By Tyler Durden

By Tyler Durden

If New Jersey is indicative of states’ fiscal health across the nation, then state bailouts are imminent.

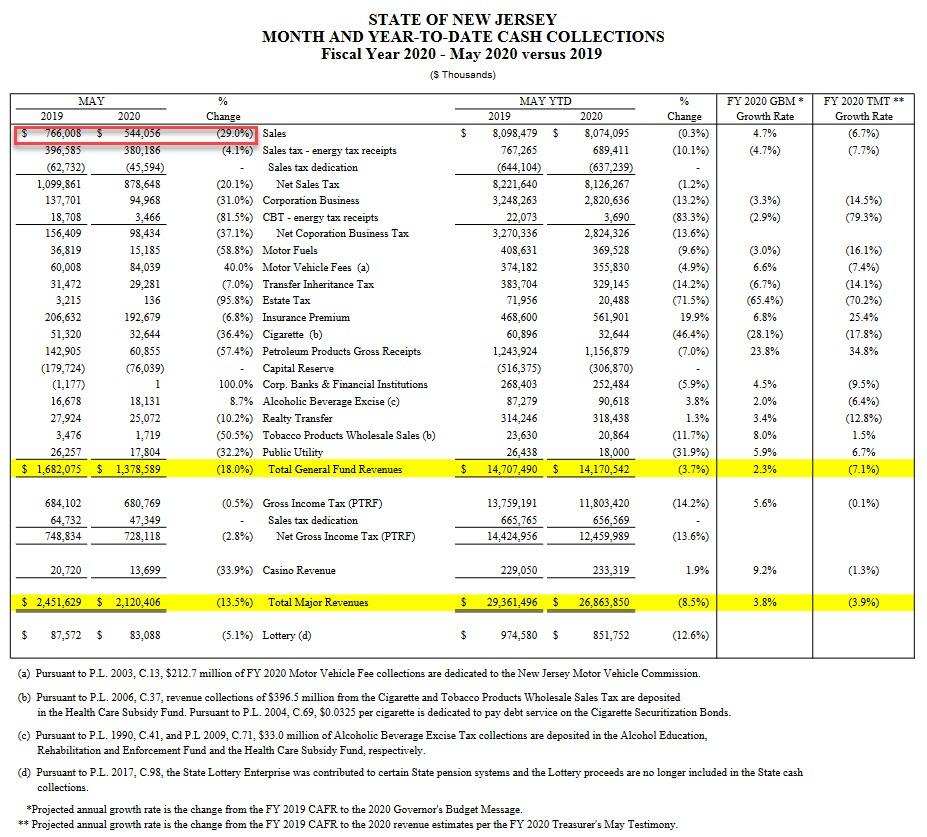

According to the Garden State Treasury Department, sales-tax collections for April, the first full month of the coronavirus shutdown, dropped by a record 29% in May from a year earlier, a decline that is about 60% greater than the worst month of the Great Recession.

“The Sales and Use Tax, the largest General Fund revenue source, reported collections of $544.1 million in May, down a remarkable 29.0 percent below last May” the report said. By comparison, the worst Sales Tax month during the Great Recession saw a decline of 18.4% in June 2009.

Year-to-date, Sales Tax collections of $8.074 billion are down 0.3% from the same period last year. Because the Sales Tax reports with a one-month lag, the May collections reflect consumer behavior during April, the first full month of COVID-based restrictions.

The NJ Treasury also noted that despite the unprecedented Sales Tax revenue decline, collections may have been slightly buoyed by direct federal stimulus payments to individuals. These payments peaked in April and were largely complete by the end of May, “suggesting that the stimulus effect will fade in subsequent months without additional federal assistance.”

Corporate taxes were also dismal: the Corporation Business Tax (CBT), the second largest General Fund revenue, generated $95.0 million, 31.0% below last May. Year-to-date, CBT collections of $2.821 billion are 13.2 percent below last year. May was the sixth consecutive month of declining CBT revenues. As with the GIT, Treasury expects some of the CBT revenue decline to be made up in July. However, since corporations have considerably greater tax planning opportunities compared to individuals, NJ warns this might reduce payments substantially given the current economic conditions.

Even more so than the Sales Tax, State fuels tax revenues were particularly hard hit this month. Motor Fuels Tax revenues of $15.2 million fell 58.8% and Petroleum Products Gross Receipts Tax revenues of $60.9 million dropped by 57.4% compared to the same month last year.

See: 177 Different Ways to Generate Extra Income

Due to the fallout from the COVID pandemic, the NJ Treasury reduced its FY 2020 revenue forecast by $2.7 billion; nearly all major revenues of note declined in May for the second consecutive month.

Source: ZeroHedge

Subscribe to Activist Post for truth, peace, and freedom news. Become an Activist Post Patron for as little as $1 per month at Patreon. Follow us on SoMee, HIVE, Flote, Minds, and Twitter.

Provide, Protect and Profit from what’s coming! Get a free issue of Counter Markets today.

New Jersey Tax Collections Crater By A Record 29%, Warns Of More Pain As Stimulus Ends