citizen, meaning return to work may be worth the risk…

The US is making the calculation that people need to get back to work for obvious economic reasons; they will live with the risk of COVID infection. Consider some data, using Italy as benchmark and noting that median age of US population is 38 years old. Italy has a relatively high aggregate case fatality rate (CFR) of 13.8%, but the CFRs for the 30-39 and 40-49 age cohorts are just 0.3% and 0.4%, respectively. Given this, the US CFR for 38 year olds is likely less than 0.3%, perhaps even in the 0.1%-0.2% range; to be (hopefully) conservative, we’ll assume range upside of 1.0%. Assuming a 99.0%- 99.9% chance of survival given infection (1-CFR) for the median-aged US worker, we believe US workers will overwhelmingly opt to return to work given the opportunity. Against the backdrop of record policy stimulus, this creates upside risk to the economic recovery scenario as reopening expands.

But don’t worry – The Fed’s got your back…

This is amazing. pic.twitter.com/fIXy0F39K4

— Robin Wigglesworth (@RobinWigg) May 15, 2020

Overnight ugliness after Washington and Beijing traded threats. An utter shitshow in Retail Sales, Industrial Production, JOLTS, and Sentiment but because some of those data items “beat” expectations, we ramped at the cash market open. Then another “rumor” lifted stocks a little more.

Source: Bloomberg

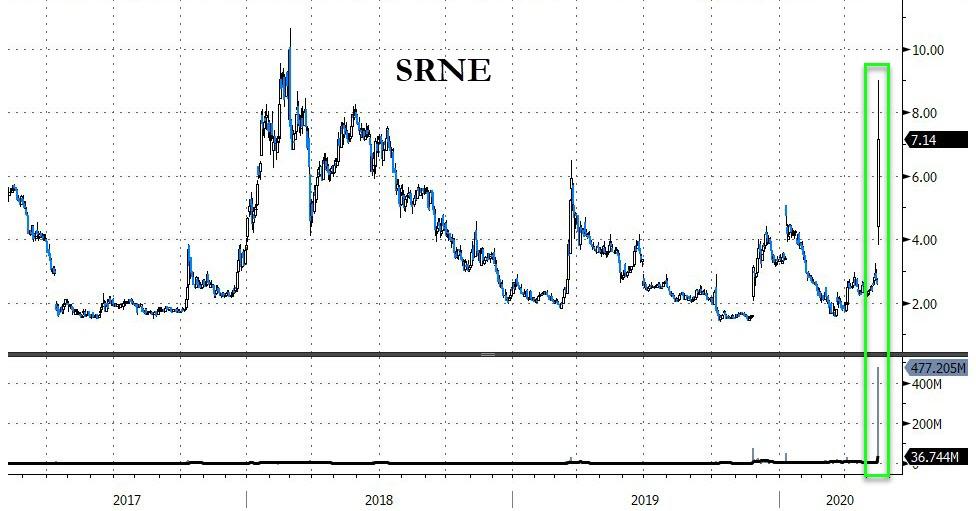

After Fox News sparked a buying panic yesterday with bullshit WFC/GS rumors; today saw Sorrento (and the market) shoot notably higher in early trading after a report from Fox News that the company said it had discovered an antibody that could protect against COVID-19. Trump came on later and commented on being ready for a vaccine… and stocks lifted some more.

So, US restarts trade war with China, US retail spending and manufacturing collapse most on record, and Nasdaq closes green (despite a weak close seemingly sparked by some honest words on Huawei by Kyle Bass)…

You had to laugh at it really… retail ran tech stocks higher all day (once cash markets opened) as yuan kept fading…

Source: Bloomberg

Semis slammed on the Huawei headlines (worst week in 2 months)…

Source: Bloomberg

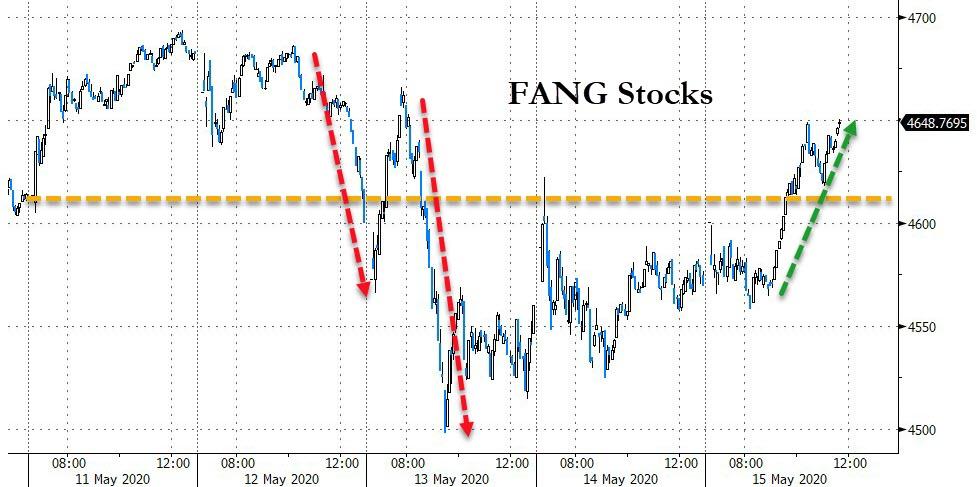

But FANG Stocks ended higher on the week – why not!? (7th weekly gain in last 8)

Source: Bloomberg

Nasdaq has not closed this high relative to Small Caps since the peak of the dotcom bubble in 2000…

Source: Bloomberg

Virus-Impacted Sectors were slammed with Airlines worst (but bounced Thursday)…

Source: Bloomberg

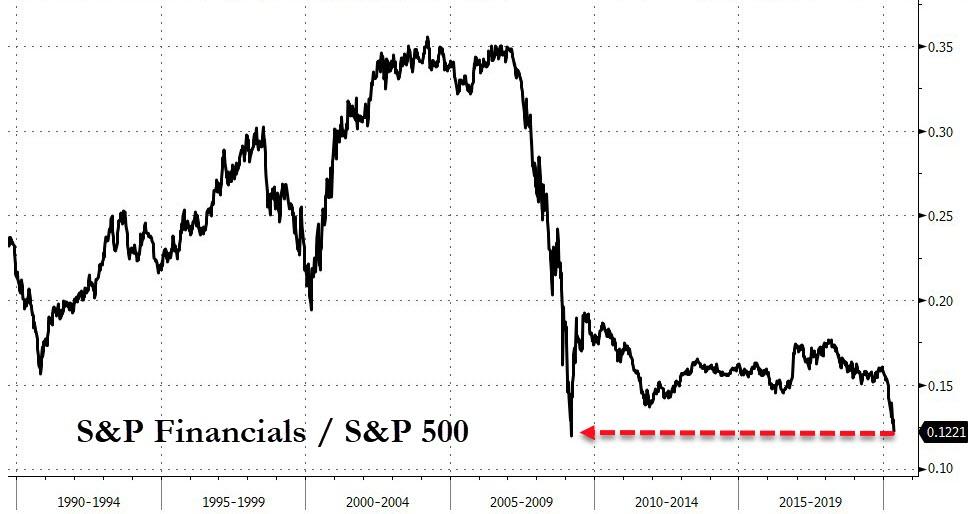

Another ugly week for banks – despite the bullshit WFC/GS rumors…

Source: Bloomberg

And banks are at a record low against the market…

Source: Bloomberg

VIX was up 4 vols on the week, the most since mid-March…

The Fed was in da house this week… but that didn’t save HY bonds which fell as IG rallied…

Source: Bloomberg

And even as stocks have rallied recently, the broader bond market has refused to play along…

Source: Bloomberg

Treasury yields were down on the week as the curve bull-flattened…

Source: Bloomberg

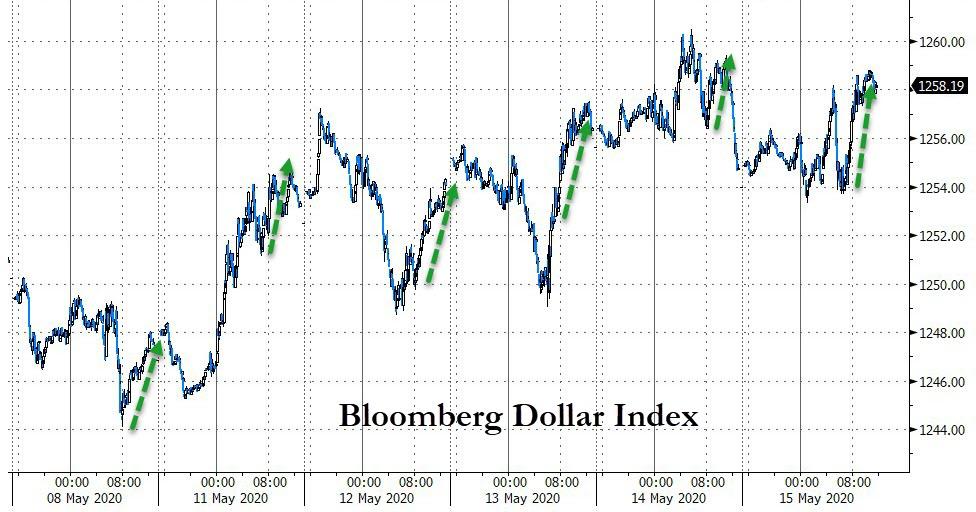

For the 6th day in a row, the dollar was suddenly bid during the US day session (across the European close)

Source: Bloomberg

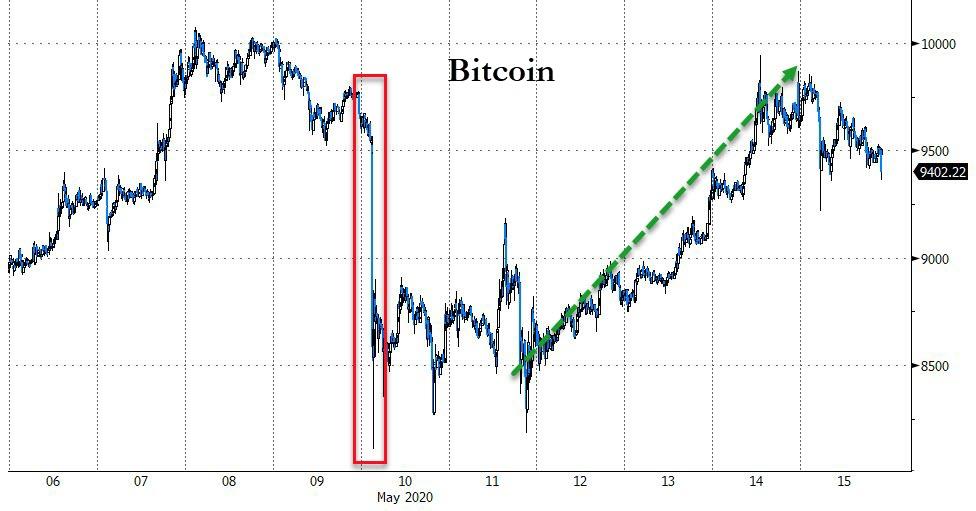

Bitcoin rallied notably after the halving…

Source: Bloomberg

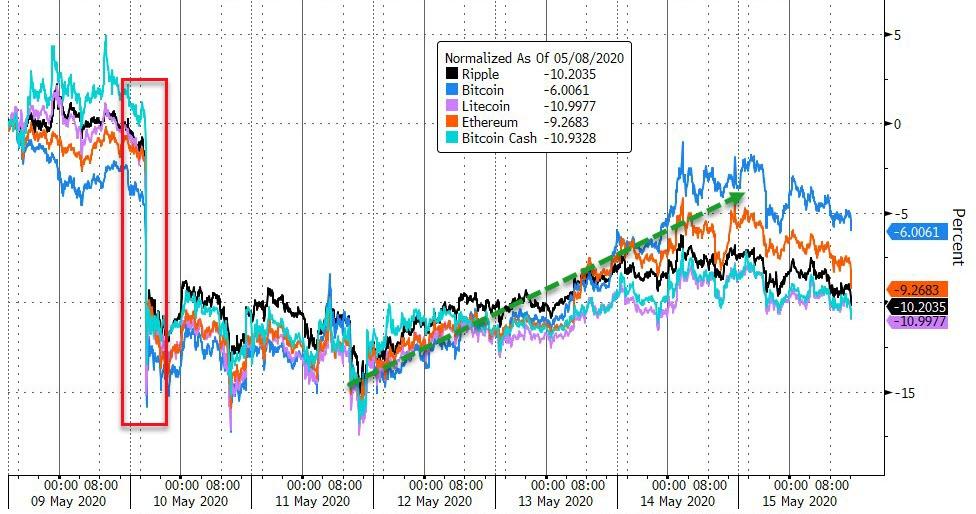

But all crypto is down from last Friday’s “close”…

Source: Bloomberg

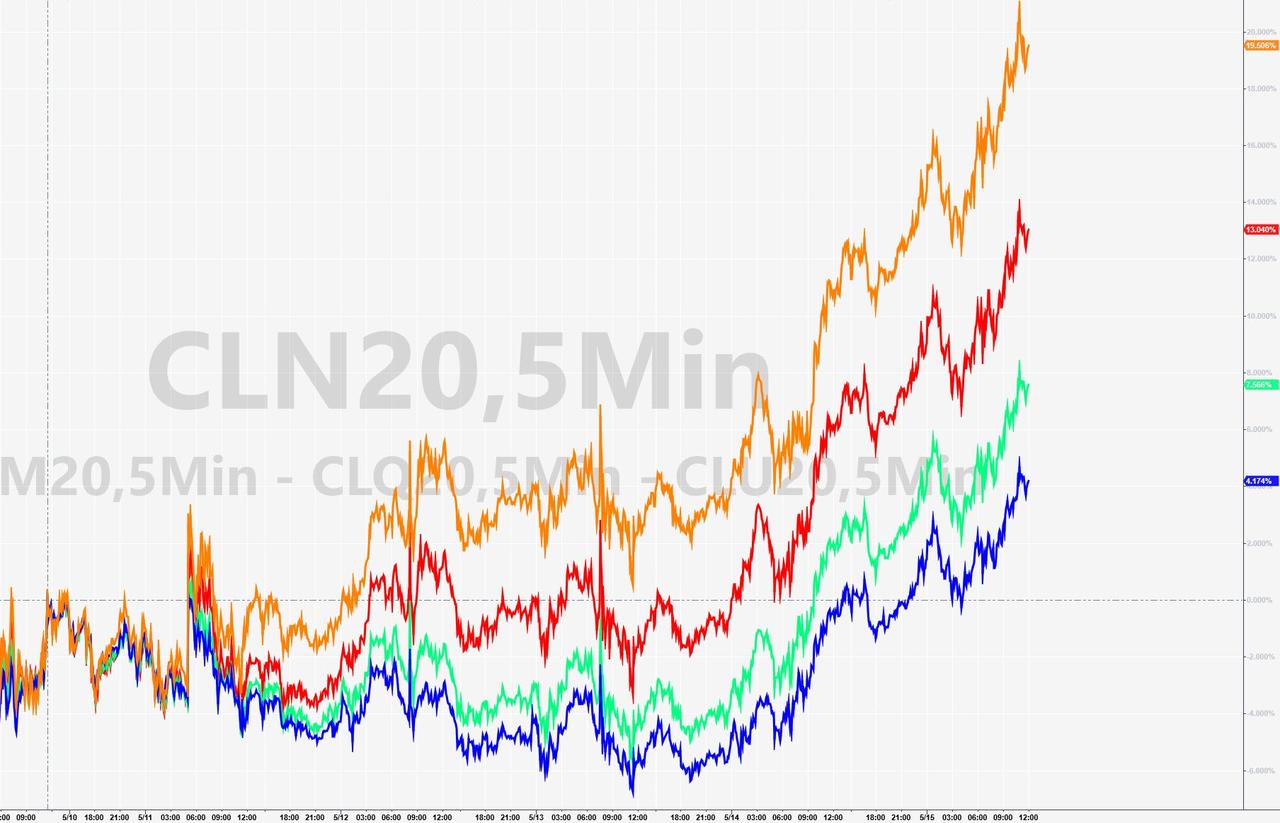

WTI (June) tested up towards $30 today…

Quite a week for June (but all contracts bid)…

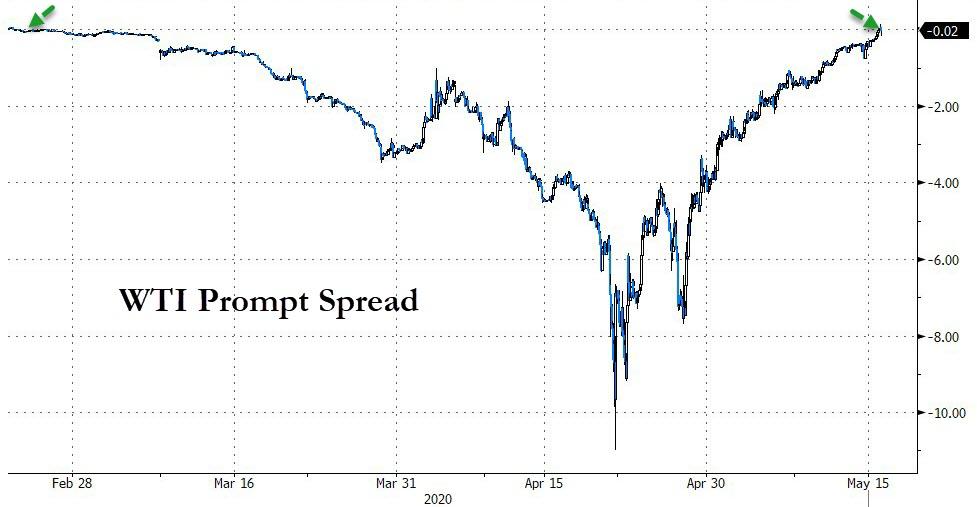

WTI’s front-month is back into backwardation after being in contango since March…

Source: Bloomberg

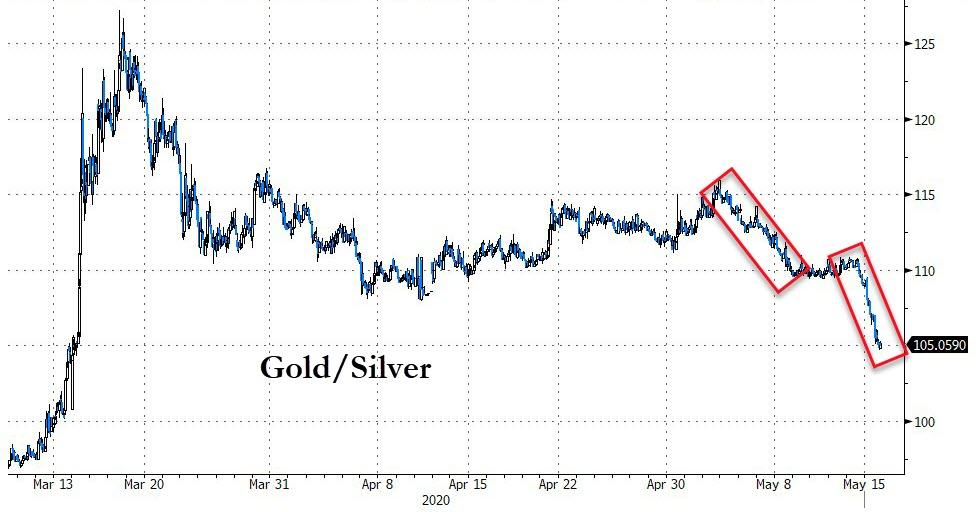

Silver surged back above $17 today…

Gold broke out of its recent triangle…

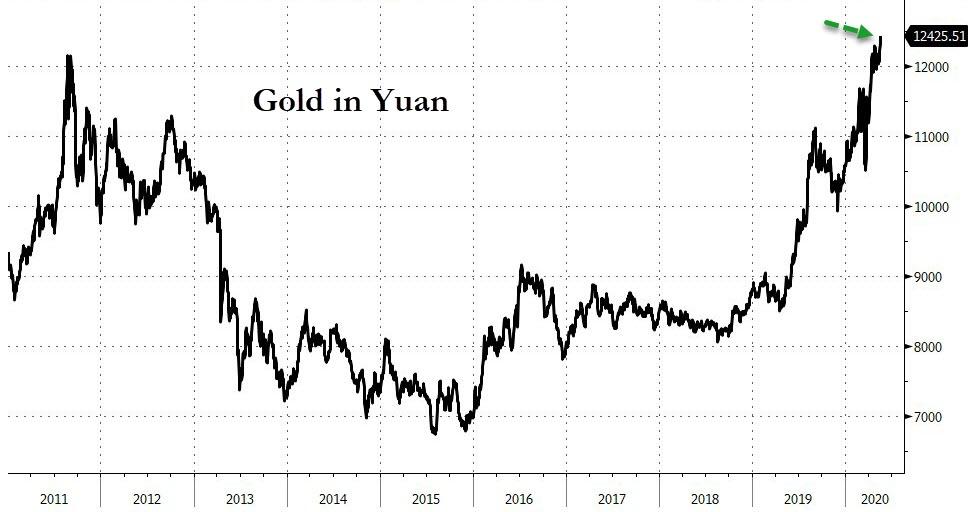

Gold hit a record high in yuan…

Source: Bloomberg

Silver notably outperformed gold for the second week in a row… (biggest daily outperformance of silver over gold since July 2016 today)…

Source: Bloomberg

Finally, we are sure many can sympathize with a bearish Hitler as he checks his trading account this month…“my wife will not be happy with me…”

“You can’t just bribe small businesses to keep people employed forever…” Or can you?

But, if only Addie had been long gold from the start?

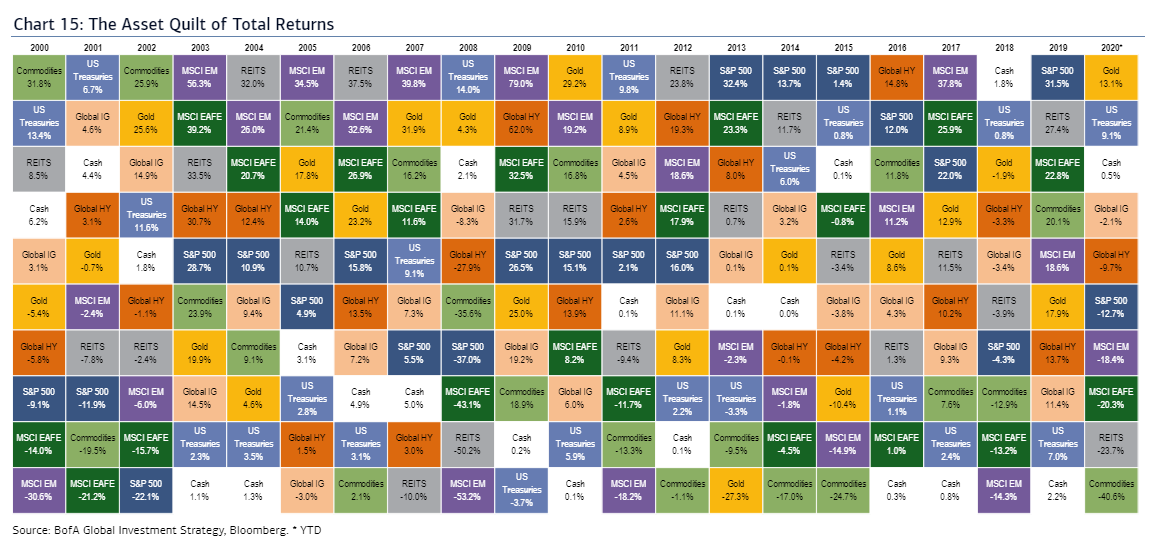

Scores on the Doors: gold 13.1%, US dollar 4.0%, government bonds 2.9%, cash 0.5%, IG bonds -2.3%, HY bonds -9.7%, global equities -14.9%, commodities -40.6% YTD.