Will Spending Surge?

Tyler Durden

Tue, 06/02/2020 – 12:21

Authored by Paul Donovan, Chief Economist at UBS Global Wealth Management

-

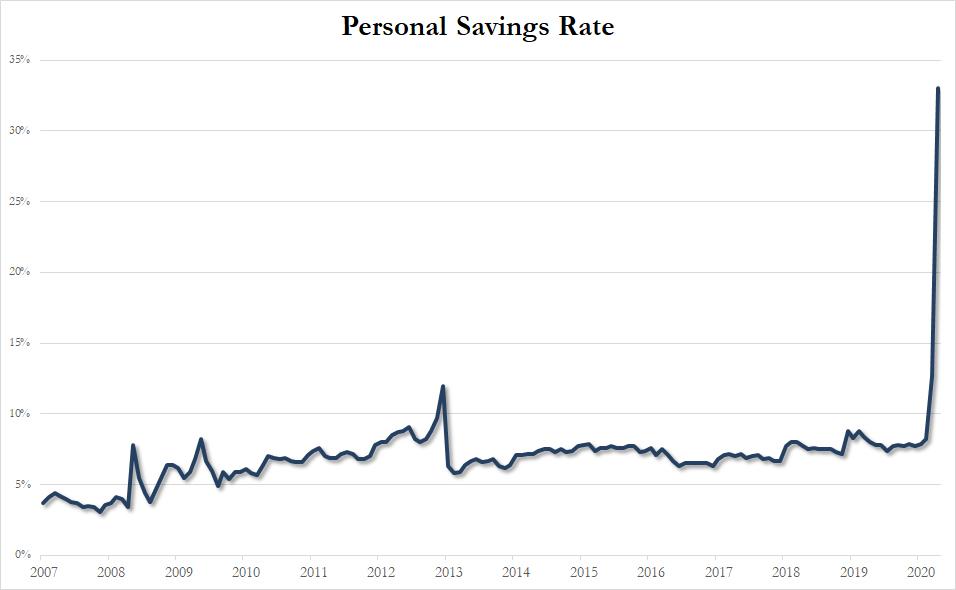

Consumers have experienced spending falling faster than incomes during lockdowns. This has led to a period of enforced saving.

-

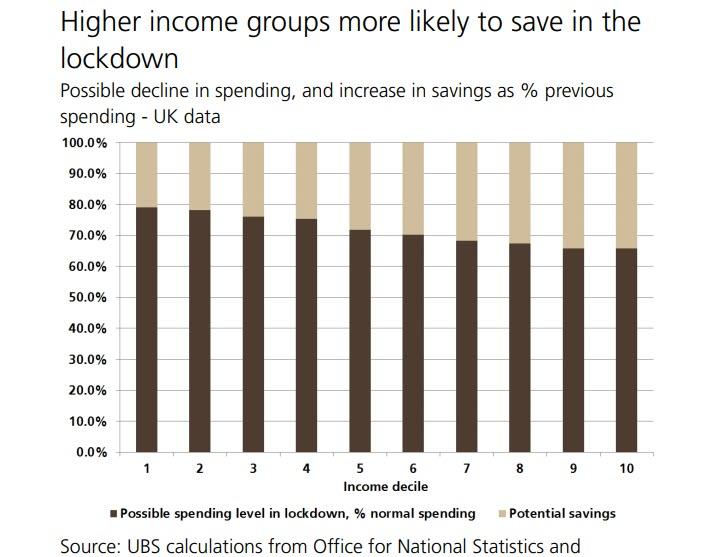

In Europe and the UK it is mainly middle and higher income groups that have saved.

-

In the US, lower income groups may have saved from increased benefit payments.

-

These savings may be spent as lockdowns ease, if consumers treat them like a tax rebate.

The policy reaction to the virus has generally hit spending harder than it has hit income. In developed economies, income has remained unchanged for people who are retired, those who are working normally, or those who are working from home.

Income has fallen for many workers who are on furlough. Furloughed workers tend to earn near normal income levels, however. In Europe the amount is around 80% of normal income (with some limits). US unemployed workers may see a temporary rise in income, as (until end July) unemployment benefit is around $1000 per week. Over half of American workers earn less than that at work. They will also receive a $1200 one-off payment. Thus lower income Americans will gain income if made temporarily unemployed. However, European unemployed workers (i.e. not on furlough) will generally lose income.

At the same time, the ability to spend is limited. During lockdown, stores and restaurants were closed. People were either prohibited from leaving their homes, or encouraged not to do so. Consumer spending seems to have declined by 20% to 30% across major economies. The precise decline will depend on the severity of the lockdown, the pattern of spending, and the availability of alternative ways of spending (e.g. online spending).

Lower income groups spend far more of their money on essentials—like food at home, and rent. This spending is not cut back in a lockdown period. Higher income groups spend far more of their money on services—like restaurant meals, and entertainment. These are the categories that are most affected by the lockdown. The amount that spending falls will vary from country to country, but the pattern of higher income groups spending less and saving more is similar for the major economies.

Lower-income groups seem more likely to be put on furlough than higher-income groups. The entertainment and hospitality industries tend to employ more lower-income workers, for example. A low-income worker on furlough may see their income and spending fall by broadly the same amount. Higher-income groups are therefore most likely to save. The US is an exception to this, where a lowincome worker will probably experience a rise in income if made unemployed.

A surge in spending?

As lockdowns end, this involuntary saving could be spent. It will depend on fear and trust. Fear of the virus and fear of unemployment need to be low. Trust in government policy needs to be relatively high. If that happens, then people will be willing to spend the savings. These are, after all, savings that many people never wanted in the first place (at least as far as saving on entertainment and services is concerned). If fear increases, however, these savings may be kept as an insurance policy.

If these savings are spent, they should give an increase to consumption in the third quarter. The spending is likely to be skewed toward more expensive consumer items. The forced savings are a bit like a tax rebate. Consumers unexpectedly have a lump sum to spend. The 2001 and 2008 tax rebates in the US were both spent. The 2008 tax rebate had only a limited effect on spending on clothes and food. The focus was on durable goods—furniture, appliances and consumer electronics. Generally speaking most tax rebates are spent within two quarters of being received.

The difference between this situation and periods when tax rebates have been spent is that there is likely to be a narrower range of items that can be consumed this time. Either because of ongoing restrictions, or lingering concerns about the virus, the money is less likely to be spent on services (restaurant meals, etc.).

Inflation implications?

It is important not to get carried away with any savings-fueled spending. This is a one-off boost to growth, and almost certainly will not last beyond the end of this year. This also suggests that the inflation implications are likely to be limited. Any increase in spending is short-lived, and focused on specific products. There may be some relative price changes as a result of spending patterns. However, last year’s trade taxes had almost no impact on consumer prices, suggesting that companies are still reluctant to raise prices for consumers. That approach is likely to continue at a time when unemployment is likely to be rising, and any increase in demand from involuntary savings will be viewed as temporary.