A Third Of Americans Who Lost Their Job Due To COVID Still Waiting For Unemployment Benefits To Arrive

Tyler Durden

Wed, 06/03/2020 – 21:20

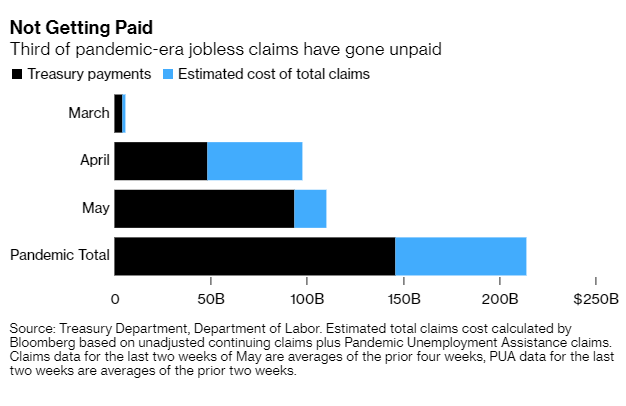

Almost 33% of unemployment benefits that have been applied for as a result of coronavirus-related job losses have still not been paid. This is despite the fact that the Treasury has disbursed $146 billion in benefits in three months through May, which is more than all of 2009.

Recall, policymakers responded to the virus outbreak by offering $600 per week more in unemployment than usual. The goal was to keep people home and prevent the virus from spreading.

But this number still isn’t enough: the total amount owed to Americans during the same period was $214 billion, according to Bloomberg:

The Treasury reports its unemployment disbursements daily. Bloomberg’s calculation of what should have been paid is based on continuing claims for benefits, including those filed under a special program that widened the safety net to include contractors and gig workers. (It assumes filings for missing weeks in May will be in line with the average in preceding weeks).

Those claims were multiplied by the weekly unemployment benefit, using the $378 state average plus the $600 boost that’s due to expire at the end of July.

The $67 billion difference is proof positive that emergency efforts to boost and disburse payments are falling short.

Jay Shambaugh, an economist at Brookings Institution, said: “There’s a lot more money that should have gone out that has not gone out.”

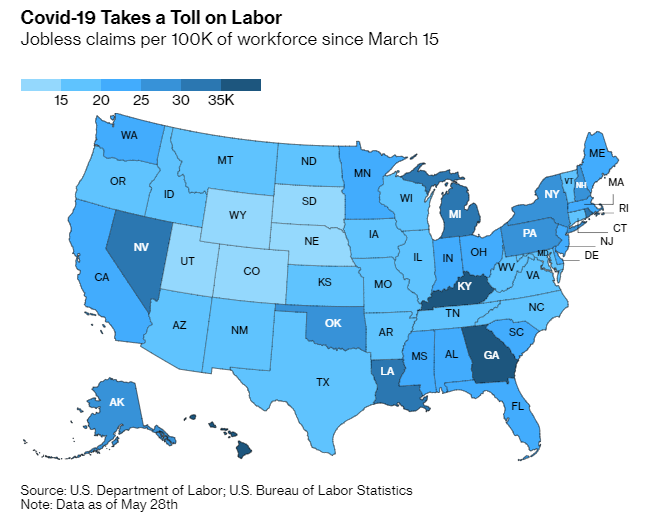

More than 40 million people have filed for unemployment amidst the economic shutdown. This includes 7.8 million people claiming under the Pandemic Unemployment Assistance program for independent contractors. And the lack of payments are coming at the worst possible time, as racial tensions have gripped the nation and widespread rioting and looting is taking place.

At the same time, economists believe another 1.8 million people filed for unemployment last week and that Friday’s numbers will show a jobless rate of 19.5%, the highest since the Great Depression.

Bob Radcliffe, who lives in Morristown, New Jersey filed for unemployment in March and is now owed almost $15,000. He has four children under eight and says he hasn’t received any benefits yet. He is taking his bank up on a three-month mortgage forbearance to survive.

“I’ve had money to live. I’m not a desperate case. But I’m running out,” he said.

The Labor Department dispute’s Bloomberg’s use of its weekly claims report to extrapolate its data, stating: “It is also challenging to use these numbers because states are struggling to keep up with demand and some have backlogs they are working through.”

Meanwhile, Bloomberg thinks it has underestimated the amount owed to Americans.

Texas, for example, has a backlog of 650,000 claims. The state has seen more than 2.6 million claims filed since March. The state has added to its staffing by redeploying other workers, but attention has also been drawn to helping people find jobs and re-opening the state. 20% of workers in the state’s oil and gas industry have filed for unemployment.

And a failure to extend benefits nationwide could prolong the crisis, according to Diane Swonk, chief economist at Grant Thornton LLP. While the $1,200 benefits have momentarily helped families pay for rent or initial food bills, it also amounts to a little more than a week’s pay for many.

Swonk said: “We’re really talking about an economy that is going to be operating at a fraction of its capacity for a long period of time.”

Ernie Tedeschi, a former U.S. Treasury economist now at Evercore ISI concluded: “On paper the U.S. strategy is very generous. But that generosity on paper is meaningless if it doesn’t translate into actual money in people’s pockets when they need it.”