Stephen Roach: “When China Sneezes…”

Mr. Roach was Chairman of Morgan Stanley Asia and now hangs out at Yale as a senior lecturer. From Project Syndicate:

The COVID-19 outbreak has hit at a time of much greater economic vulnerability than in 2003, during the SARS outbreak, and China’s share of world output has more than doubled since then. With other major economies already struggling, the risk of outright global recession in the first half of 2020 seems like a distinct possibility.

NEW HAVEN – The world economy has clearly caught a cold. The outbreak of COVID-19 came at a particularly vulnerable point in the global business cycle. World output expanded by just 2.9% in 2019 – the slowest pace since the 2008-09 global financial crisis and just 0.4 percentage points above the 2.5% threshold typically associated with global recession.

Moreover, vulnerability increased in most major economies over the course of last year, making prospects for early 2020 all the more uncertain.

In Japan, the world’s fourth-largest economy, growth contracted at a 6.3% annual rate in the fourth quarter – much sharper than expected following another consumption-tax hike. Industrial output fell sharply in December in both Germany (-3.5%) and France (-2.6%), the world’s fifth- and tenth-largest economies respectively. The United States, the world’s second-largest economy, appeared relatively resilient by comparison, but 2.1% real (inflation-adjusted) GDP growth in the fourth quarter of 2019 hardly qualifies as a boom. And in China – now the world’s largest economy in purchasing-power-parity terms – growth slowed to a 27-year low of 6% in the last quarter of 2019.

In other words, there was no margin for an accident at the beginning of this year. Yet there has been a big accident: China’s COVID-19 shock. Over the past month, the combination of an unprecedented quarantine on Hubei Province (population 58.5 million) and draconian restrictions on inter-city (and international) travel has brought the Chinese economy to a virtual standstill. Daily activity trackers compiled by Morgan Stanley’s China team underscore the nationwide impact of this disruption. As of February 20, coal consumption (still 60% of China’s total energy consumption) remained down 38% from the year-earlier pace, and nationwide transportation comparisons were even weaker, making it extremely difficult for China’s nearly 300 million migrant workers to return to factories after the annual Lunar New Year holiday.

The disruptions to supply are especially acute. Not only is China the world’s largest exporter by a wide margin; it also plays a critical role at the center of global value chains. Recent research shows that GVCs account for nearly 75% of growth in world trade, with China the most important source of this expansion. Apple’s recent earnings alert says it all: the China shock is a major bottleneck to global supply.

But demand-side effects are also very important. After all, China is now the largest source of external demand for most Asian economies. Unsurprisingly, trade data for both Japan and Korea in early 2020 show unmistakable signs of weakness. As a result, it is virtually certain that Japan will record two consecutive quarters of negative GDP growth, which would make it three for three in experiencing recessions each time it has raised its consumption tax (1997, 2014, and 2019).

The shortfall of Chinese demand is also likely to hit an already weakening European economy very hard – especially Germany – and could even take a toll on a Teflon-like US economy, where China plays an important role as America’s third-largest and most rapidly growing export market. The sharp plunge in a preliminary tally of US purchasing managers’ sentiment for February hints at just such a possibility and underscores the time-honored adage that no country is an oasis in a faltering global economy….

Roach does not mention that the U.S. response to China’s trade depredations over the last couple years has had the salutary effect of jump-starting the decoupling of the U.S. economy from China’s.

That is not to say the U.S. is inoculated from the economic contagion, just that it was becoming somewhat less exposed to supply chain disruption.

This is something the FT’s Rana Foroohar mentioned in passing in her opinion piece, “Coronavirus is speeding up the decoupling of global economies“:

“…A gradual decoupling of global economies has been under way for a few years. The South Korean electronics group Samsung, for example, has been closing Chinese plants and opening others in Vietnam. Mexico has benefited from some US corporations moving their supply chains closer to home. But decoupling will undoubtedly speed up as Beijing’s opacity in handling the coronavirusn epidemic highlights the risks of doing business in China….”

I’ve had an (unrequited) love-hate relationship with Mr. Roach for a few years, see the recycled introduction to:

Stephen Roach—”The Crisis of 2020″

The introduction to our last visit with Mr. Roach, December 1’s “Stephen S. Roach: After the US-China Trade War“:

Mr. Roach is a sharp guy with a vast knowledge of Asia, one of the reasons MS kept him around as chairman of Morgan Stanley Asia. However… when the U.S. retaliated against China for China’s trade practices Mr. Roach seemed to have lost a half-step, focusing on the next quarter rather than the next quarter-century (as the pension/insurance crowd is fond of saying, if not doing) and was too dovish in his estimation of the effects of U.S. tariffs on the Chinese economy.

Because of that we haven’t linked to him since July 2017 after years of visiting him for his thoughts on possible futures.

But now he’s back to doing what he does so well, getting his audience to think about the picture on the horizon rather than the one immediately in front of one’s nose….

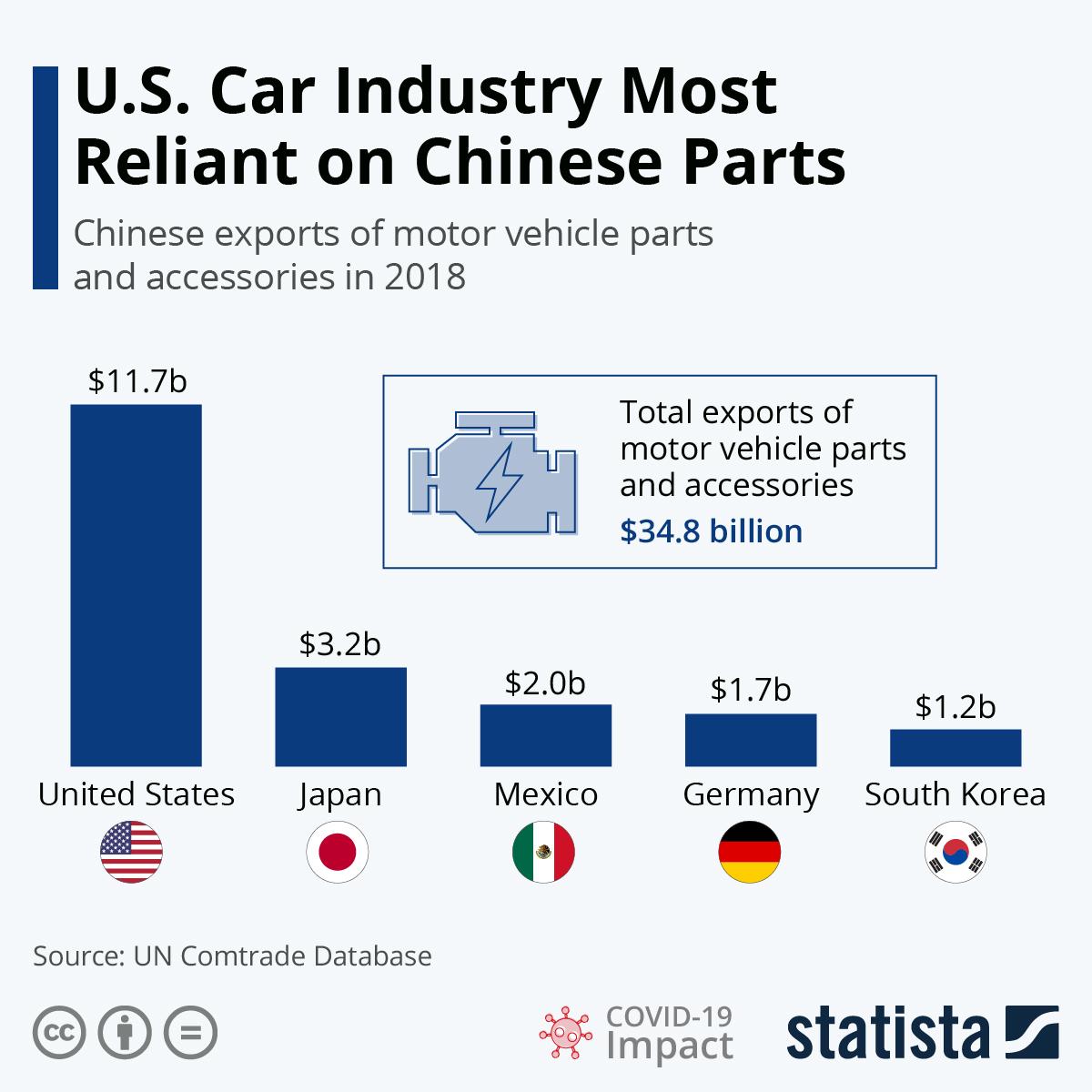

All that being said the U.S. is still very dependent on China…

From Statista:

Tyler Durden

Wed, 02/26/2020 – 12:55