“A Cry For Help”: Global Sell-Off Accelerates On Rising Coronavirus Panic

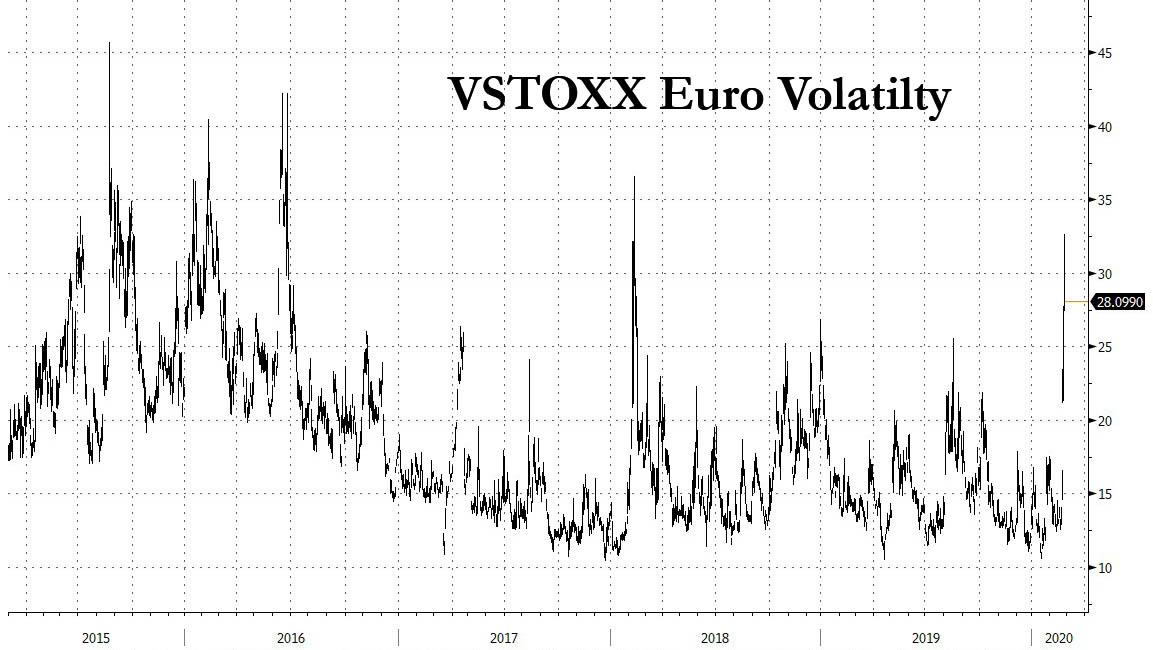

With little other data to guide risk sentiment, traders remained in thrall to the barrage of coronavirus headlines with last week’s bizarre complacency now completely shattered as volatility soars.

As a result, with the global pandemic now getting worse by the day, world stocks tumbled for the fifth straight day on Wednesday, while safe-haven gold rose back towards seven-year highs and U.S. bond yields held near record lows after governments and health authorities warned of a possible coronavirus pandemic.

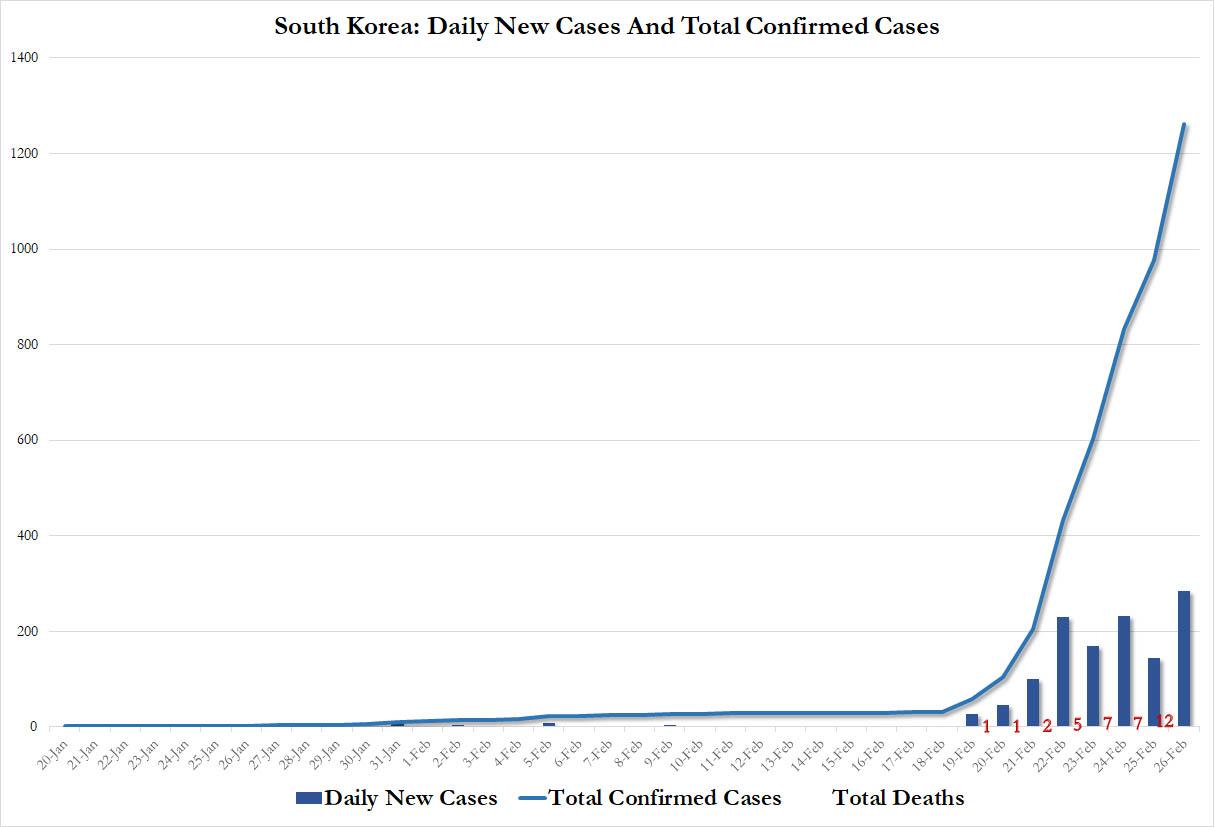

Overnight, the closely watched South Korean cluster reported 115 additional cases as of 4pm, after announcing 169 as of 9am this morning, according to a statement. Among a total of 1,261 cases vs. 51 a week ago, 710 were confirmed from Daegu and 317 from neighboring North Gyeongsang province Total death toll is 12; one fatality includes Mongolian citizen.

South Korea also said 16,734 people are currently being tested for coronavirus, up from 13,880 last night. Many of them are being tested as a precaution. Also overnight, Italy reported an additional 19 new virus cases, with the death toll now at 12. French health official announced three new confirmed COVID-19 cases in France, as well as the first death. Spain reported 2 more cases of the coronavirus, including the first case in Madrid, with 7 total cases reported in the last 24 hours. While Poland has recorded its first case as has Greece, according to press reports. Brazil’s Health Ministry said a man has tested positive for coronavirus in an initial test, with subsequent tests confirming this; in the first case for Latin America. A second coronavirus case has been reported in Africa, tests indicate an Italian adult who arrived in the country on 17 February has tested positive, according to WHO Africa.

In short: a deadly virus has now gone global and no matter what the WHO says, it is now a pandemic; for those who do care what the criminally corrupt World Health Organization did say, the WHO’s Tederos said using the word ‘pandemic’ carelessly has no benefit, could amplify unjustified fear and stigma; word might also signal that the virus can no longer be contained, “which is not true.”

Meanwhile, amid fabricated numbers, the virus has claimed almost 3,000 lives (the real number is probably over 100,000) in mainland China where drastic travel restrictions slammed the brakes on China’s manufacturing and consumer spending, and there are worries other countries will face similar disruptions.

“China’s template to contain the virus was to restrict economic activity and that’s hitting home. Markets are fearing there will be sequential shutdowns of economic systems to stop the spread,” said Lombard Odier strategist Salman Ahmed. Those fears of severe economic damage, and eventually a global recession if not depression, have sent MSCI’s all-country equity index to 2-1/2-month lows, wiping almost $3 trillion off its value this week alone.

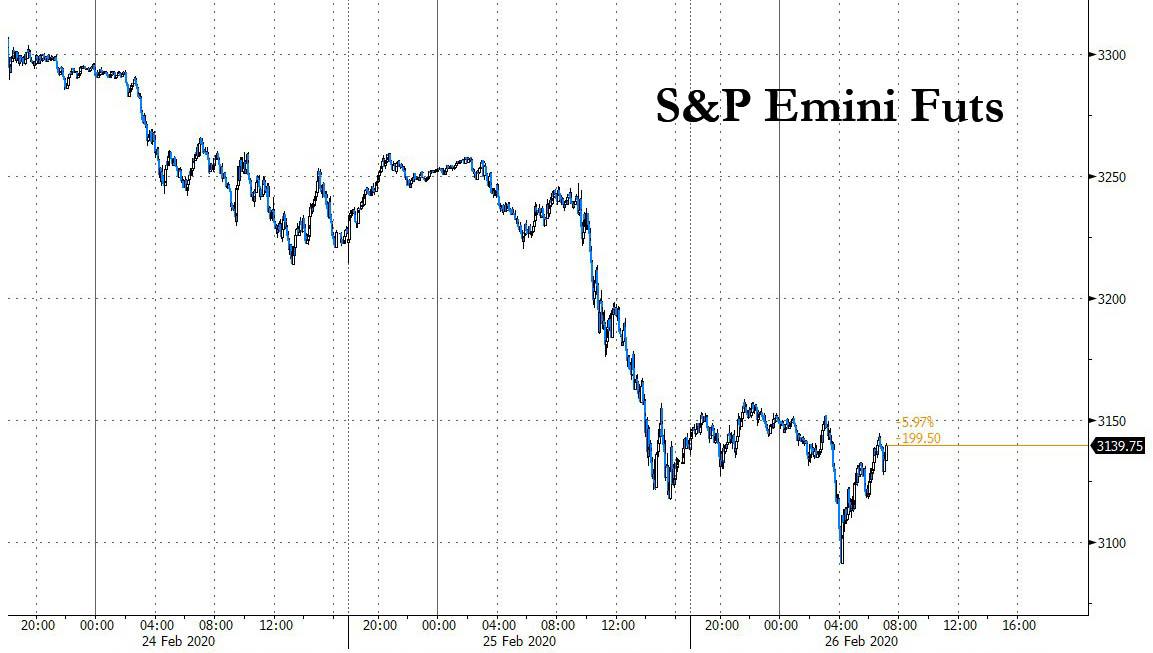

US Index futures initially rose, then plunged, then rebounded and were trading modestly in the red at last check while stocks in Europe and Asia tumbled.

In EUrope, the Stoxx Europe 600 Index declined for a fifth session, its longest down streak since July, as Diageo Plc and Danone SA warned the virus outbreak will hit sales in China. The first cases in Greece and in South America were reported, while Spain locked down a resort hotel in the Canary Islands with about 1,000 guests and workers inside. Europe’s VIX, the V2X index, briefly printed above 32 – the highest since the Feb 2018 volmageddon – as European equities slumped as much as 2.5% before bouncing off the lows, all driven by reports of more virus cases outside of China.

The export-heavy DAX lags European peers but recovers half of the morning’s losses; sectors-wise, travel names shed more than 3%, financial services and chemical names lose over 2% as markets run for havens.

Earlier in the session, Asian stocks fell for the fourth day, led by health care and IT, on concern over the impact of the coronavirus amid infections outside of China continue to spike. Stocks in Sydney and Seoul led declines in Asia, with the won falling back toward its weakest since 2016 as South Korea emerged as a hot spot for the contagion. All Asian markets were down, with Thailand’s SET Index dropping 4% and Australia’s S&P/ASX 200 falling 2.3%. Trading volume for MSCI Asia Pacific Index members was 44% above the monthly average for this time of the day. South Korea has emerged as the hot spot for the virus as infections surged pass 1,200. Italy and Iran have reported 11 and 15 deaths respectively. The Topix declined 0.8%, with Daitobo and Segue falling the most. The Shanghai Composite Index retreated 0.8%, with Irico Display Devices and Ningbo Tuopu posting the biggest slides

In rates, ten-year Treasury yields edged up from a record-low close set Tuesday, while a dollar gauge rose. Bund and Treasury futures pare Asian losses with curves bull steepening. ECB-dated OIS rates price a 10bps rate cut by Dec. ‘20 for the first time since October last year. Gilts rally sharply, gains in 10y futures capped around 135.00. Peripheral spreads widen more aggressively with Bund/BTP trading through 150bps. Money markets also price roughly two 25-basis-point rate cuts by the Federal Reserve. A Bank of England rate cut is also fully priced for September.

“Part of this selloff is a cry for help,” Ahmed said but he said Fed cuts were unlikely in the early part of the year unless “we get an Italy-like situation in the United States.”

In FX, G-10 FX slips versus USD as rate cut expectations weighed on the dollar while continued to pullback against the yen from recent 10-month high of 112.23 yen. It traded around 110 yen. greenback also came off an almost three-year high against the euro, reached on Feb. 20 while it remained flat to a basket of currencies.

The Swiss franc advanced a second day and Treasuries rose with bunds, with emphasis on the front-end of the curve; European peripheral bonds sold off, led by Italy, amid increased credit risk. Money markets are pricing a 10-basis-point ECB interest-rate cut in December 2020, the first time a full cut has been factored in for this year since October. The euro recovered to trade little changed against the dollar; the Stoxx Europe 600 Index dropped for a fifth straight session, suffering its longest losing streak since July. The pound fell and gilts rallied as negotiations between the U.K. and the EU over the two sides’ future trading relationship were expected to get off to a tense start, with the Westminster government’s strong majority giving extra credence to its threats to walk away without a deal. The Australian dollar dropped after hedge funds sold the commodity currency, triggering stop-losses, as concerns grow over the widening impact of the coronavirus. The yuan rose against its peers for a second day as investors started to price in the virus outbreak globally instead of a China domestic event.

“The significant dovish tilt being priced in by markets from the Fed may not materialize and that might cause the next leg of the dollar rally,” said Peter Chatwell, head of multi-asset strategy at Mizuho.

The dash for safety also boosted gold 1% to around $1,650 per ounce, heading back towards seven-year highs of 1,688.66 hit on Monday. Brent crude futures fell 1% to $53.95 per barrel.

Expected data include new home sales. Lowe’s, TJX, and Wendy’s are among companies reporting earnings. Turning to the day ahead now, the highlights include January’s US new home sales and the MBA’s weekly mortgage applications. From central banks, there’ll be a number of ECB speakers, including President Lagarde, as well as Makhlouf, Panetta and Holzmann.

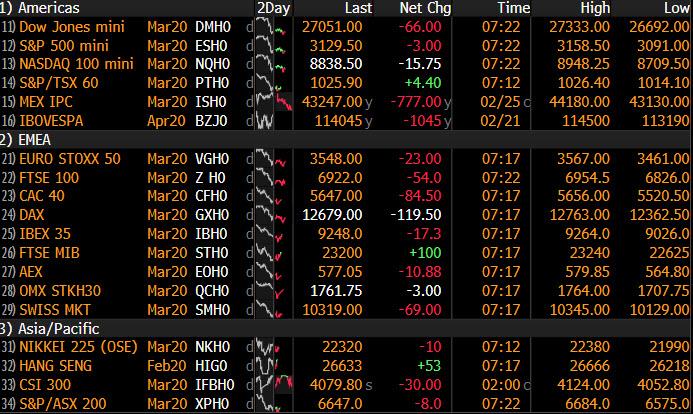

Market Snapshot

- S&P 500 futures down 0.3% to 3,124.75

- STOXX Europe 600 down 2.2% to 395.69

- MXAP down 1.2% to 160.84

- MXAPJ down 1.4% to 524.63

- Nikkei down 0.8% to 22,426.19

- Topix down 0.8% to 1,606.17

- Hang Seng Index down 0.7% to 26,696.49

- Shanghai Composite down 0.8% to 2,987.93

- Sensex down 1.1% to 39,838.26

- Australia S&P/ASX 200 down 2.3% to 6,708.10

- Kospi down 1.3% to 2,076.77

- Brent futures down 1.3% to $54.26/bbl

- Gold spot up 1% to $1,651.79

- U.S. Dollar Index up 0.1% to 99.09

- German 10Y yield fell 1.3 bps to -0.525%

- Euro up 0.06% to $1.0889

- Italian 10Y yield rose 2.0 bps to 0.822%

- Spanish 10Y yield rose 3.4 bps to 0.247%

Top Overnight News from Bloomberg

- Europe remained on high alert for coronavirus cases as Spain joined Italy and other nations in battling to contain the disease, confining around 700 guests to a Canary Islands hotel while they undergo tests. The number of infections on Tenerife climbed to four

- Global investors are stashing more and more assets into gold as the coronavirus outbreak spreads and appetite for risk takes a hit. The global tally of bullion in exchange-traded funds swelled by the most in more than a month on Tuesday as equities sank. That was the 25th consecutive day of inflows, a record. At 2,624.7 tons, the holdings are the largest ever

- Japanese Prime Minister Shinzo Abe called for major sporting and cultural events to be called off, postponed or scaled down over the next two weeks, saying the move was crucial in preventing the domestic spread of the new coronavirus

- Hong Kong’s government unveiled a budget packed with giveaways including a one-time cash handout that economists said isn’t likely to spur growth, as the city struggles to stabilize an economy battered by political unrest and the coronavirus

- Global banks including UBS Group AG and Bank of America Corp. are broadening their contingency plans across Asia to ensure they can keep trading and other operations running as the spread of the coronavirus accelerates outside China

- Bank of England will apply tougher haircuts on Libor-linked collateral in its operations from October. BOE Executive Director for Markets Andrew Hauser announces move as part of measures to accelerate replacement of Libor, which he says is a global stability risk

Asian equities traded mostly lower, with losses across the board for a bulk of the session after Wall Street experienced another bleak session which saw the DJIA shed almost 900 points, whilst the S&P posted is largest two-day loss since August 2015 and the Nasdaq turned negative for the year – traders were also spooked by the 10yr Treasury yield falling to a fresh record low of ~1.3070%, which came as a function of the rising virus fears. ASX 200 (-2.3%) continued to be pressured by its heavyweight financials and mining sectors, whilst Nikkei 225 (-0.8%) bore the brunt of declines across mining and auto names, but Canon shares rose around 4% at the open on the back of reports that the Co. has started developing a coronavirus testing kit. The index drifted off lows as it tracked the movements in USD/JPY. KOSPI (-1.3%) conformed to the regional declines following its breather session yesterday, as confirmed South Korean cases topped 1000 vs. 51 a week ago. Over in China, Hang Seng (-0.7%) was weighed on by losses across its oil giants, entertainment stocks and financials – which together account for almost 70% of the index, although the index pared some losses upon the unveiling of the Hong Kong budget, which announced a HKD 120bln package of measures to bolster the economy. Shanghai Comp. (-0.8%) opened lower by over 1% but thereafter trimmed losses despite the PBoC skipping OMO for a 7th consecutive day, after the latest China virus numbers showed a slowing rate of new cases and deaths.

Top Asia Headlines

- Virus Damage to China’s Economy Clear From Early Indicators

- The Race to Lead Malaysia Comes Down to Two Long-Time Rivals

- Jet Air Creditors to Ask Court to Extend Liquidation Deadline

- Lebanon Faces a $50 Billion Hole Even Beyond Its Eurobonds

Stocks in Europe (Eurostoxx -1.2%) have once again fallen victim to the fallout of COVID-19 as the virus shows no sign of abating outside of China. The velocity of the selling pressure in Europe has been noteworthy with interim support levels proving to be futile (e.g. FTSE MIB has now entered correction territory from last week’s highs). That said, ahead of the US entrance to market, indices have nursed some losses as markets paused for breath following recent selling. In terms of the case count, reporting for the purposes of a written report is particularly difficult given the fluidity of the situation (as such we will refer you to the headline feed of the website), however, from a European perspective, Italy is continuing to announce further coronavirus diagnosis’, France has announced two deaths, Spain’s case tally continues to rise, Britain has stepped up preventative measures, Poland and Greece have announced their first cases. Again, this is just a small snapshot of where we currently stand and the situation is consistently evolving on an hour-by hour basis. Losses are relatively broad-based across sectors with defensive names unable to insulate themselves from the selling pressure. Notable specific laggards include, LSE (-2.7%) with Co. shares have been weighed on by FT reports that the Co.’s purchase of Refinitiv is facing increasing scrutiny by the EU, whilst travel names once again are a source of heavy underperformance with TUI (-2.1%), easyJet (-2.3%), RyanAir (-4.3%). Furthermore, corporate updates in the UK from Metro Bank (-17%) and Taylor Wimpey (-3.5%) have been poorly received with the latter hampering some of its UK peers. To the upside, Weir Group (+6.5%) top the Stoxx 600 post-FY earnings update, whilst Saipem (+3%) shares were lifted after exceeding 2019 financial targets and Danone (Unch) has been able to avoid negative territory despite cutting sales guidance.

Top European headlines

- Avast Says Jumpshot Scandal Caused Brief Spike in Defections

- Money Markets Start Pricing in ECB Interest-Rate Cut This Year

- Spanish Hotel Remains on Lockdown With Europe on High Alert

- Avast Says Jumpshot Privacy Scandal Impact Has Been Limited

In FX, all off best levels, but retaining a firm underlying bid as broad sentiment remains bearish on the ongoing spread and accumulation of COVID-19 cases/deaths further beyond mainland China. The Franc is probing above 0.9750 against a relatively depressed Dollar, though unwinding some gains vs a perkier Euro that has breached Fib resistance against the Greenback around 1.0887 and tested 1.0900, while reclaiming big figures at 1.0600 and 0.8400 in Eur/Chf and Eur/Gbp cross terms. Note, market contacts suggest the latter may have rebounded on month end factors and the usual RHS demand, while Eur/Usd could have derived some upside impetus from option expiries skewed towards the top of a 1.0850-1.0900 range (1.8 bn at the base, 1.2 bn from 1.0860-70 and 2.5 bn between 1.0890-1.0900). Elsewhere, the Yen has been meandering within 110.57-14 parameters and mindful of comments from Japanese PM Abe underlining a watching brief on nCoV and market moves in response to unfolding developments, while Gold has settled down after another bout of heavy selling to straddle Usd1650/oz again.

- GBP/AUD/NZD/CAD/NOK/SEK – As noted above, the Pound has lost traction partly due to Eur/Gbp positioning for Friday, while Cable has retreated from 1.3000+ peaks amidst speculation of seasonal US selling on top of Brexit uncertainty that is hampering Sterling before UK-EU trade talks begin. However, the Aussie is underperforming in outright terms following much weaker than forecast construction data overnight, as Aud/Usd falls to fresh decade+ lows circa 0.6570 in contrast to a more resilient Kiwi clinging to 0.6300 ahead of NZ trade later. Another decline in crude has undermined the Loonie and Norwegian Crown, with Usd/Cad hovering just shy of 1.3300 and Eur/Nok up to 10.2300 at one stage, while the Swedish Crown is keeping its head afloat of 10.6000 vs the single currency after more Riksbank attempts to downplay weak inflation and Sek itself.

- USD – The Buck remains prone to more pronounced demand for safer-havens and soft US Treasury yields, but the DXY is holding around 99.000 by virtue of bigger net advances vs the more high-beta, risk or cyclical currencies ahead of housing metrics.

- EM – Aside from the overall negative tone, the Lira awaits news from Turkey’s first meeting with Russia on Syria to see if positive sentiments from the latter about finding an Idlib solution come to fruition, while the Rand is eagerly eyeing the SA budget at noon and Mexican Peso more macro news in the form of retail sales.

In commodities, WTI and Brent remain under pressure this morning, as another bout of wide-spread selling commenced as European players entered the market. At present, WTI and Brent front month futures are just off of session lows which are around the USD 49/bbl and USD 54/bbl marks respectively as downside pressure appears to have abated slightly as we approach the US’ market entrance; albeit, they are still down in excess of USD 0.50/bbl on the day. Focus this morning has been firmly on the coronavirus, with reports of additional cases in multiple countries just after the European cash open as well as the first death in France. Coronavirus contagion aside, next week brings the OPEC+ meeting and, as we continue to await Russia’s stance to the JTC’s recommended cuts, ING posit that OPEC+ will extend the current cuts and Saudi will continue to over-comply to offset the virus’s demand-side impact; it’s worth noting that doing so may be made modestly easier in the event that Libyan ports remain closed for the foreseeable future. Looking ahead, we have the release of the weekly EIA report, which is expected to print a headline crude build of 2.467mln; almost double last nights smaller than expected 1.3mln build via the API’s. Turning to metals, where spot gold is around USD 12/oz firmer on the day, but has retreated from highs at USD 1655/oz; a level which is comfortably below yesterday’s USD 1663.78/oz peak and the YTD’s USD 1689.29/oz mark. Copper prices remain subdued this morning, and within proximity to the USD 2.48/lb low for the year thus far; base metals more broadly remain similarly hampered on demand concerns from the virus.

US Event Calendar

- 7am: MBA Mortgage Applications, prior -6.4%

- 10am: New Home Sales, est. 718,250, prior 694,000

- 10am: New Home Sales MoM, est. 3.5%, prior -0.4%

DB’s Jim Reid concludes the overnight wrap

If you want a hint at how bad things could get logistically with the covid-19, my wife and I agreed last night that we were going to get an extra large shop this weekend to fully stock up our cupboards and freezer in case the disruptions become more widespread over the next week or so. I’d like to think we’re a fairly rational and balanced couple (you may think differently) so if we’re doing that I’d imagine there will be some pretty extreme things done and measures taken over the next few weeks as the virus spreads through the West. In terms of more scientific advice, here at DB research we are trying to give you as much colour as possible on the implications of the spread and if you haven’t already done so I think you’ll find it insightful to listen to the replay of yesterday’s call with our expert epidemiologist Dr. Michael Edelstein. You can see how by viewing this link here. As we warned you yesterday after our pre-call with him on Monday, the most likely scenario now is that this virus will spread across Europe as a minimum, and more than likely the US, causing a lot of economic disruption. As we also said yesterday it should be seen as flu plus or plus plus with a slightly worse contagion rate and a mortality rate likely between 2.5 and 5 times the flu’s 0.2% – so still under 1%. The commonly cited China mortality rate of c.3% is likely far too high due to numerous mild cases that have likely gone unreported in an area overwhelmed by the spread. It still also appears that the mortality rate is biased toward older men with pre-existing illnesses. A big difference to the flu is that this is a new virus and therefore humans won’t have built up an immunity of several years or decades.

Overall the long-term health consequences while serious for those unfortunately caught up in it are probably not the main macro issue, but the short-term economic consequences are a very major concern. Western governments and citizens are likely to increasingly be on lockdown to try to limit the risks of infections and contagions. Just yesterday there were stories circulating that a senior member of the International Olympic Committee said that if it proves too dangerous for Tokyo to host the Olympics this summer because of the coronavirus outbreak, organizers are more likely to cancel it than postpone. Expect the news-flow to get worse from here as the virus and the knock-on effects spread.

After the CDC warning last night (more on that below), the latest on the virus is that cases in South Korea have increased to 1,146, up 169 versus this time yesterday and comparing to just 51 cases a week ago with the vast majority of new cases overnight coming in Daegu with a US solider in the city amongst those testing positive. The first case has been confirmed in South America with a man in Brazil testing positive having traveled to northern Italy for work earlier this month. Worth highlighting also, Japan PM Abe has called for major sporting events and cultural events to be called off, postponed or scaled back over the next couple weeks with the PM also announcing a ban on people travelling from Daegu into Japan. Chinese State TV has also said overnight that China has quarantined 94 passengers from a Seoul to East China’s Nanjing flight after three passengers were found to have a fever on the flight. In total the number of cases globally now is 80,987 and deaths 2,761.

With the virus escalating more stimulus announcements are being made. Overnight, Hong Kong announced a HKD 120bn ($15.4bn) relief package which includes a payment of HKD 10,000 to each permanent resident of the city 18 or older. Markets still remain unsettled, however the good news is that moves have been comparatively more modest this morning. The Nikkei (-0.90%), Hang Seng (-0.56%) and Kospi (-1.13%) are down with bourses in China more mixed (Shanghai Comp is up +0.30% and CSI 300 down -0.05%). Futures on the S&P 500 are also up +0.49% while Oil has gained over half a percent. As for overnight data releases and highlighting the impact from virus, Hong Kong’s January trade balance came at HKD -30.6bn (vs. HKD -11.1bn expected) with exports slumping by -22.7% (vs. -3.7% expected) and imports coming in at -16.4% (vs. -2.5% expected).

In terms of European cases, Italy remains the worst affected country, with 322 confirmed cases and 10 fatalities, but the virus is continuing to spread around the continent, with Croatia, Switzerland and Austria all reporting their first cases yesterday. There were also dramatic developments on the Spanish island of Tenerife, where a hotel with around a thousand people was put into lockdown after an Italian doctor tested positive for the virus. With the upsurge this week, there’s increasing recognition of the potential impact on European growth, and Bank of France governor Villeroy de Galhau said that it was “very likely we will revise slightly downward our forecast”.

Yesterday was another tough day for risk with the main headline that US 10yr Treasuries officially closed the US session at their record low (1.352%) with our data going back to the birth of the nation in the 1790s. 30yr Treasuries also fell to a fresh record low of 1.825%. Using the WIRP function on Bloomberg, markets are now pricing in a 66.5% chance that the Fed will have cut rates again by their April meeting, up from 24.5% at the close last Wednesday. Meanwhile the 3m10y yield curve inverted by a further -0.3bps yesterday to close at -18.4bps, which is the lowest level since September.

Over in Europe 10yr bunds fell -3.1bps to -0.515% but Italian yields rose 2bps. This is fairly mild risk off for Italy probably reflecting that this is a global issue that happens to have some temporary immediacy in Italy for now. Having said that our economist published a note yesterday (link here) looking at the importance of the affected areas to the broader economy in Italy and the channels through which a virus shock, if not quickly contained, could create an economic shock. Structurally, the Italian economy is vulnerable to shocks. They also look at possible policy flexibility so a good note to review.

Elsewhere other haven assets also continued to be supported thanks to the widespread investor concern, with the Japanese Yen seeing its strongest 2-day advance against the US dollar since June 2019.

It was another torrid day for global equity markets, with the S&P 500 giving back its gains at the open to plunge -3.03% after warnings from the CDC to prepare for an epidemic in the US following the outbreaks and spike in cases across Italy, Iran, South Korea and Japan in recent days. This is the index’s 4th consecutive move lower, which is the first time that’s happened since last August. The index is down over 7% over the last 3 sessions, the worst 3-day performance since August of 2015. Selling was more widespread in the US, but Financials and Energy stocks saw the largest decline as the move in rates and oil (Brent down -2.40%) impacted them disproportionally. Volatility continued to climb, with the VIX index up +2.8pts to around 28 – its highest level since December 2018 when financial markets looked in horrible shape. On US equities as we’ve been saying over the last 2-3 months, the US market went into this virus outbreak priced for perfection with PE ratios only historically higher when we’ve been in a bubble. We’ve likened it to being at ‘bubble’ base camp. So although no one could have predicted the virus you could have said that markets were extremely rich and not pricing in any risk.

In Europe the STOXX 600 had a weak performance yesterday but closed before the peak of the US sell-off to close down -1.76%. This still leaves the index with its worst 2-day performance since the aftermath of the Brexit referendum in June 2016. Banks in Europe also underperformed in particular against the backdrop of falling yields, with the STOXX Banks index down -3.19% in the index’s 6th consecutive decline.

Fed Vice Chairman Clarida spoke late in the session. He reiterated that the coronavirus threats require close monitoring and that it will have a significant impact on China activity, but that it is too soon to assess the global and US implications. He emphasized that policy is not on a pre-set course and that the Fed will be taking it on a meeting-by-meeting basis – which may be obvious but also serves as a “go to” line for Fed officials that want to signal they are flexible. He didn’t give as much of a guide to current thinking as our economists thought he could have given the magnitude and momentum in recent market moves.

Coronavirus even came up briefly during the Democratic debate in South Carolina, where the candidates gave their last pitch to voters there, who vote on Saturday, and across all 14 states and American Samoa on Super Tuesday, 3 March. The national front runner, Senator Bernie Sanders, took a lot of attacks from his competitors in what was likely the most contentious debate of this cycle yet. However, it remains to be seen if there will be any material impact ahead of an important 2 weeks of primary voting.

Before that, there was an important development in German politics with the CDU leadership race, as health minister Jens Spahn, a contender in the last contest, announced that he would not be running for leader again and endorsed Armin Laschet. Laschet is a more moderate figure in the party and is currently the premier of North Rhine-Westphalia, Germany’s most populous state, whereas Spahn is considered to be a more conservative figure. The two will be running on a joint ticket, so that if Laschet is elected, he will put forward Spahn to become the CDU vice chair. Because they come from different wings of the party, this is a ticket that has the potential for broad support among CDU members, and poses a threat to the campaign of the more conservative Friedrich Merz, who campaigned for the leadership last time and also announced yesterday that he would be running.

Onto Brexit, and the EU published their mandate for the upcoming negotiations on the future relationship yesterday, ahead of the start of formal talks between the two sides on Monday. In the EU’s publication, they maintained their demands for a level playing field, saying that “the envisaged agreement should uphold common high standards, and corresponding high standards over time with Union standards as a reference point, in the areas of State aid, competition, state-owned enterprises, social and employment standards, environmental standards, climate change, relevant tax matters and other regulatory measures and practices in these areas.” However, the UK rejected demands that the UK sign up to the level playing field, with the No.10 press office tweeting that “The EU mandate stresses (reasonably) the importance of its own legal autonomy. We are equally determined to protect ours. That is the key point of Brexit and is fundamental to the sustainable long-term relationship the EU says it wants with us.” Nevertheless, the EU’s Michel Barnier said yesterday that “The trade deal will be associated with a fisheries agreement and a level playing field, otherwise there won’t be any agreement at all”.

In terms of now backward looking economic data out yesterday, the Conference Board’s consumer confidence reading for February came in at 130.7 (vs. 132.2 expected). While this was somewhat below expectations, the downward revisions to the previous month’s reading meant that it actually hit a 6-month high, while the expectations reading also advanced to a 7-month high of 107.8. Over in France, the INSEE’s business confidence indicator outperformed expectations, coming in at 105 in February (vs. 103 expected), the index’s highest level in 3 months.

Turning to the day ahead now. The highlights include French consumer confidence for February, January’s US new home sales and the MBA’s weekly mortgage applications. From central banks, there’ll be a number of ECB speakers, including President Lagarde, as well as Makhlouf, Panetta and Holzmann.

Tyler Durden

Wed, 02/26/2020 – 08:00