Oil Rally “Running Out Of Steam” As Hedge Fund Buying Fades

Tyler Durden

Mon, 06/08/2020 – 11:00

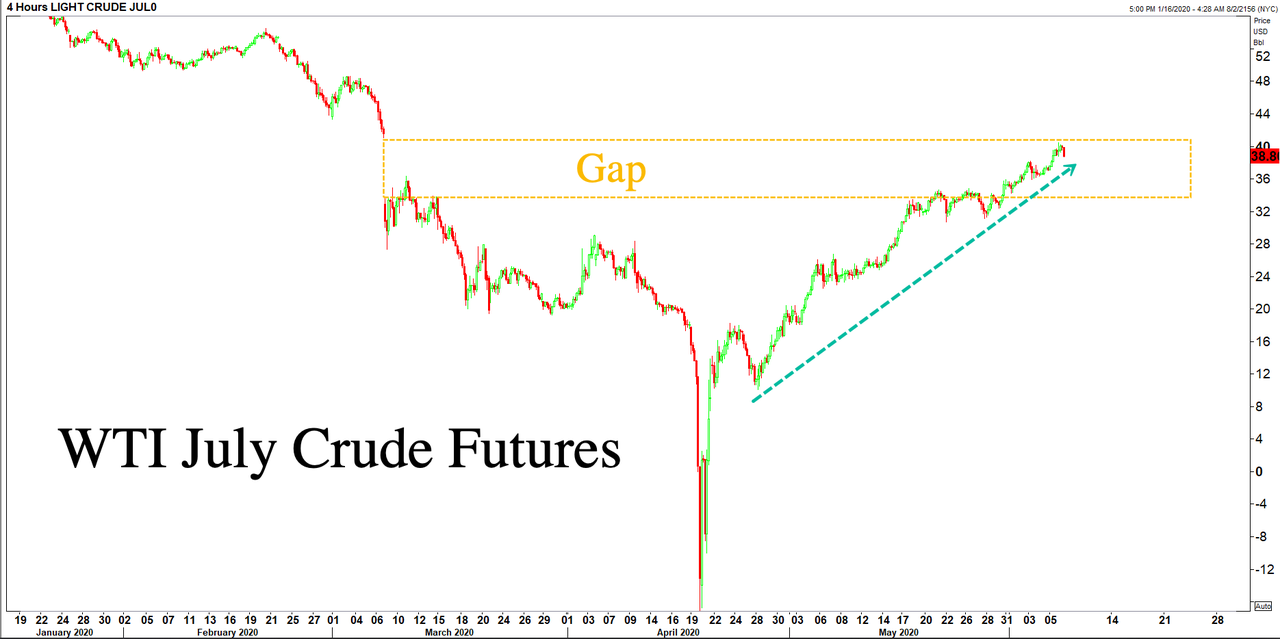

WTI July crude futures hit a wall of resistance around the 40-handle on Monday morning as the Organization of Petroleum Exporting Countries (OPEC) and its allies agreed on Saturday to extend historic output cuts for one month. The 23-nation group known as OPEC+ extended production cuts of 9.7 million bpd through July 31.

Goldman’s comments this morning also sparked an immediate selling effort.

Optimisms of production cuts, China increasing crude imports, and the global economy troughing have resulted in a doubling of price in about 1.5 months.

An epic rally in crude futures in such a short period, absent of a meaningful V-shaped recovery in world trade flows and or crude demand, suggests a pullback in prices could be ahead as fundamentals must catch up to the price.

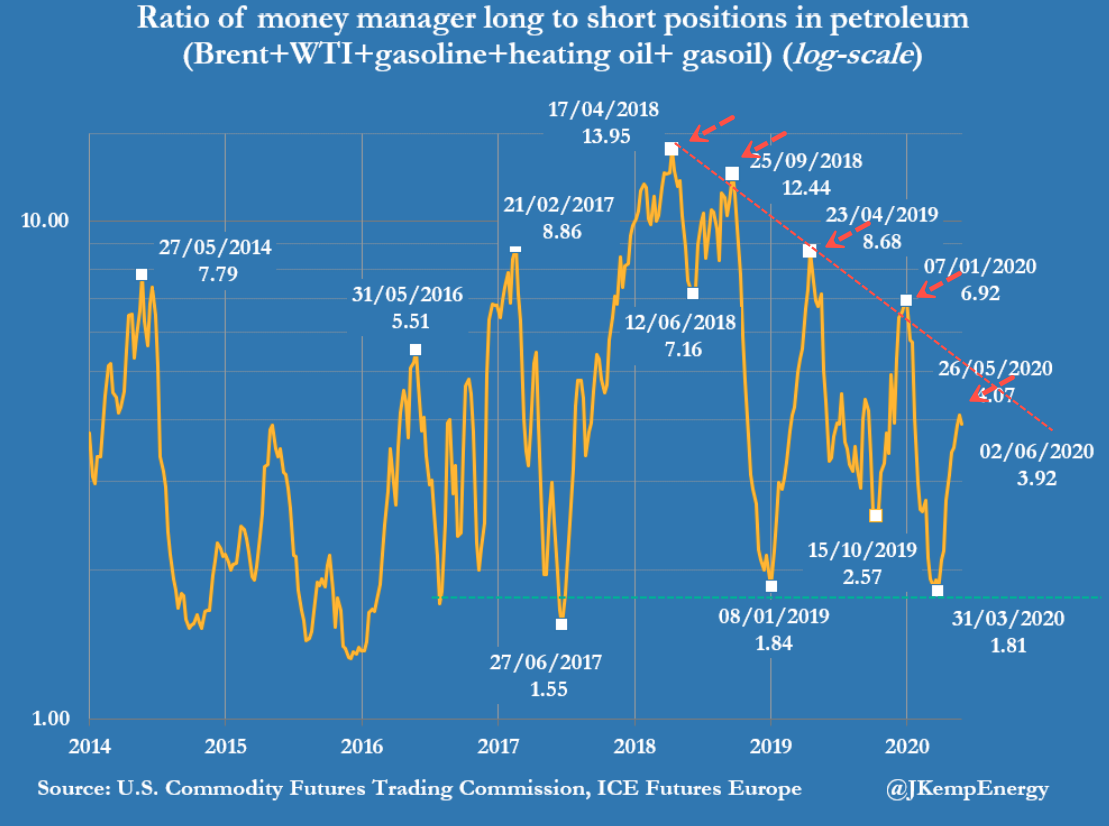

Reuters’ John Kemp says hedge funds have started “to temper their bullishness towards oil after crude futures prices have doubled since late April.”

Kemp says hedge funds and money managers purchased 6 million barrels in the six major petroleum futures and options contracts in the week to June 2. He said portfolio managers bought crude derivatives in nine out of the last ten weeks, as their bullishness increased to a total of 324 million barrels since late March.

He points out that in the last week, hedge funds placed their smallest bullish bet on crude in the previous nine weeks, suggesting the crude rally could be on shaky grounds.

Position changes were mostly insignificant with purchases of NYMEX and ICE WTI (+7 million barrels) and European gasoil (+8 million) but sales of Brent (-2 million) and U.S. gasoline (-8 million) and no change in U.S. diesel.

But there were some tentative indicators the rally in crude prices may be running out of steam, while funds try to anticipate an improvement in the relative price of distillates, where margins have become uneconomic:

Portfolio managers added new short positions in petroleum last week and their ratio of bullish longs to bearish shorts dipped for the first time since the end of March.

Fund buying in WTI was some of the smallest since portfolio managers started to accumulate positions in U.S. crude in March. Funds were net sellers of Brent for only the second time in nine weeks.

Funds have been net buyers of European gasoil for three weeks running, and last week’s purchases were the largest yet, indicating traders are trying to position themselves ahead of an anticipated improvement in distillate margins.

None of these is a strong signal and there is a big risk of over-interpreting them. But taken together they suggest a possible pause or even a future reversal in fund buying.

Benchmark Brent futures prices have already more than doubled over the last seven weeks, to more than $40 per barrel from just over $20 in late April, increasing the probability of short-term profit-taking and a pull back.

At the same time, the refining margin for making gasoil from Brent has halved from $10 to $5 per barrel, and is down from $17 at the start of the year, which suggests distillates will eventually outperform. – Kemp

As hedge funds start to pare down bullish bets on crude, Goldman Sachs is also getting bearish on oil as it believes a tactical “pullback in prices in coming weeks with our short-term forecast of $35/bbl vs. Brent spot prices of $43/bbl.”

The oil market only moved into deficit late May and still faces the daunting challenge of normalizing a billion barrels of excess inventories. Yet, the oil relief rally remains unfazed, with prices doubling and exceeding our year-end price target just six weeks after the likely cycles lows.

This rebound has been fueled by a macro risk-on backdrop and a policy induced Chinese crude import binge yet fundamentals are turning bearish: demand expectations are running ahead of a more gradual and still highly uncertain recovery, shale and Libyan shut-in production are coming back online, and prices are at levels where OPEC supply cuts should ease and Chinese purchases slow.

With OPEC’s latest cut already more than priced in, we now forecast a pull-back in prices in coming weeks with our short-term Brent forecast of $35/bbl vs. spot prices of $43/bbl. Just as strengthening physical oil prices led us to turn constructive on the oil market on May 1, very poor refining margins and the recent sharp decline in US crude bases now comfort us in our sequentially bearish outlook…. – Goldman’s energy analyst Damien Courvalin. Read the rest of Courvalin’s note here.

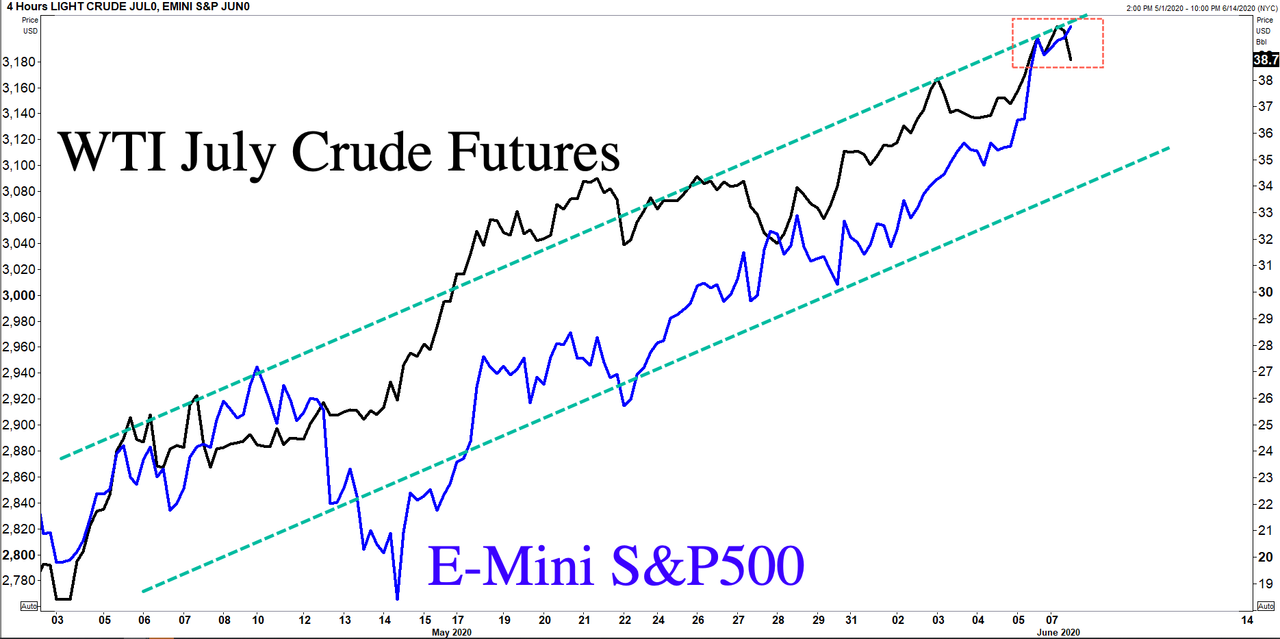

With crude futures sputtering out at the moment — this could also suggest S&P500 futures are due for a pullback as well.