As Market Dumps, Millennials Muppet’d: Robinhood Is Down… Again

Tyler Durden

Wed, 05/27/2020 – 10:14

The market is down…

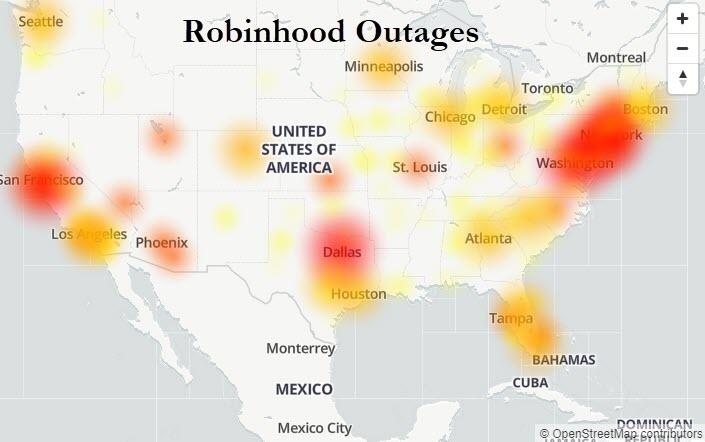

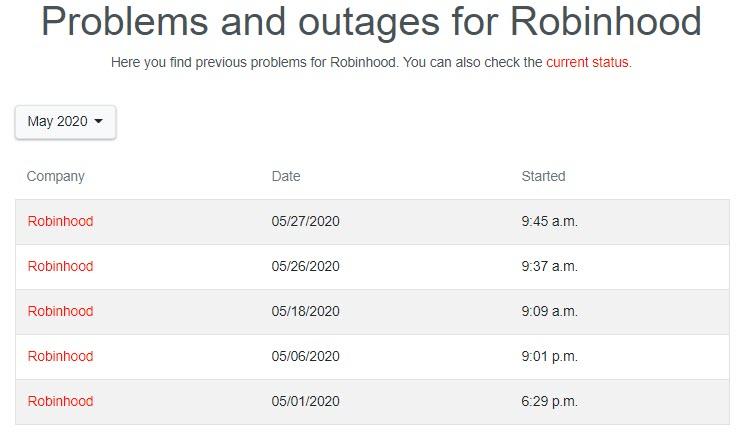

And so is Robinhood…

Not the first time…

And so after this…

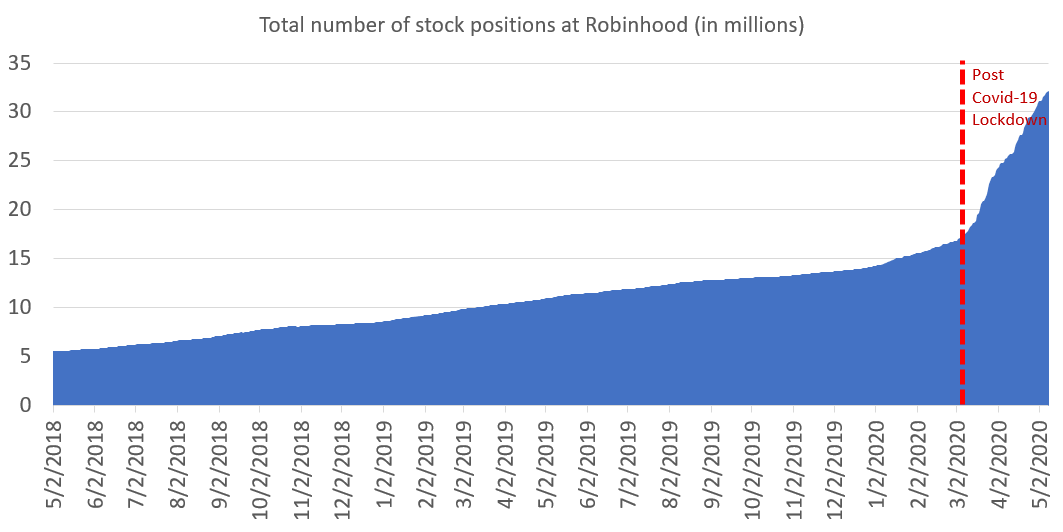

With retail investors flooding the market as the so-called “smart money” steps back, “Wall Street says it will end badly.”

“Obviously you’re exposing yourself, depending on how you’re doing it, to catastrophic losses,” said Brian Nick, chief investment strategist at Nuveen. “If you get a lot of investors in either individual securities, companies or investment strategies that they may not have experience with, it could lead to unhappy investors down the road.”

Bloomberg also picked up on a chart that we showed from Goldman yesterday, demonstrating that the “fingerprints of tiny investors are all over the options market” where as we noted yesterday, trades consisting of just one contract now account for 13% of total volume.

This is how Millennials feel as their sell orders fall on deaf ears…

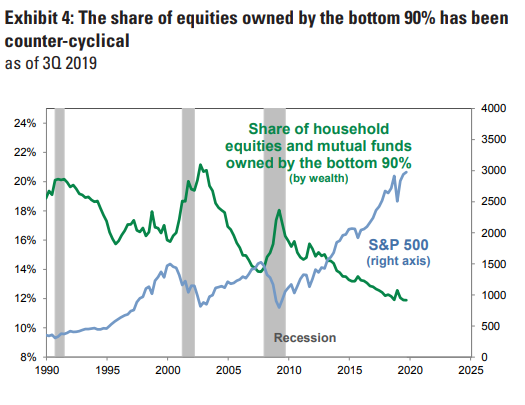

As the vast majority of unsophisticated retail investors start to chase momentum at the worst possible time, they buy stocks en masse just as a recession begins, which in turn craters the market. In the Goldman chart below, we can see that the share of equities owned by the 90% jumps just as recession begin.

This is precisely what is going on right now: in laymen’s terms, the rich are dumping their stock to the poor. The technical term is “distribution.”

And when it comes to other signs of both recession and “dumping to the bottom 90%” as of late, there’s plenty.

“There is a long, documented history of retail investors chasing a handful of story stocks and then getting burned,” said James Pillow, managing director at Moors & Cabot Inc. “We humans love a good narrative. I cannot imagine this time around ending any different.”