China Warns US That “Crossing Red Lines” Puts Trade Deal At Risk

Tyler Durden

Fri, 06/26/2020 – 11:22

The US bill imposing mandatory sanctions on Chinese individuals and entities who “materially contribute to the contravention of China’s obligations” to Hong Kong’s autonomy – and banks that do “significant transactions” with them – was passed unanimously by the Senate on Thursday, with the House of Representatives working on its own version; the final bill gets passed to President Trump, who either signs it or vetoes it – in which case it has a veto-proof majority anyway. This, as Rabobank’s Michael Every wrote, is the constitutional dynamic that has been described several times in the last 12 months for China-focused bills with serious consequences for not just international relations, but international business and finance.

“So far the results have not hit markets: but this bill cuts out the middleman and takes us straight to the biting sanctions”, Every concluded.

But while we await the sanctions to kick in, moments ago we learned once again that China is hardly impressed by the latest developments, and in “quietly delivering a message” to Washington, Chinese leaders have “accused Washington of meddling in areas such as Hong Kong, where China is imposing a sweeping national-security law, and Taiwan.”

According to a report in the journal, during a meeting between Mike Pompeo and China’s top diplomat last week in Hawaii, Yang Jiechi listed these actions as well as China’s “strong dissatisfaction” with a bill President Trump signed last week mandating sanctions against Chinese officials and entities deemed responsible for mass detention of Uighur Muslim in China’s northwestern Xinjiang region.

While Yang reiterated Beijing’s commitment to carrying out the trade deal, he stressed that both sides had to “work together,” said people familiar with the conversations. A Chinese official said that meant “the U.S. side should refrain from going too far with meddling” and that “Red lines shouldn’t be crossed.”

The report then notes that shortly after the meeting concluded, Vice Premier Liu He said that Beijing’s ability to carry out the trade deal required the U.S. to “ease off” pressure on other fronts.

“The two countries should create conditions and atmosphere, and eliminate interference, to jointly implement the Phase One agreement,” Liu said in written remarks to a high-profile financial forum held in Shanghai on June 18.

“You can’t keep asking us to buy your stuff and at the same time keep beating up on us,” said Mei Xinyu, an analyst at a think tank affiliated with China’s Commerce Ministry. “That’s not how it works.”

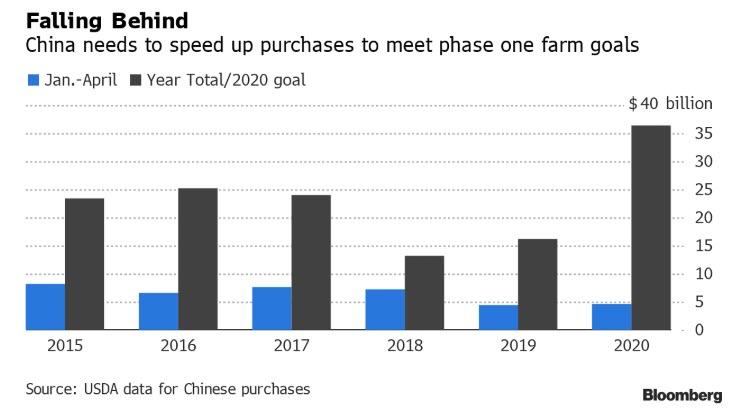

In short, while Peter Navarro may have fumbled his message earlier this week when he said that the trade deal was off, only to immediately reverse himself when futures plunged and even Trump scrambled to tweet that the deal is still in place, the ball is now in Beijing’s court which – in order to project strength following the just passed sanctions – may decide that it is in Beijing’s best interest to kill the Phase 1 trade deal (especially if that helps get the pro-China Biden elected). And after all, it’s not like China is actually complying with the terms of the deal -as we noted last week, China is currently lagging its import pledges made as part of the “Phase One” deal by some 87%.

And with China’s economy on edge, it is virtually impossible that Beijing will force more companies to uproot existing supply chains and shift to US-sourced production just to appease a US president who is seen by a majority of China’s population as taking an increasingly aggressive stance toward China.

While the news helped push US stocks to session lows, the yuan was mostly unchanged, perhaps because China remains on holiday.