“For Lease”: The Commercial Real Estate Apocalypse In Photos

Tyler Durden

Sun, 05/17/2020 – 16:50

In early 2017, we first reported a bearish trade emerged which quickly gained popularity in the investment community, and was dubbed “The Next Big Short.” At the time, only a few bearish funds were positioned for a “retail apocalypse” that could spur a wave of defaults.

Fast forward to today, coronavirus outbreak, and the ensuing lockdown, has essentially frozen the commercial real estate market. Buildings that were once used for restaurants, offices, hotels, spas, and or anything else that is classified non-essential have seen soaring vacancies.

This is single handily sending the commercial property market into chaos. As vacancies soar, tremendous downward pressure is being put on almost every asset class tied to commercial real estate.

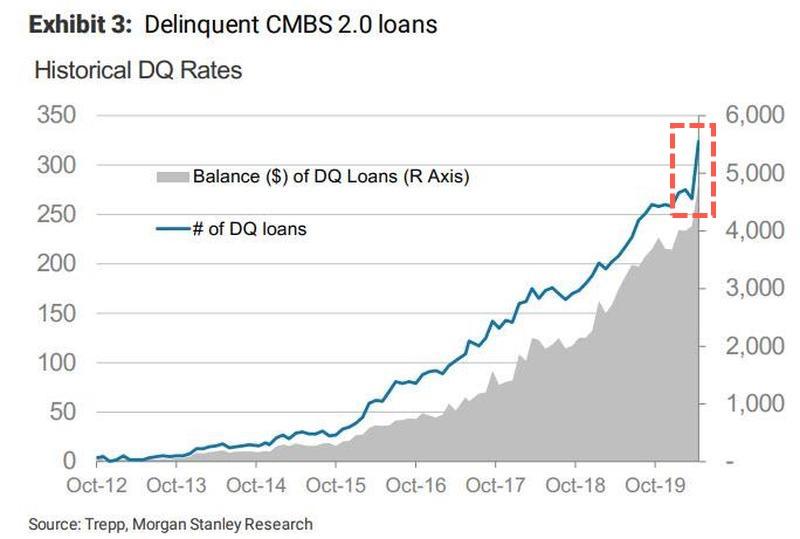

The latest TREPP remittance data compiled by Morgan Stanley showed a quarter of all commercial mortgage-backed securities (CMBS) could be on the verge of default. CMBS delinquencies surged to a new high in April as lockdowns continued:

With retail in disaster, a deluge of CMBS defaults is on the horizon. Shown below, the value of commercial mortgage-backed securities (CMBX Series 6 BBB- tranche) is collapsing…

For more color on the collapse, mcm-ct.com created a “subthread showing the economic devastation down here in the Lighthouse Point to Delray Beach area on a main commerce/travel route…” It appears MCM recently drove up and down a stretch of highway in South Florida, an area of great wealth, and said, “three months ago one could count “For Lease” signs on this whole route on a few hands,” which now appears to have significantly multiplied during lockdowns.

Stretch of highway MCM traveled

“Here are pictures of many (probably most of the “For Lease” signs as of yesterday…remember there used to be very few just months ago…each one of these comes with tragedy before it imo and needs a VERY CREDIT WORTHY NEW TENANT willing to make a big/long-term commitment,” mcm-ct.com tweeted.

“For Lease” signs along a stretch of South Florida highway

In a series of tweets, here is what MCM said about the current situation of the commercial real estate market in South Florida and the local economy:

Rebuilding credit worthiness from these aborted/terminated or insolvency related lease and business blow ups will take years. The only way this could have been prevented was if the government provided a national backstop directly BEFORE THESE SIGNS APPEARED

— mcm-ct.com (@mcm_ct) May 16, 2020

spoke to a lot of people recently – have yet to meet a person who got the full package of unemployment aid in FL

Many people have received the $1,200 federal government check but most have not gotten state unemployment. And many businesses are still waiting for business support

— mcm-ct.com (@mcm_ct) May 16, 2020

Many people do not know what to do or where to go or even how to get free food – yet these leases are suddenly going to be filled with credit worthy businesses willing to make 10 year risks based on a government that proved it will and can terminate their businesses at any time

— mcm-ct.com (@mcm_ct) May 16, 2020

I’m sorry, the one thing that people think when they start a business is THEY WILL DECIDE WHEN ITS OPEN barring Mother Nature or a War not self immolation and violation of constitutional rights by the US government

For Christ’s sake, New Jersey beaches are open but not here pic.twitter.com/nA1nwLh6Ye

— mcm-ct.com (@mcm_ct) May 16, 2020

NOW WHEN YOU TAKE A LEASE OUT you need to factor business risk in but also add the risk of the government violating the constitution and your rights to the assessment as whether to put good money down to take on a business commitment & a lease

Entrepreneurs will be gun shy imo

— mcm-ct.com (@mcm_ct) May 16, 2020

Regardless, the situation will take TWO YEARS BEFORE DAMAGED ENTREPRENEURS BEGIN TO BE ABLE TO REBUILD CREDIT SUFFICENT EVEN BE APPROVABLE TO TAKE A LEASE and that will be a minimum…and then there are the next waves of business that will decide to pack it in

— mcm-ct.com (@mcm_ct) May 16, 2020

The govt (esp marxists) screwed up a generation of business & its going to take 2 to 4 yrs to start to come back

they proved that SOCIALISM DOES NOT WORK because it does not & CAN NOT work EQUALLY for all because INTEGRITY/INDUSTRIOUSNESS/EFFORT IS NOT EFFECTIVE 4 GETTING ACCESS

— mcm-ct.com (@mcm_ct) May 16, 2020

And perhaps MCM is correct, as we’ve explained before, a recovery back to 2019 levels could take several years.

Not to mention, Scott Minerd, the chief investment officer of Guggenheim Investments, believes it could take upwards of “four years” for a recovery to take place adding that “to think that the economy is going to reaccelerate in the third quarter in a V-shaped recovery to the level where the gross domestic product (GDP) was prior to the pandemic is unrealistic.”

The disaster unfolding on main street America will be devastating.