Tesla “Midnight Massacre”: Musk Cuts Prices Across Entire US Lineup; Demand Cliff “Secured”?

Tyler Durden

Wed, 05/27/2020 – 09:09

Submitted by Gordon Johnson of GLJ Research

Midnight Price “Massacre” Underpins TSLA’s “Large” Demand Problem (as we have warned now for several months). Materially hurting the “unlimited demand” thesis so many TSLA pundits use to support the company’s current forward EV/EBTIDA multiple of 26.4x, and going against Musk’s claim that TSLA would see Model 3 demand “slip to about 500,000″/year in a recession (link), this morning at around 12:30am EST TSLA slashed the US prices for its entire lineup of EVs by $2K-$5K across the board.

More specifically, for the Model 3, its most affordable and highest selling US car, the staring price for the M3 SR+ is now $37,990 vs. $39,990 prior. Moving to the Model S LR+, TSLA’s luxury sedan, the price was cut $5,000 to $74,990; the price for the Model S Performance was also cut by $5,000 to $94,990. Moving to the Model X, similar to the Model S, both versions of the luxury electric SUV saw an overnight price cut of $5,000, with the LR+ iteration of TSLA’s egg-shaped SUV now touting a price of $79,990. Finally, with respect to the Model Y, TSLA left the US prices for these cars unchanged.

Exhibit 1 – Model 3 SR+ Price Cut $2K Early this AM

Exhibit 2 – Model S LR+ Price Cut $5K Early this AM

Exhibit 3 – Model X LR+ Price Cut $5K Early this AM

But these price cuts weren’t limited to the US… They were Extended to China and Japan. As reported by Chinese news rag Global Times early this am, TSLA unexpectedly also cut the price of its imported Model S and Model X cars in China by $4,060 effective immediately (Ex. 4).

Exhibit 4 – Tesla Cuts the Price for its Imported Model S/Model X Cars by $4,060

Separately, in Japan, the price for the Model S LR was cut from JPY$10,350,000 to JPY$9,899,000 (-4.4%), while the Model S Performance price was cut from JPY$12,810,000 to JPY$12,999,000 (-4.0%). For the Model X LR in Japan, the price was cut from JPY$11,100,000 to JPY$10,599,000 (-4.5%), while the Model X Performance price was cut from JPY$13,480,000 to JPY$12,999,000 (-3.6%).

So what’s the big deal? Well, in addition to this being among the clearest signals that TSLA has a (significant) APAC demand problem, TSLA is currently facing 10 civil lawsuits in China (and two possible class-action lawsuits) over “disputes in sales contracts” (link). Stated differently, unlike the US where TSLA appears immune from any perceived wrongdoing (see here, here, and here), in China, already, criticism has turned into lawsuits due to lack of transparency, too-often price changes, and alleged deceptive sales pitches. Thusly, with another spate of sharp/unexpected APAC price cuts in its attempts to move metal ahead of 2Q20 results, it seems TSLA could soon be in receipt of another round of civil, and potentially class action, lawsuits.

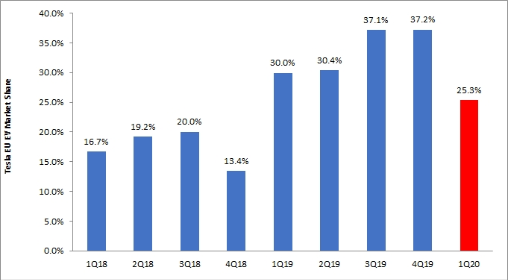

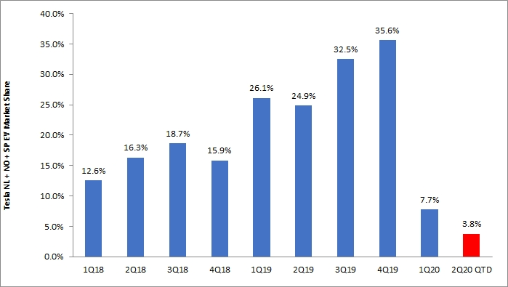

The Data Says it All, but Up Until Now… Nearly Everyone in the Investing World Continues to Ignore that Data in Favor of TSLA’s “Ambitions”. In 1Q20, ahead of the onslaught that is COVID-19, TSLA sold 23,173 cars in Europe (or 92,692 cars annualized), down -35% q/q and up just 0.8% y/y. By comparision, in 4Q19, TSLA sold a record 35,656 cars in Europe, or 142,624 annualized (up +20.8% q/q, and +327.0% y/y). What’s more, from 4Q19-to-1Q20, TSLA’s share of the European market fell from 37.2% to 25.3% (Ex. 5), while in NO + NL + SP its share fell from 35.6% to 7.7% – it’s no coincidence that this is happening as competition from the likes of VW, Audi, Renault, and KIA, among others, is ramping up. Furthermore, 2Q20 QTD, in NO + NL + SP, TSLA’s market share has eroded further to 3.8% (Ex. 6).

Exhibit 5 – Tesla Quarterly Share of The European EV Market (registrations)

Exhibit 6 – Tesla Quarterly Share of Netherlands + Norway + Spain (registrations)

Stated differently, TSLA’s share in Europe is in a state of collapse due to the first competition the company has ever faced, and its annual sale of cars in all of Europe appears set to come in handily below 100K units. Yet, against this backdrop, TSLA is currently in the process of ramping a new plant in Germany capable of 500K cars/year of output (to supply the European EV markets). At risk of stating the obvious, we believe, based on the data, today, sustainable demand for TSLA’s cars in Europe is around 70-80K units/year. Consequently, while, admittedly, the cost of TSLA’s new German plant will be mainly financed by German taxpayers… in our view, building capacity at ~5x-6x sustainable demand for a product in among the most capital intensive industries in the world (i.e., the auto business), is reckless. In fact, when considering TSLA did something similar with its “gigafactory” in Buffalo, NY (link), where expectations have never been fully met, the idea that a new plant in Germany could fall far short of TSLA’s targets seems fitting.

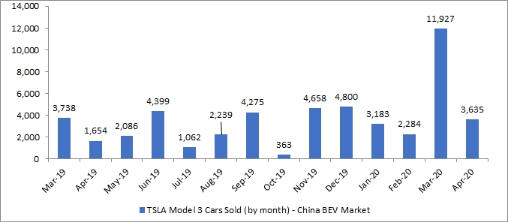

Looking to China, the Data Paints a Similarly “Grim” Picture. When looking at the trend in China, once again, we don’t quite understand why what’s clear in the data has not resonated with TSLA “investors”. More specifically, TSLA is building a plant capable of 500K cars/year of output, targeted specifically to Chinese buyers. Yet, as shown in Ex. 7 below, after peaking at 12,709 cars in Mar. 2020, TSLA’s sale of cars in China fell to 4,075. In fact, since Jan. 2020, TSLA’s avg. cars sold/month is 5,665. Thusly, similar to Germany, when considering TSLA is targeting 4,000 cars/week of production in Shanghai… once again it appears TSLA’s targeted output is substantially ahead of run-rate demand for its cars as it will have to sell ~17,000 cars/month in China to keep up with planned output (in April, upon launching the Model 3 LR [where the lion’s share of China backlog was likley filled], TSLA received a total of just ~15,000 orders – this is simply not enough). Stated differently, after cutting prices on its made-in-China (“MIC”) Model 3 cars three times this year, TSLA is now cutting the price for both its Model S and Model X China imports. At risk of being repetitive, this suggests, similar to Europe, TSLA has a (major) demand problem in China. And, with BYD outselling TSLA in Apr. 2020 (Ex. 8), and GAC and BAIC/BJEV not far behind, it seems the competition in China will remain stiff.

Exhibit 7 – TSLA Model 3 Cars Sold (by month) – China BEV Market

Exhibit 8 – China April EV Sales – Top 10 Brands

While TSLA Seemingly has Infinite Lives (i.e., the ability to raise money), we Feel the Growth Story will be Thoroughly Debunked in 2020. As its share in China and Europe wane further this year, and its sales in the US fall far short of expectations, we believe the TSLA “hyper-growth” story will finally be unequivocally put to rest – interestingly, to this point, TSLA’s LTM sales in the US are down -14.8% y/y. And, with no Model 3 backlog to fall back on, and demand for the Model Y far short of expectations in 2020 (the Model Y is made with 75% of the same parts as the Model 3, meaning the demographic who is buying the Model 3 and the Model Y is virtually identical), we believe TSLA will struggle to sell cars this year.

Resultantly, we believe TSLA will need to execute several, large, capital raises to fund acute real cash burn (which we expect TSLA to successfully achieve). However, as we enter 2021, we believe TSLA’s ability to attract additional institutional money will end; at that point, we feel liquidity concerns will creep back in (as TSLA continues to burn excessive amounts of real cash each quarter), ultimately pushing TSLA’s stock to our year-end 2021 price target of $87/share (-89.4% downside from yesterday’s closing price).