Market Bloodbath Unleashes Furious Robinhood-Based Dip-Buying

Tyler Durden

Thu, 06/11/2020 – 13:50

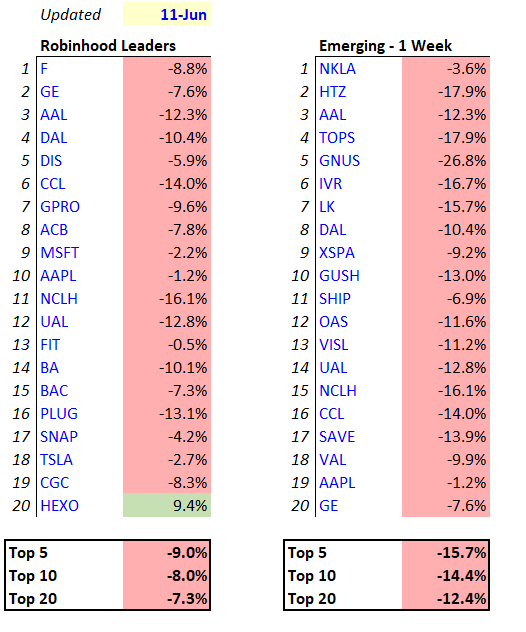

With stocks tumbling, and on pace for their worst day since the March turmoil, everyone’s favorite “new normal” indicator of irrational exuberance, the Robinhood brokerage is having a tough day, with the top 5 stocks down almost 10%, and the 15% most popular names in the past week tumbling over 15%.

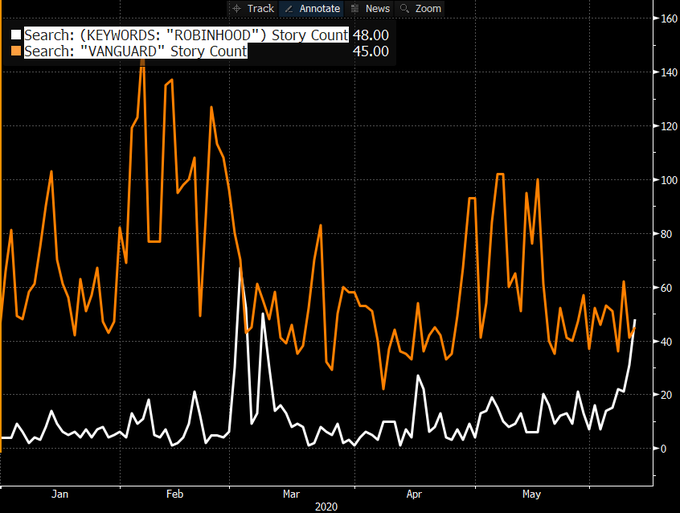

This is taking place at a time when as Eric Balchunas points out, media mentions of the word “Robinhood” have surpassed mentions of the word “Vanguard.”

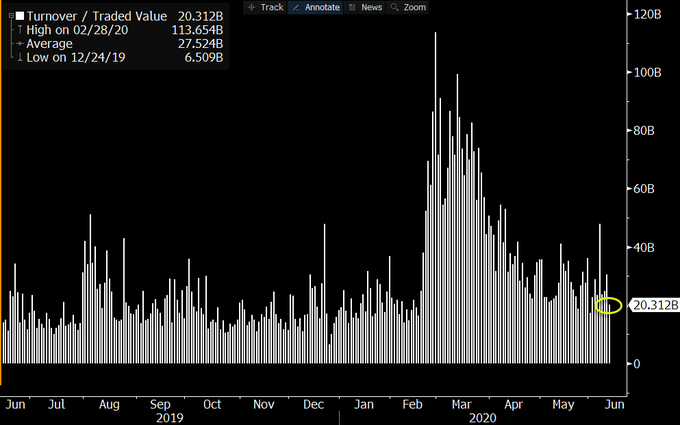

And yet despite today’s dismal market, which incidentally sees a big drop on relatively modest volume unlike the mega pukes observed in March, which indicates that institutions aren’t in full unwind mode…

… after shaking off the initial tumble, “hooders” appear to be doing what they do best, and after some early selling since the market opened, they are back in full BTFD mode, with far more position increases than decreases among the most popular stock of the day.

Why?

Because as Jim Bianco noted earlier, “the next time markets stumble, small investors can expect even more aggressive action by the Fed, such as buying equities. This is why they have the confidence to chase collapsed stocks like airlines, cruise ships, retailers and energy companies with reckless abandon. The rampant speculation has no reason to stop. In fact, many small investors are surely hoping for another market pullback to buy aggressively like they did in March.”