Herbalife Selling $600MM In Junk Bonds To Fund Stock Buyback

Tyler Durden

Wed, 05/20/2020 – 12:14

While the bond bubble is alive and well, with over a trillion in investment grade issuance YTD (ignore the $1.1 trillion in IG downgrades in the same period), the reality is that the credit market has been increasingly bifurcated ever since the Fed announced it would buy only investment grade bonds (and select fallen angels), while leaving the junk bond market largely to its fate.

The result has been a record scramble for “risk-free” investment grade debt, offset by a sharp slowdown in demand for junk bonds where investors are waiting for the “next shoe to drop” after the coming wave of defaults spawned by plunging oil prices and the coronavirus pandemic.

One person who refuses to wait and see where the chips may fall is billionaire Carl Icahn, who is not only seeking to raise some $600 million in junk-bonds for Herbalife where he is the biggest shareholder, but is explicitly telling any new creditors they are basically paying for his next several homes as he will pocket most of the proceeds himself since Herbalife will use all the new cash to finance share buybacks – needless to say an “unusual move” at a time when companies are borrowing billions of dollars to shore up liquidity during the coronavirus pandemic, and when there is a broad revulsion against buybacks (even by those companies which repurchase billions in stock in the past decade).

The notorious maker of weight-loss shakes that counts Carl Icahn as its largest shareholder (he owns 35mm shares or 24% of the outstanding) and which was the target of a protracted feud with Bill Ackman who for years accused the company of being a pyramid scheme, is sounding out investors for the unsecured bond at a yield in the range of 8% based on early, unofficial pricing discussions, according to Bloomberg sources.

The deal may be sold as soon as today, with proceeds used for general corporate purposes, including the purchase of stock or capital investment, said the Bloomberg sources. At roughly 8%, the new 5.25-year bond would yield only slightly more than the company’s existing $400 million of 7.25% unsecured notes due in 2026 that last traded at 100.25 cents on the dollar. Moody’s rated the bonds B1, or four notches below investment grade.

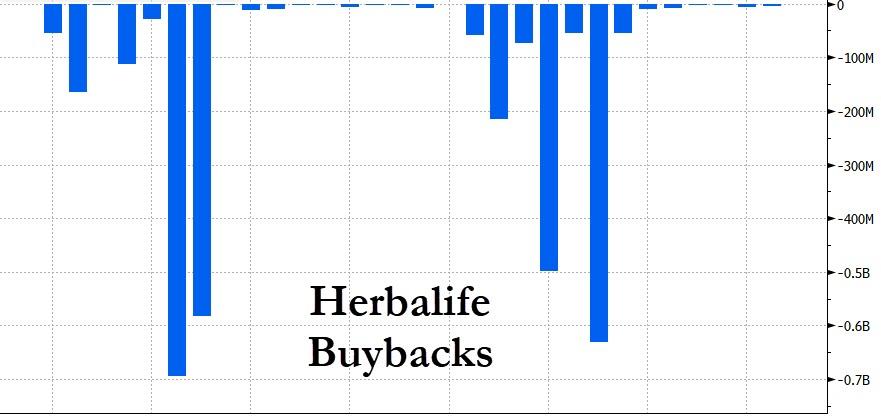

As we explained back in 2014 the main reason why Icahn went hard after Herbalife is because the company had balance sheet capacity to lever up and do even more buybacks; and now – sensing that the junk bond market is starved for even more deals, Icahn is willing to give high yield bond investors just what they want. Indeed, as Bloomberg notes, Herbalife has a history of doing so with its last buyback for $600 million in May 2018, according to data compiled by Bloomberg. It also authorized an ongoing five-year $1.5 billion buyback program in October 2018.

Curiously, Herbalife’s business has fared well during the pandemic. Net sales increased 7.7% on a year-over-year basis in the first quarter ended March 31, and the company expects only a small dip in preliminary April volumes as a result of the virus, according to an earnings release earlier this month.

“The demand for our products and for our services has gone up around the world,” Chief Executive Officer John Agwunobi said on a recent earnings call.

While the company has good profitability, cash flow and geographic diversity, there are parts of its business model that are fragile, Moody’s analyst Chedly Louis wrote. Its global multi-level marketing structure has been under scrutiny for years by a number of regulatory agencies, and its business model is highly reliant upon its ability to recruit and retain sales representatives around the world, Chedly wrote.

And while the pyramid scheme cloud over Herbalife has been lifted, the SEC and the Department of Justice are currently investigating whether Herbalife violated the Foreign Corrupt Practices Act over the time period of 2006 through 2016. The company has reached an “understanding in principle” with both agencies and is expected to resolve the investigations soon, according to a May 7 filing.