Failed State Walking

Tyler Durden

Wed, 06/10/2020 – 12:10

Authored by Chris Hamilton via Econimica blog,

I love America. It’s the land of my birth, my education (Go Beav’s), my children’s births, and where I live and will eventually die. I did spend about five years living in Europe and Asia and loved it…but my home is and will be the vast expanse of the Western US.

So, when I’m critical of the US, it’s not because I want it to fail or fall into chaos…quite the opposite. I believe that a patriot and citizens role is to critically analyze and constructively push forward. And this means critiquing the direction of its politics, economy, society, and the state of its soul.

So, when I show the following charts…it is in the spirit of constructively questioning what we are doing…and where this is leading us? What present and imminent future are we fostering for our children and young adults?

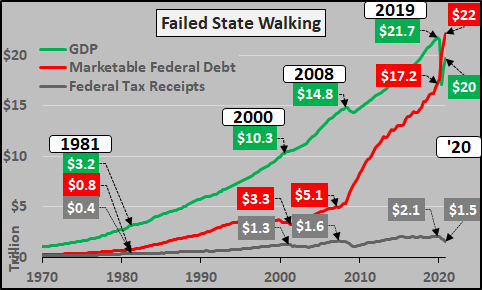

Anyways, consider the state of the economy (as measured by GDP), versus the total marketable federal debt, and the federal tax receipts collecting underlying the system. The tax receipts reaped from the economy are moving along around about 10% of GDP…but what you may note is the public or marketable federal debt is on a totally different trajectory.

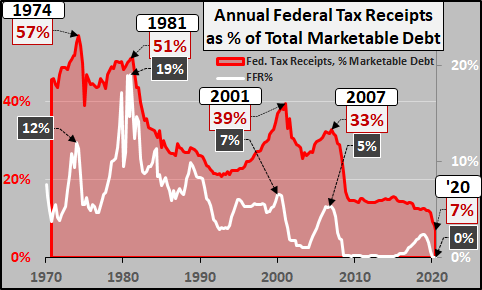

To gauge the quantity of federal taxes collected from the economy, it’s pretty easy to divide annual federal tax receipts vs. the marketable debt (red shaded area below). If the tax receipts or coverage is declining versus the debt…we have a problem (BTW- we have a very big problem). But then you have to add in the Federal Reserve’s role in (mis)managing rates (since 1981) and actively buying Treasuries (since 2008) to distort rates and asset prices. This has encouraged Congress to spend what it isn’t willing to collect from the people…thanks to the Federal Reserve giving Congress the idea that the money is “free”. It is not.

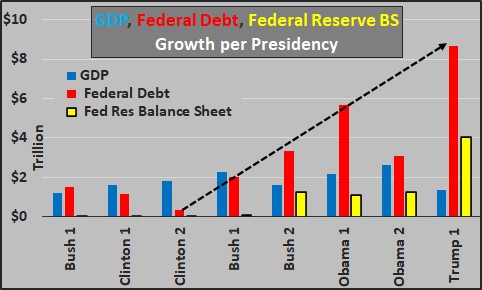

So, although I graduated with a history/political science degree long ago…the primary thing I learned is that both parties are crooked and untrustworthy…and easily purchased by the highest bidders. So, when I show the chart below of soaring federal debt and Federal Reserve balance sheet during the last eight presidential terms…and decidedly not soaring GDP, please understand it is not to lift one party over the other. It is to show they are both unworthy of a single additional vote. They are there in DC for the few at the expense of the many.

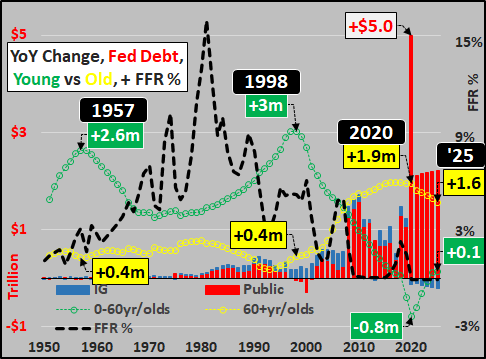

To put this into a demographic context, I show the annual growth of the under 60 year-old population versus 60+ year-old population. Give the declining interest rate policy as working age population decelerates…and debt moves inversely…some consideration. Plus consider where this is going over the next five years through 2025 (up, up, and away).

Invest accordingly (lol).