BofA: There Is Just One Bull Market To Short … And The Fed Won’t Let You

Tyler Durden

Fri, 06/19/2020 – 17:18

Is it time to go short?

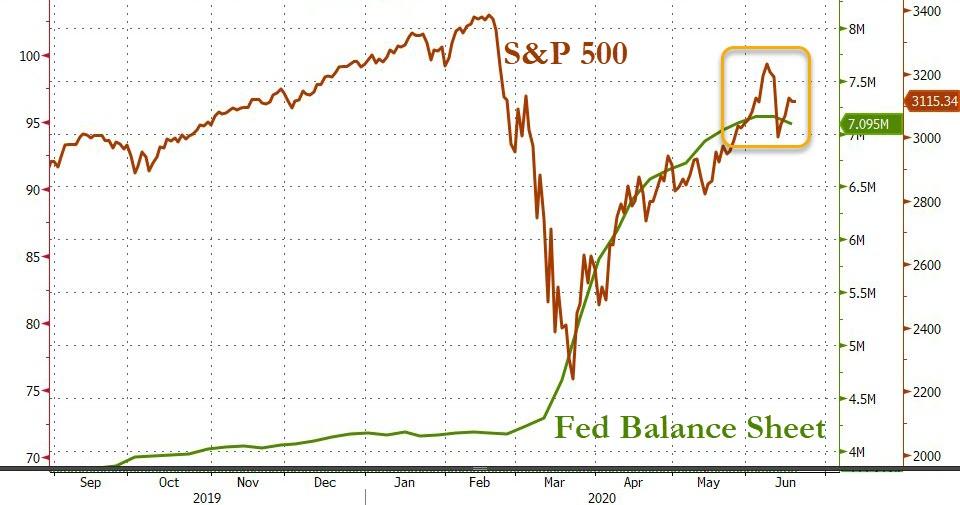

With the Fed’s balance sheet posting its biggest weekly drop in 11 years, and hitting a plateau of sorts (at least until the next major QE push)…

… coupled with an ominous reversal on today’s quad-witch expiration, which saw stocks slump despite opening sharply higher, investors are starting to ask if it is once again time to start shorting (especially with Robin Hood realizing it is time to pull in the reins on its teenage trading army).

Well, at least according to Bank of America’s CIO Michael Hartnett the answer is, for now at least, no.

Writing in his latest Flows and Liquidity report titled “Only bull to short is credit…and Fed won’t let you”, Hartnett proposes that according to the Fed, it is still too early for Big Short: “Fed is “all-in” and will remain in that stance until US unemployment rate falls to acceptable level i.e. <5% (or claims <400k)."

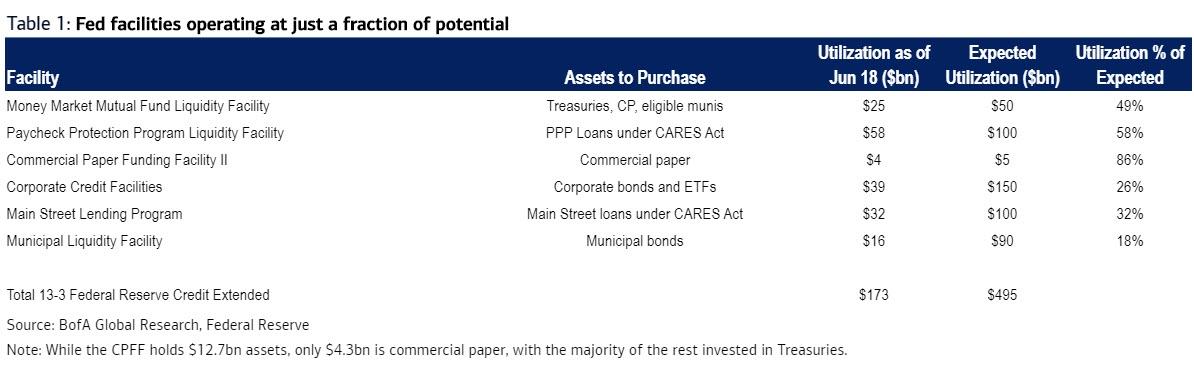

Hartnett also warns that Fed rhetoric has been bigger than wallet thus far, which means Powell can easily crush shorts. Here’s why – the Fed’s facilities are operating at just a fraction of potential, and as Table 1 below shows, the Fed has spent just $173bn out of its potential $495bn in firepower (and it can always add more).

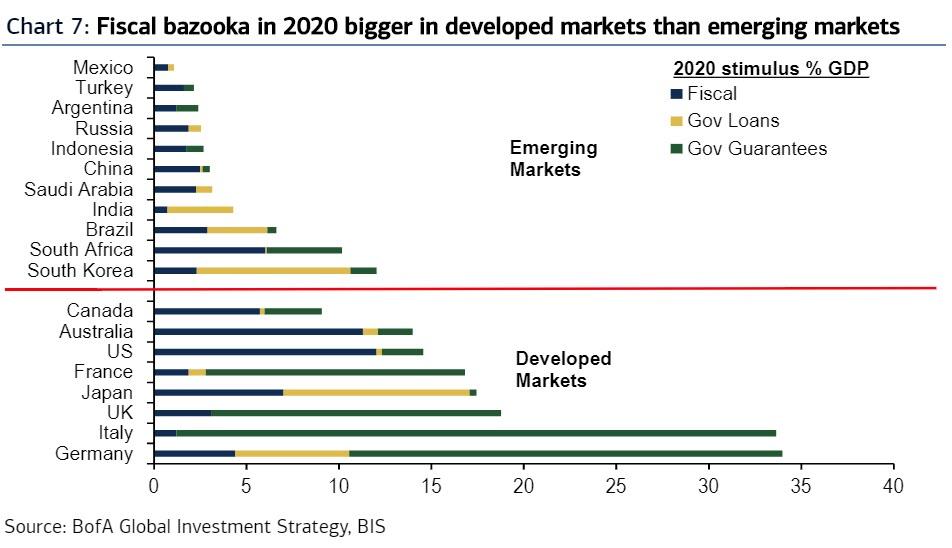

It’s not just the Fed: there is also the 2020 fiscal bazooka which has a way to go.

As Hartnett adds, the fiscal stimulus is taking 3 forms in 2020… spending, credit guarantees, loans & equity. BIS data shows US & Australia lead spending (>10% GDP), Europe is using aggressive credit guarantees (e.g. Italy 32% GDP), while Japan/Korea are stimulating via government loans/equity injections.

And while Hartnett echoes what we said last month, that it is “notable how Emerging Markets lagging in terms of fiscal ability to address pandemic/recession”, recall that last night we reported that China has now vowed to inject global credit amounting to 30% of GDP in the economy this year.

So does that mean don’t short under any conditions? Not exactly. As Hartnett summarizes, the tactical risk remains to the upside:

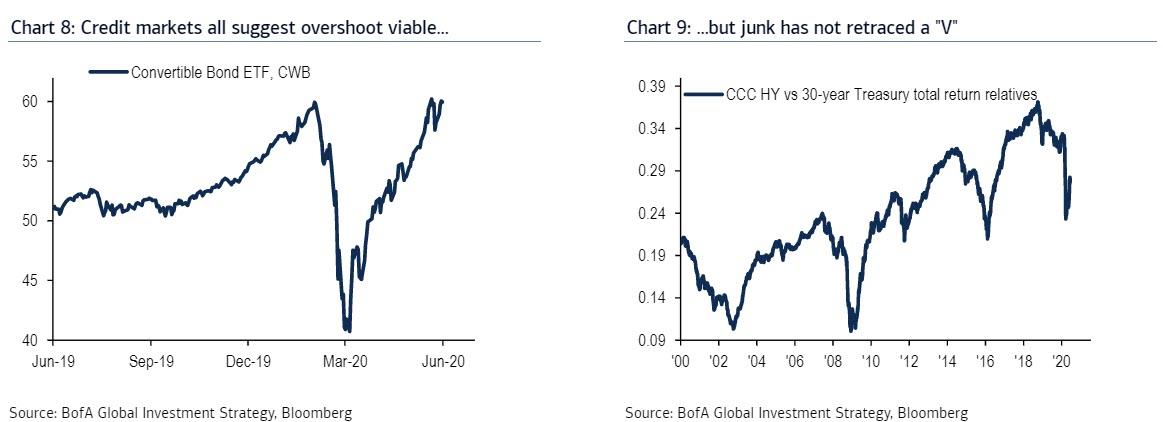

positioning, policy, credit markets all still point to potential for or above 30Y TSY above 2%, IG CDX 60, SPX 3250, while credit markets are still too strong (see LQD, PFF, CWB)…

… to short stocks, even if like stocks, junk has only retraced partially versus quality bonds (see relative performance of CCC HY bonds vs 30-year Treasury – Chart 9); summer risk remains to upside driven by central bank repression of credit spreads (positive for “growth”…see world’s best performing market, Chinese Nasdaq (ChiNext), threatening to breakout to new highs – Chart 10), or via big RoW macro surprise to upside via fiscal stimulus (see soaring Baltic Freight Index); barbell of credit/tech and EU/US small cap value & banks.

But the structural risk is to the downside: Fall 2020 risks will be 1. Fear of double-dip recession & default risk, 2. Debasement of US dollar & disorderly bond markets, 3. Politics threatening 2021 EPS;

His parting advice for a tipping point back into shorts: watch the yield curve: a failure of the curve to steepen >80bps in June/July would signal “peak policy stimulus” and reinvigorate shorts.