“The Most Absurd Moment In The History Of Capital Markets”: Hertz Plans To Sell Up To $1 Billion In New Bankrupt Stock

Tyler Durden

Thu, 06/11/2020 – 19:52

On Monday, when the market hit its absolute blow off top phase and Robinhooders sent the stock of bankrupt Hertz as high as $6.25, resulting in a market cap of just under $900 million – a testament to the absolute idiocy of capital markets – we decided to double down on this idiocy and said that “we hope the company sells a few hundred million worth of stock – after all there is apparently endless demand for its shares – just so we can test the so-called “price discovery” of Powell’s latest and greatest FOMO bubble.”

Well, it turns out that some banker at Jefferies read us, however ignoring the clear sarcasm of this proposal decided to turn it into what may soon be the most insane and/or stunning, maybe even legendary capital markets product ever proposed: an Initial Bankruptcy Offering. You see, after the close on Thursday, Jefferies filed a motion in the Hertz bankruptcy case, seeking to sell $500 million in bankrupt Hertz stock (or 246,775,008 HTZ shares) in a “unique opportunity” to “raise capital on terms that are far superior to any debtor-in-possession financing.“

Why is Jefferies proposing this deal? Because “the recent market prices of and the trading volumes in Hertz’s common stock potentially present a unique opportunity for the Debtors to raise capital on terms that are far superior to any debtor-in-possession financing.”

In other words, the feverish retail participation in the most ridiculous asset bubble ever created by the Fed is just the opportunity Jefferies – and Hertz – needed to turn the bankruptcy process on its head.

It gets better: according to the filing, “if successful, Hertz could potentially offer up to and including an aggregate of $1.0 billion of common stock, the net proceeds of which would be available for general working capital purposes. Unlike typical debtor-in-possession financing, the common stock issuance would not impose restrictive covenants on the Debtors and would not impair any of the creditors of the Debtors. Moreover, the stock issuance would carry no repayment obligations, and the Debtors would not pay any interest or fees to those who provide the funding by buying shares at the market.”

While something like this has never been done before for the simple reason that in a bankruptcy, the common stock is… worthless – after all Jefferies is effectively asking for permission to steal from Robinhooders knowing full well the equity will be worthless as the various claimant classes are satisfied and there is nothing left for the preptition equity, Jefferies takes the humor up a notch when it claims with a straight face before the bankruptcy judge that “This Court Should Authorize the Sale of Hertz’s Unissued Shares under Sections 105(a) and 363(b) of the Bankruptcy Code.” Last we checked, there is nothing in the bankruptcy court authorizing a debtor to effectively take advantage of a massive asset bubble to fund a bankrupt entity.

And just in case someone accuses Jefferies of trying to get away with borderline fraud – you know, in case the SEC wakes up and realizes that what the mid-market investment bank is proposing is to basically steal from clueless Robinhooders, slapping it with a massive penalty – the filing has the following disclaimer:

Hertz would include disclosure in any prospectus used to offer common stock highlighting that an investment in Hertz’s common stock entails significant risks, including the risk that the common stock could ultimately be worthless.

Well, the common stock is worthless right “now”, not “ultimately”, although as a result of the idiocy on Robinhood where some 151,793 users decided to go long the insolvent company, and sent it soaring in recent days, Jefferies is basically claiming that these clueless momentum chasers who recently had to google what “bankruptcy” means have ascribed a value of $500 million for the worthless equity tranche, and so there is value there.

Why is this the most insane thing anyone has ever seen? Simple.

In bankruptcy, companies raise capital to go through the Chapter 11 or 7 process by issuing a debtor in possession (DIP) loan, which has superpriority and has a seniority to all other existing indebtedness, for the simple reason that all other existing indebtedness is impaired to large or small degree. After all, the company filed for bankruptcy for a reason: it couldn’t meet its interest payments. This also means that unless all the existing debt is repaid in full, or there is some unprecedented agreement between the equity tranche and the debtors, the pre-petition equity is worthless. Eventually, the company converts some or all of its impaired debt into post-petition equity, while the prepetition debt is either satisfied or rolled into the new entity. Eventually, the new, post-petition equity may end up being traded on public markets and have value as the newly reorganized company has far less debt and can pay the interest on this debt.

However, what is going on in this case is that Jefferies has basically turned the bankruptcy process on its head, and instead of raising capital for a bankrupt entity by selling the most secured form of debt it can, it is instead going to the other end of the capital structure, and hopes to sell equity!

Essentially, Jefferies is claiming that just because a bunch of momentum chasers sent the bankrupt equity to a value of almost $1 billion, then by implication all the debt above the equity tranche is not impaired, and thus there is equity value, arguably the most circular argument ever observed in capital markets.

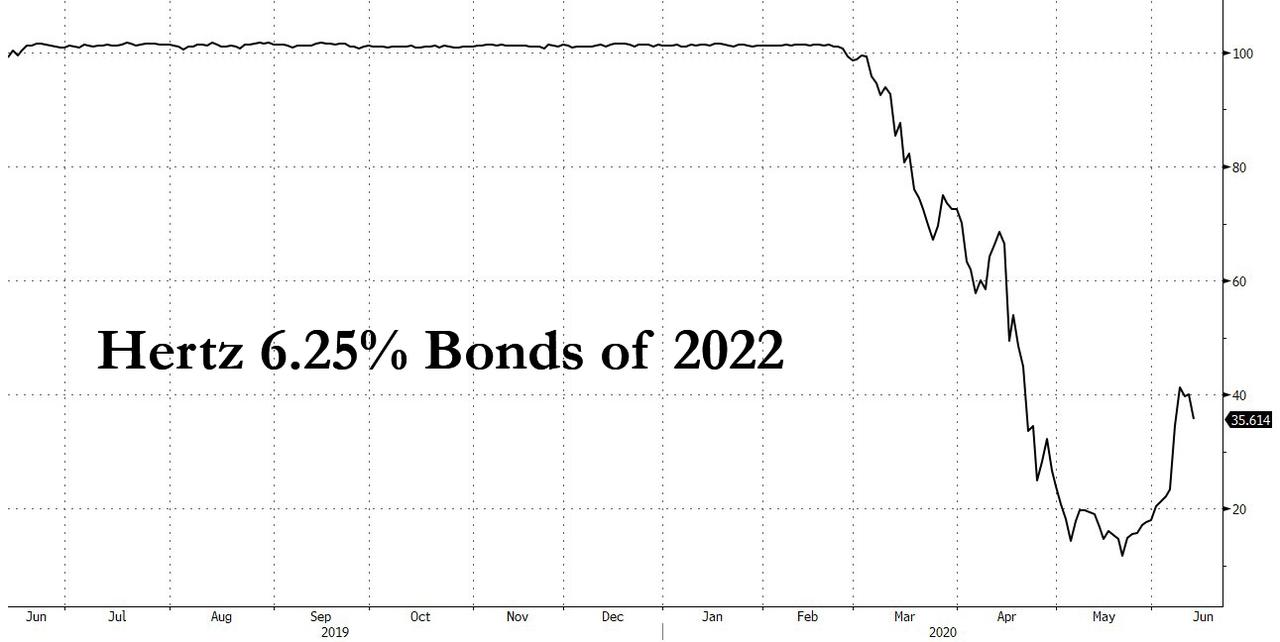

The only problem is that if the debt was indeed not impaired it would be trading at par. Instead Hertz’ bonds due October 2022 are trading at 35 cents on the dollar. And while this is a simplification, if this one issue of $500MM in bonds alone is pricing in impairment of roughly $325 million, it means that the equity value is, at best, negative.

However, just because Robinhooders can only trade the worthless “hot potato” HTZ stock and not any of its other obligations, and just because they have been buying it up from each other in hopes that greater fools will buy it from them later, Jefferies – which obviously knows better – has decided to take a historic gamble with what may soon be the most iconic testament to the bubble spawned by the Federal Reserve.

What happens next? Well, any legitimate bankruptcy judge will laugh this off – after all no institutional investor would touch this offering with a ten foot pole. But Jefferies intended audience in this case is not an institutional audience – the bank hopes to sell the stock directly to those Robinhooders who pushed it up to $6.25 as recently as Monday. It was that idiotic move that prompted our original modest proposal for Hertz to sell stock “just so we can test the so-called “price discovery” of Powell’s latest and greatest FOMO bubble.”

Of course, there is a possibility a bankruptcy judge will allow this transaction to take place. There is also the possibility that the SEC will ignore what is going on, well aware that anyone who “invests” in this bankrupt stock will end up with nothing once the bankruptcy process concluded. In which case we look forward to what will be a truly unprecedented event: an Initial Bankruptcy Offering.

We could say much more about this absolute idiocy but instead we will leave it to other commentators, such as former Jefferies banker Dan Polner who had this to say: “I spent a career on Wall St and 9 years at Jefferies. I’ve never seen new equity holders provide DIP financing for the benefit of the creditors. Absolutely insane!”

Jared Ellias, a law professor, said he has studied hundreds of bankruptcies and never seen a company try to fund a case with an equity offering at the start of chapter 11. “Hertz looks at the market and sees there is a group of irrational traders who are buying the stock, and the response to that is to seek to sell stock to these people in hopes of raiding some amounts of money to fund their restructuring.”

And the absolute kicker: the stock is actually trading higher on this report!

Here are some other kneejerk opinions:

I have to say that I have never seen a Debtor petition the court for permission to sell equity to idiots, er, investors….WHILE IN BANKRUPTCY! $HTZ

— Diogenes (@WallStCynic) June 11, 2020

I have never read anything more insane in finance world.

Hertz asking if they can sell equity to raise cash to pay debtors because equity market is so dumb that they’ll buy it anyway. Thanks Robinhood. https://t.co/FD3612qMsq

— Zach Weinberg (@zachweinberg) June 11, 2020

“Your honor, we ask permission to authorize an At The Monkeys Offering”

— Bachman (@ElonBachman) June 11, 2020

“Your honor, we’d simply like the Court’s permission to milk this Robinhood cow until the udders are dry, cracked, and bleeding. “

— Henry Williams (@HenryWilliams74) June 11, 2020

I am so tempted to say this has to be the most absurd moment in the history of public markets…

But even if I’m right, I’ll be wrong by next week. https://t.co/bLbZPnrVHY

— Unlimited Grain Printer (@GrainSurgeon) June 11, 2020

This just codified the insanity of this market.

BTFD! https://t.co/O7z4nvUNaV

— Tito el Bandito (@TitoElBandito) June 11, 2020

Can we all pour one out for our devoted public servant Jay Powell?

He’a officially broken capitalism.$HTZ pic.twitter.com/4uzM1MtAn7

— Donut Shorts (@DonutShorts) June 11, 2020

The stock is trading higher on plans to sell more stock to feed their trough.

If $htz trades higher tomorrow, I’m going full white collar fraud. I’m committing. Absolutely nothing matters.

— luis carruthers (@orthereaboot) June 11, 2020

Can someone pls protect the braindead Robinhood account holders ?

Isn’t it against the law to exploit those who are mentally challenged ?$htz $chk $tsla $tslaq $nkla https://t.co/joHsJTnWen

— NikolaCharts (KingKublai5) (@KKublai5) June 11, 2020

The express purpose of this $htz offering is to channel money from baggies to debtors.

Plenty of worthless paper has been sold before, but never with such honest intent.

This offering, if pulled off, is absolutely legendary.

Godspeed.

— luis carruthers (@orthereaboot) June 11, 2020

The full filing can be found here.