Futures Flat On Last Day Of Best Quarter In 22 Years

Tyler Durden

Tue, 06/30/2020 – 08:06

There was some sound and fury in a very illiquid overnight session, which ended up signifying nothing, and futures were little changed from their Monday closing ramp as markets puts a close to the best quarter for stocks since 1998.

The MSCI world equity index was up about 0.1% in early trading after Asian shares rose on strong data from the U.S. housing market and Chinese factories. European shares continued the rally. S&P futures fluctuated and the dollar index strengthened to a one-month high amid concern that new virus infections could slow the pace of business re-openings.

Overnight sentiment fizzled after Australia’s Victoria state said it would shutter 10 areas in the metropolis of Melbourne. Arizona also ordered a number of establishments including gyms to close for 30 days and New Jersey halted plans for indoor dining. However, this latest gloom was quickly forgotten shortly after Europe reopened and the magical overnight futures levitation kicked in right on schedule.

“Renewed shutdowns of economic activity would bring additional market volatility,” said Kristina Hooper, the chief global market strategist at Invesco in New York. “But importantly, we do not expect the same draconian shut-down measures as seen earlier in the year.”

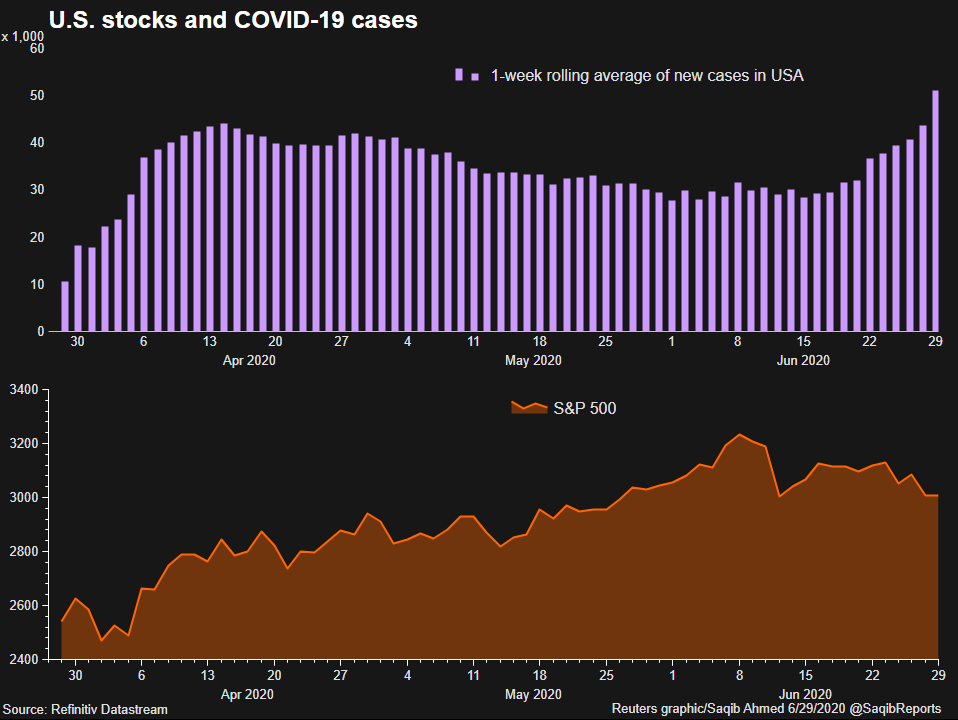

After new cases of the coronavirus trended lower in May, they climbed again in June, denting investors’ enthusiasm that the U.S. economy would recovery relatively quickly from the crisis. Investor enthusiasm had been driven in part by recent economic data that were better than expected.

A spike in virus infections in Southern and Western states last week spooked investors. Florida, Texas, California and Arizona, which were the top four states with the most new cases, account for nearly a third of U.S. economic output. California’s government on Sunday ordered bars in several counties to close due to the coronavirus rebound, while San Francisco put plans to reopen businesses on hold.

Los Angeles has become a new epicenter in the pandemic as coronavirus cases and hospitalizations surge there despite California Governor Gavin Newsom’s orders requiring bars to close and residents to wear masks in nearly all public spaces. The World Health Organization (WHO) will “read carefully” a Chinese study on a new flu virus found in pigs, a spokesman said, adding that the findings underscored the importance of influenza surveillance during the current pandemic.

“Asset markets are looking beyond COVID stats,” said Neil Jones, head of FX sales at Mizuho Bank. “There’s some expectation of containment and then, further down the line, an expectation of some form of measure to combat the virus.”

Anyway, back to markets, where Uber climbed in pre-market trading after reports that the company is in talks to buy Postmates as a consolation prize after it failed to acquire Grub Hub. Boeing, which idiotically surged yesterday on trials of the 737 MAX airplane which nobody will want to fly in, slipped after one of its biggest European customers scrapped its $10.6 billion purchase deal.

European shares edged up, with the Euro STOXX 600 up 0.1% in early trading having been relatively range-bound for the past two weeks. Germany’s DAX was up 0.3%. London’s FTSE 100 was down 0.6%. Britain’s economy shrank by the most since 1979 in early 2020 as households slashed their spending, according to official data that included the first few days of the lockdown. Annual inflation in the Euro area accelerated to 0.3% in June from a four-year low of 0.1% in May, beating forecasts for no change and supporting the European Central Bank’s expectation that a negative reading may be avoided.

Earlier in the session, Asian stocks gained, led by materials and communications, after falling in the last session. The Topix gained 0.6%, with EJ HD and DVX rising the most. The Shanghai Composite Index rose 0.8%, with Xinjiang Yilu Wanyuan Industrial Investment and Chengtun Mining posting the biggest advances. China’s parliament passed national security legislation for Hong Kong in response to last year’s pro-democracy protests. The United States, Britain and other Western governments have said the legislation erodes the autonomy the city was granted at its 1997 handover. Market reaction was limited.

While the latest stronger than expected Chinese PMI print added to reopening optimism…

… some investors are questioning the rally that has carried global stock benchmarks higher. The MSCI All Country World Index is up about 18% this quarter and just 10% below its February record high, the biggest advance in a decade. Yet the World Health Organization warned that the worst of the coronavirus pandemic is still to come. As a result, investors are parsing an array of factors that could weigh on stocks in the months ahead, including potential delays in reopening parts of the U.S. economy and sky-high stock valuations.

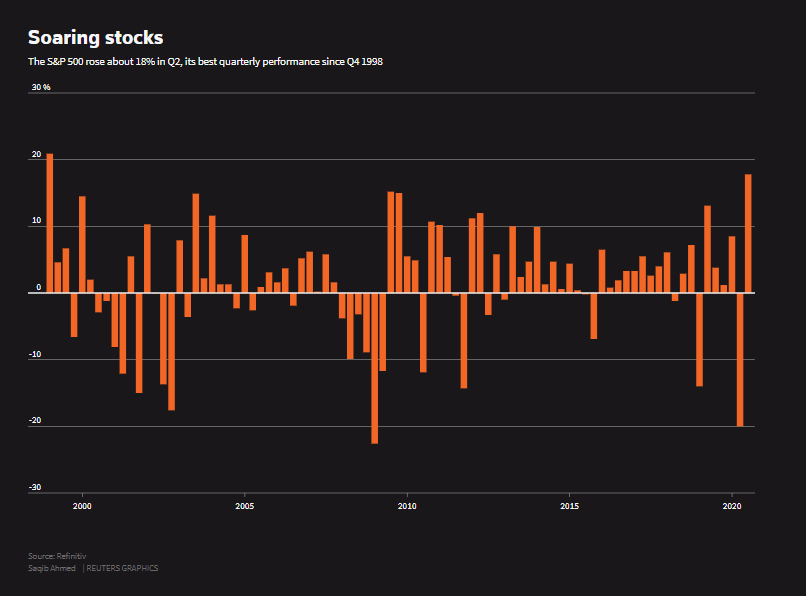

The S&P 500’s strongest quarterly performance since the fourth quarter of 1998 — during the dot-com boom — was driven by gains in April and May, followed by an overall flat June after Wall Street gave back gains in the second half of the month.

In FX, the dollar advanced against all its Group-of-10 peers amid quarter-end positioning and as investors tracked a resurgence in coronavirus infections. The dollar got a boost while the Aussie swung to a loss as the Australia’s second-most populous state imposed a lockdown in some areas for four weeks, while also diverting flights for a shorter period; other risk-sensitive currencies reacted in a similar fashion.

“I would expect overall dollar demand to continue as we go into July,” Mizuho’s Neil Jones said. “If there’s a summer lull then we may see a dollar sell-off into the elections but as we run up to the end of the year I would expect to see a resurgence of dollar demand,” he added.

The euro was down around 0.3% against the dollar, at $1.1208, while the Australian and New Zealand dollars also edged down. The Australian and New Zealand dollars are set to end the best quarter against the greenback since the financial crisis; Sweden’s krona and Norway’s krone are heading for their best quarter against the euro in a decade or more.

In rates, Treasuries were steady ahead of a slew of Fed speakers. European peripheral spreads widened as Bunds popped through Monday’s best levels, however Italian bonds advanced as a sale of 10-year debt saw the highest oversubscription rate since 2012. Copper rose above $6,000 a ton for the first time since January.

In commodities, oil prices slipped as traders took profits after sharp gains the previous session and Libya’s state oil company flagged progress in talks to resume exports, potentially boosting supply. Prices then recovered partially. WTI was down 0.6% at $39.15 a barrel, having hit as low as $39.00, while Brent crude slipped 0.6% to $41.16 per barrel.

Looking at today’s calendar, expected data include Chicago PMI. FedEx reports earnings.

Market Snapshot

- S&P 500 futures down 0.1% to 3,045.75

- STOXX Europe 600 down 0.3% to 358.75

- MXAP up 0.7% to 157.99

- MXAPJ up 0.7% to 513.21

- Nikkei up 1.3% to 22,288.14

- Topix up 0.6% to 1,558.77

- Hang Seng Index up 0.5% to 24,427.19

- Shanghai Composite up 0.8% to 2,984.67

- Sensex up 0.5% to 35,128.74

- Australia S&P/ASX 200 up 1.4% to 5,897.88

- Kospi up 0.7% to 2,108.33

- German 10Y yield fell 0.8 bps to -0.478%

- Euro down 0.2% to $1.1221

- Brent futures down 0.7% to $41.44/bbl

- Italian 10Y yield rose 0.6 bps to 1.17%

- Spanish 10Y yield unchanged at 0.47%

- Brent futures down 1.2% to $41.22/bbl

- Gold spot down 0.1% to $1,771.15

- U.S. Dollar Index up 0.18% to 97.70

Top Overnight News

- China’s top legislative body approved a landmark national security law for Hong Kong, a sweeping attempt to quell dissent that drew fresh U.S. retaliation and could endanger the city’s appeal as a financial hub

- Boris Johnson will confirm his commitment to spending billions of pounds on infrastructure to rebuild the coronavirus-ravaged U.K. economy in a major speech on Tuesday, arguing that balancing the books must wait until recovery is secure

- Bets that the Federal Reserve will implement yield-curve control sooner rather than later are showing up in positioning data and the curve itself

- Germany is paving the way for a green bond revolution in Europe by announcing it will sell its first government-backed securities later this year

- Some of Germany’s furloughed workers are beginning to return to work full time, according to a survey by the Ifo Institute

- Prices in the euro area rose 0.3% in June from a year ago, according to preliminary data, versus a 0.2% estimate, as economies across the bloc allowed more businesses to reopen

- France risks losing control of its debts unless the government overhauls its long- term fiscal policy, according to the national auditor

Asian equity markets traded higher as the region took its cue from the firm performance on Wall St which was attributed to several factors including technical buying in the S&P 500 around the 3000 level and encouraging comments by Fed Chair Powell who suggested the US economy entered an important new phase sooner than expected and that recent economic data offers some positive signs, while better than expected Chinese PMI figures also contributed to the overnight optimism. ASX 200 (+1.4%) was lifted from the open with upside in Australia led by firm gains in energy and strength in the top weighted financials sector, with industrials also inspired by the outperformance of their counterparts stateside after Boeing shares soared by double digits as it began 737 MAX test flights. Nikkei 225 (+1.3%) was underpinned as recent favourable currency moves helped participants overlook the soft data which showed the weakest Industrial Production since March 2009 and highest Unemployment Rate in 3 years. Hang Seng (+0.5%) and Shanghai Comp. (+0.8%) were also positive after Chinese Manufacturing PMI and Non-Manufacturing PMI both topped estimates, but with gains capped following another PBoC liquidity drain and after China’s legislature reportedly passed the Hong Kong security bill as expected. Finally, 10yr JGBs traded lower to test support at the 152.00 level as the gains in riskier assets sapped haven demand which also resulted in the 40yr yield rising to its highest since March last year, while weaker results at the 2yr JGB auction further weighed on prices.

Top Asian News

- BOJ’s Bond Purchases Signal Japan’s Curve to Steepen Further

- CAR Inc Surges 17%, Sparks Speculation of Progress in Stake Sale

- BOJ Widens Buying Ranges for Bonds Due Up to 10 Yrs in July Plan

Another day of volatile price action across the equity-sphere but European bourses are ultimately negative [Euro Stoxx -0.1%] as the risk appetite seen during APAC hours petered out on month/quarter and HY-end, where Citi’s month-end model shows a relatively strong signal for a rotation out of European and Japanese stocks into bonds, specifically US, Asian and Canadian. Furthermore, markets could also be bracing for a rise in COVID case-counts as the weekend effect dissipates. Add to that the passage of the Hong Kong security law which is likely to face international pushback, namely from the US, UK and the EU, albeit the latter two have previously signalled a more balanced approach to the situation given their preferability for a Chinese partnership. It’s also worth bearing in mind that Germany will take the EU presidency from tomorrow and have previously hinted at the tougher stance against China. For refence, Eurex suffered an outage overnight for several hours. Nonetheless, European stocks saw a bout of buying immediately after the cash open – somewhat mimicking yesterday’s actions – before gains again subsided. Sectors are now mixed after earlier flow rotated into defensives from cyclicals shortly after the open. The detailed breakdown sees Tech holding its position in the green on the back of Micron’s (+4% pre-mkt) after-market earnings in which guidance was upgraded – thus propping up European peers STMicroelectronics (+1.8%), Dialog Semiconductor (+1.9%), Micro Focus (+0.8%) and Infineon (+0.3%). Banks are on the other end of the spectrum amid lower yields and after Wells Fargo (-1.8%), the fourth largest bank State-side, opted to cut its Q3 dividend when it reports earnings on July 14th. In terms of individual movers, Wirecard (+96%) shares feel some reprieve after UK FCA lifted restrictions on the Co’s UK arm. Meanwhile, Novartis (-1.0%), the likely culprit for losses in the Healthcare sector, remains pressured after the Canadian federal court dismissed a plea by drug makers, including Co., challenging the government’s new regulation aimed at lowering prices of patented drugs.

Top European News

- Shell to Write Down Up to $22 Billion as Virus Hits Big Oil

- Boris Johnson Vows ‘New Deal’ to Rebuild Britain After Virus

- Hedge Funds Score Big Gains on Dividend Bets That Hurt Banks

In FX, the Dollar may yet succumb to bearish rebalancing flows around daily fixes, but more pronounced weakness in major currency rivals is keeping the index afloat around 97.500 and close to a new 97.774 peak amidst waning risk appetite on the final day of June, Q2 and the first half of 2020. Moreover, the Greenback has maintained momentum following Monday’s positive US data (pending home sales) and a slightly more upbeat economic assessment via the text of a speech to be delivered by Fed chair Powell to the House later today.

- NOK/NZD/AUD – Another downturn in crude prices has undermined the Norwegian Krona’s revival, while the Kiwi and Aussie have pulled back from overnight highs after the latter failed to sustain post-Chinese PMI gains on reports that 10 sectors of Melbourne are returning to lockdown and some suburbs may be on the verge of being ordered to stay at home. Eur/Nok has rebounded from sub-10.9000 towards 10.9500, Nzd/Usd has lost grip of the 0.6400 handle and Aud/Usd is back below 0.6850 after fading ahead of 0.6900 where a hefty 1.4 bn option expiry resides.

- GBP/EUR/CAD – Also weaker vs the Buck, as Cable languishes below 1.2300 in wake of weaker than expected UK Q1 GDP awaiting further BoE commentary via Haldane and Cunliffe, while the Euro is only just holding up above 1.1200 and the 100 DMA (1.1205) in the midst of big expiries either side of the round number, and with Eur/Usd one of the only exceptions to the modest sell Dollar for portfolio mantra over month/quarter/half year end. Elsewhere, the Loonie is trying to keep its head above 1.3700 in advance of Canadian GDP for April and the first full month of COVID-19 contagion.

- CHF/JPY – Relative G10 ‘outperformers’ or at least showing more resilience than others due to underlying safe-haven demand and for the Yen in particular reports of RHS Usd/Jpy interest that is seen gathering pace, if not peaking in the run up to 4 pm London time. However, a weaker than forecast Swiss KOF survey has offset a rebound in retail sales, while Japanese ip missed consensus and the jobless rate hit a 3 year high.

- EM – Some respite for the Rand via SA Q1 GDP contracting considerably less than anticipated, as Usd/Zar pares back from nearly 17.4000, albeit still higher in line with peers against the backdrop of fragile risk sentiment and broad Dollar strength. Conversely, the Rouble is still underperforming and jittery on the last day of voting for/against the new Russian convention before Wednesday’s national holiday, with Usd/Rub hovering just shy of 70.9000, and Eur/Pln is firmer following a surprise rebound in Polish CPI.

In commodities, A downbeat session thus far for the oil complex as stocks hold onto losses as with global economies re-imposing some targeted lockdowns amid local flare-ups in COVID-19 cases, with Australia’s Victoria state the latest to re-introduce stay-at-home orders across 10 postcodes. Negativity also arises from the passage of the Hong Kong Security Bill, poised to be implemented tomorrow. WTI Aug resides near session lows, just north of the USD 39/bbl mark (vs. high 39.80/bbl), whilst Brent Sep trades on either side of USD 41.50/bbl, off its USD 41.80/bbl high. Looking ahead, price action will likely be dictated by COVID-related headlines in the absence of anti-China flare-ups over the National Security Bill ahead of the weekly Private Inventory numbers . Elsewhere, spot gold remains within recent ranges between USD 1768-1774/oz as markets eye portfolio rebalancing. Copper prices meanwhile gained overnight amid broader upside in APAC stocks and with supply concerns still on trader’s minds.

US Event Calendar

- 9am: S&P CoreLogic CS 20-City MoM SA, est. 0.5%, prior 0.47%; CS 20-City YoY NSA, est. 3.8%, prior 3.92%;

- 9:45am: MNI Chicago PMI, est. 45, prior 32.3

- 10am: Conf. Board Consumer Confidence, est. 91.4, prior 86.6; Expectations, prior 96.9; Present Situation, prior 71.1

Central Bank Speakers

- 11am: Fed’s Williams Speaks on Central Banking in the Age of Covid

- 11:05am: Fed’s Brainard Discusses a Decade of Dodd- Frank

- 12:30pm: Powell and Mnuchin Speak Before House Financial Panel

- 2pm: Fed’s Bostic and Kashkari Takes Part in Panel on Diversity

DB’s Jim Reid concludes the overnight wrap

Welcome to the last day of the first half of 2020. We’ll have our usual month, quarter and YTD (H1) performance review out tomorrow. As H1 draws to a close, equity markets yesterday resolutely looked past the negative headlines from the US and abroad on the coronavirus, choosing to focus on some better than expected economic data. However it’s quite clear from yesterday that there will be hiccups to come in terms of re-openings. In New York City, Mayor de Blasio said that the city might slow the restart of indoor dining, which is currently scheduled to be reopened from July 6, given the spread seen elsewhere. Concurrently, the New York Times reported that Broadway would remain closed for the N this year, with other large cultural venues such as the Metropolitan Museum and Lincoln Center likely to delay opening until later in the summer even if the city gives them a green light. Over in Florida, cases continued to grow, with the state seeing a further 3.7% increase (weekly average of 5.5%), and parts of the state are now indicating they will make mask wearing mandatory. Florida’s slight drop in case growth was seen elsewhere in US. Cases rose by 1.5% overall, compared to the 1.6% weekly average, but the weekend effect was clearly seen in some states. Arizona saw cases rise by 0.8%, but cited a clerical error, where one lab didn’t submit a report to the state’s record keepers. This compounded by the lower testing capacity that we have seen across the US over the weekend likely means there will be a sharp revision in the next couple of days.

Our US Chief Economist, Matthew Luzzetti, released a new video yesterday where he assesses whether the recent deterioration in covid trends across many states led to a retrenchment in economic activity even prior to official rollback of reopenings. A link to video and report are here.

Looking elsewhere, reports continued to be concerning, with Iran reporting its highest number of daily fatalities since the outbreak began, with 162 new deaths in 24 hours. New cases in India continue to grow rapidly, at roughly 3.8% per day on average over the past month, while South America as a whole is now seeing over 40,000 new cases per day with the largest countries yet to see a meaningful drop in new cases. However reported fatalities remain relatively contained given caseloads in those regions. With around 280 fatalities per 1 million residents, Chile, Brazil, and Peru are well below the US (388), UK (642), and Italy (575), however they do trail Germany (108) and Canada (225).

Even against this worrisome virus backdrop, global equity markets rallied following a rather lackluster start to the day as economic data from the US came in stronger than expected and turned the session around. The S&P 500 closed up +1.47%, which as it stands puts the index just one day away from its strongest quarterly performance on a total returns basis since Q4 1998. And that comes after a first quarter that was the worst since Q4 2008, so it’s fair to say we’ve had an eventful few months in financial markets. There may have been some quarter-end rebalancing at work as well given the over +0.5% move in the last 10 minutes of US trading – typical of quarter end type price action. Tech stocks just slightly underperformed, with the NASDAQ up +1.20%, while the Dow Jones climbed +2.32% as Boeing surged +14.43% (best S&P performer on the day) following the weekend announcement that the Federal Aviation Administration had approved some test flights for the 737 Max. Europe lagged slightly as it missed the afternoon rally in New York. The Stoxx 600 gained +0.44%, even while some of the individual bourses were higher. The DAX (+1.18%), IBEX (+1.39%) and FTSEMIB (+1.69%) all outperformed the index.

Other risk assets also benefited from the sudden turn in sentiment yesterday, including commodities. Oil prices recovered from their losses earlier in the session to move higher, with Brent (+1.68%) and WTI (+3.14 %) both advancing, while copper rose +0.77% to a 5-month high as well. Over in fixed income, yields on 10yr Treasuries fell a further -1.8bps to 0.623%, which is their lowest level in over 6 weeks. And in the UK, yields on both 2yr and 5yr gilts fell to a record low as they inched deeper into negative territory.

Asian markets have followed Wall Street’s lead this morning with the Nikkei (+1.67%), Hang Seng (+0.89%), Shanghai Comp (+0.58%), Kospi (+1.74%) and ASX (+1.39%) all up. Meanwhile, futures on the S&P 500 are up a more modest +0.22%.

In terms of the main headlines overnight, China’s NPC has passed the new Hong Kong security law, expected to become effective from July 1. The SCMP has reported that Hong Kong’s Basic Law committee is expected to meet immediately to discuss insertion into Annex III of the city’s mini-constitution. Xinhua, the official state news agency, is expected to publish the details at some point today, marking the first time the law will be fully disclosed to the public.

Prior to that, US Commerce Secretary Wilbur Ross said that regulations affording preferential treatment to Hong Kong over China, including the availability of export license exceptions, are to be suspended while adding “further actions to eliminate differential treatment are also being evaluated”. He also said, “with the Chinese Communist Party’s imposition of new security measures on Hong Kong, the risk that sensitive U.S. technology will be diverted to the People’s Liberation Army or Ministry of State Security has increased, all while undermining the territory’s autonomy.”

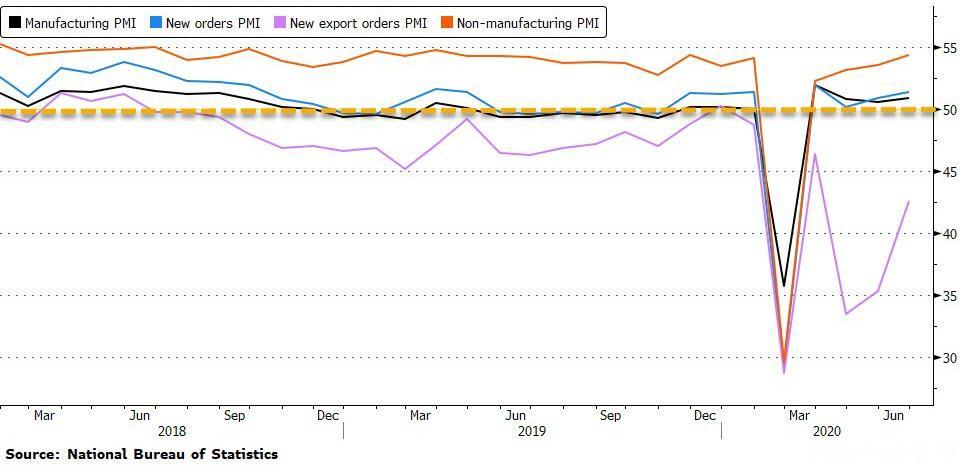

Meanwhile, we’ve also had the latest PMIs out of China which surprised to the upside. The manufacturing PMI rose to 50.9 (vs. 50.5 expected and 50.6 last month) while the non-manufacturing PMI printed at 54.4 (vs. 53.6 expected and 53.6 last month) which left the composite at 54.2 (vs. 53.4 last month). Encouragingly, there was a broad improvement in the details for the manufacturing PMI with output, new orders and new export orders all rising from last month.

The other overnight story has come from here in the UK, with Bloomberg reporting that PM Johnson will announce £5bn of accelerated spending today in roads, schools and hospitals while promising to publish a strategy for further capital spending in the fall. The report further added that in a briefing note about the speech, Johnson’s office has said decisions over increasing taxes or cutting services to pay for the debt will have to wait. The report also added that UK’s Chancellor Sunak is poised to make an economic statement next week.

Back to yesterday. When referencing the EU Recovery plan in a joint press conference with President Macron, Chancellor Merkel made it clear the “talks won’t fail because of us, but there will be no new proposal.” This is not necessarily a negative coming from the two biggest proponents of an extensive continent-wide recovery proposal, as the President of the European Council, Charles Michel, is the one trying to craft a compromise proposal based on the original Merkel-Macron plan. All 27 EU members will convene in Brussels on July 17 to continue hammering out the details of the nearly €750bn plan. Ahead of their press conference, continental sovereign bonds were steady yesterday, with yields on 10yr bunds (+1.2bps), OATs (+0.5bps) and BTPs (+0.6bps) seeing relatively little movement.

While we’re on Europe, it’s worth mentioning a couple of ECB headlines in the light of the recent German constitutional court ruling on their asset purchases. One was a letter from ECB President Lagarde to an MEP which said that the ECB Governing Council had received a request earlier this month from the Bundesbank President “to authorise the disclosure by the Deutsche Bundesbank of non-public documents that show how the ECB has assessed and continues to assess the proportionality of the PSPP and of all its instruments of monetary policy.” It said that the Governing Council had accommodated the request and authorised them to disclose these to the German government, who in turn can share the documents with the German Parliament. This followed a report from FAZ earlier in the day that German finance minister Scholz had told the Bundestag President that the Bundesbank was “permitted to continue to participate in the implementation and execution” of the PSPP since the demands of the German constitutional court had been fulfilled.

Staying with Europe, yesterday our UK team put out a note looking at the state of play in the Brexit negotiations (link here ), and whether there’s room for a deal in the remaining time before the end of the year. Their view is that although the UK has said it wants to complete a deal by the end of the summer, the bar for this remains high. And with a deal also needing time for ratification, it could be that late October/early November becomes the real deadline. On balance, they still see a deal as the more likely outcome, with space for compromise in many of the key areas slowly emerging.

Looking at yesterday’s data releases, in Germany the EU-harmonised CPI reading rose to +0.8% in June, which was above expectations for a +0.6% reading, and up from its nearly-four year low of +0.5% back in May. Meanwhile the European Commission’s economic sentiment indicator for the Euro Area rose to 75.7 (vs. 80.0 expected), which was the second successive increase from April’s low, but still well below the 103.4 reading recorded back in February. And over in the US the data surprised to the upside, with pending home sales rebounding by +44.3% month-on-month in May, well above the +19.3% rebound expected, while the Dallas Fed manufacturing activity also beat expectations to rise to -6.1 (vs. -21.4 expected).

To the day ahead now, and one of the main highlights will be the appearance of Fed Chair Powell and US Treasury Secretary Mnuchin before the House Financial Services Committee. Otherwise, central bank speakers include the BoE’s Haldane and Cunliffe, the Fed’s Williams and Kashkari, and the ECB’s Schnabel and de Guindos. In terms of data, we’ll get the flash June CPI reading for the Euro Area, along with the preliminary June CPI for France and Italy as well. Otherwise, there’ll be Canada’s GDP for April, and from the US we have the Conference Board’s consumer confidence reading for June and the MNI Chicago PMI for June.