“The Data Is Disturbing” – Extreme Options Sentiment Flash Red Light For Stocks

Tyler Durden

Wed, 05/20/2020 – 15:45

Stocks know something… they must do right? Remember, they’re a discounting mechanism… or some other such trite bullshit. They are nothing of the sort, as bond and commodity markets and fundamental earnings expectations signal quite clearly…

But “Fear not…” echo the halls of mirror and smoke vendors appearing on your education channels… Tomorrow, some other drug trial will announce the person its testing its virus on looks slightly happier, or a Central Banker will say something really market supportive like: “We’ve got lots of money and we want to give it to you so that markets don’t fall…”

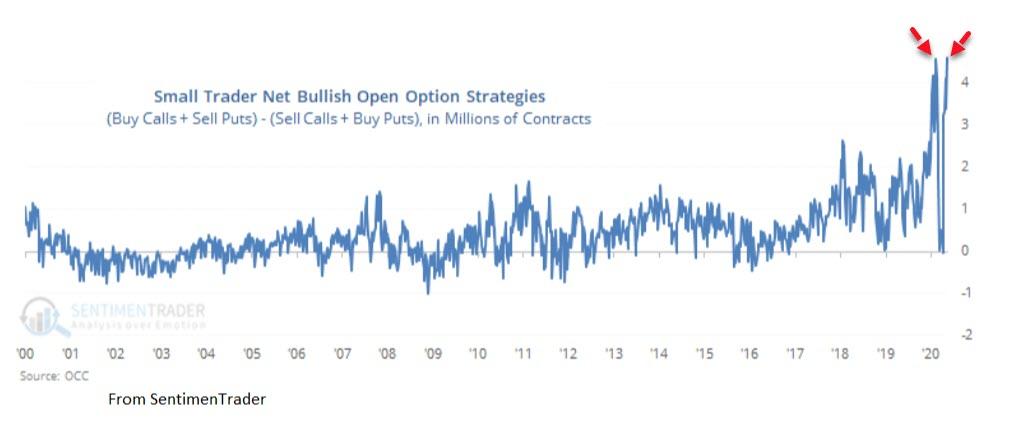

There’s just one thing (well a few, but let’s focus on this one). As Bloomberg reports, small options traders are bullish to a point that signals trouble for U.S. equities, according to Sundial Capital Research.

“Last week, the smallest of options traders, those with trades for 10 contracts or fewer at a time, opened a new record of net bullish positions,” Sundial President Jason Goepfert wrote in a note Tuesday.

In comparison, very large traders, those with trades of 50 or more contracts at a time, haven’t been betting so much on a rally, he said.

That has widened the spread between small- and large-trader net bullish positions to a record, with the gap jumping “like it did in 2008” in the past couple of weeks, he added.

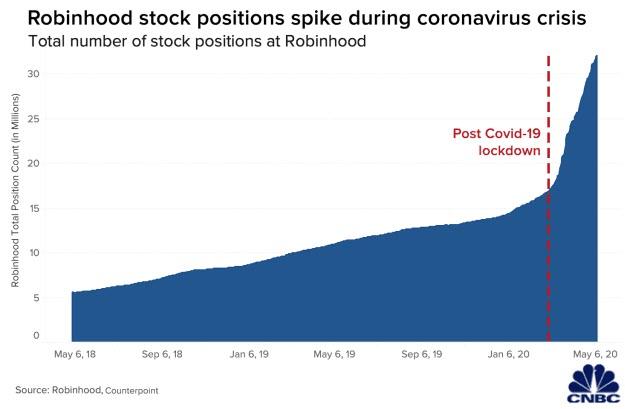

All of which reflects on the buying panic by small millennial retail buyers…

Extremes in the data have consistently led to poor market returns, Goepfert wrote.

“The data from last week is disturbing,” Goepfert wrote.

“It clearly shows that the smallest of traders, who tend to be the most consistently ill-positioned at extremes, have gone aggressively long, in a leveraged fashion.

This has a strong tendency to lead to lower prices over the short to medium term.”

But, as Bill Blain summed up succinctly earlier:

“The big risk is that people are going to tire of this B/S.

Bank analysts and big investors trying to look past the vaccine/treatment noise, past the Central Bank puts, and focusing on fundamentals all say the same thing: Stocks are massively overvalued ahead of a looming recession. Corporate bond yields need to reflect rising default risk. Simple as. “

Trade accordingly.