Equity & Oil Futures Crash As Market Opens Without Fed Bailout

After Friday afternoon’s combination of Jay Powell’s statement and a major rebalancing flow sent stocks soaring into the close, a lack of the much-demanded ‘coordinated global easing’ this weekend has spoiled the party and futures are opening down hard.

Friday’s almost 1000 point surge in less than an hour – on absolutely nothing but hope that somebody will do something –

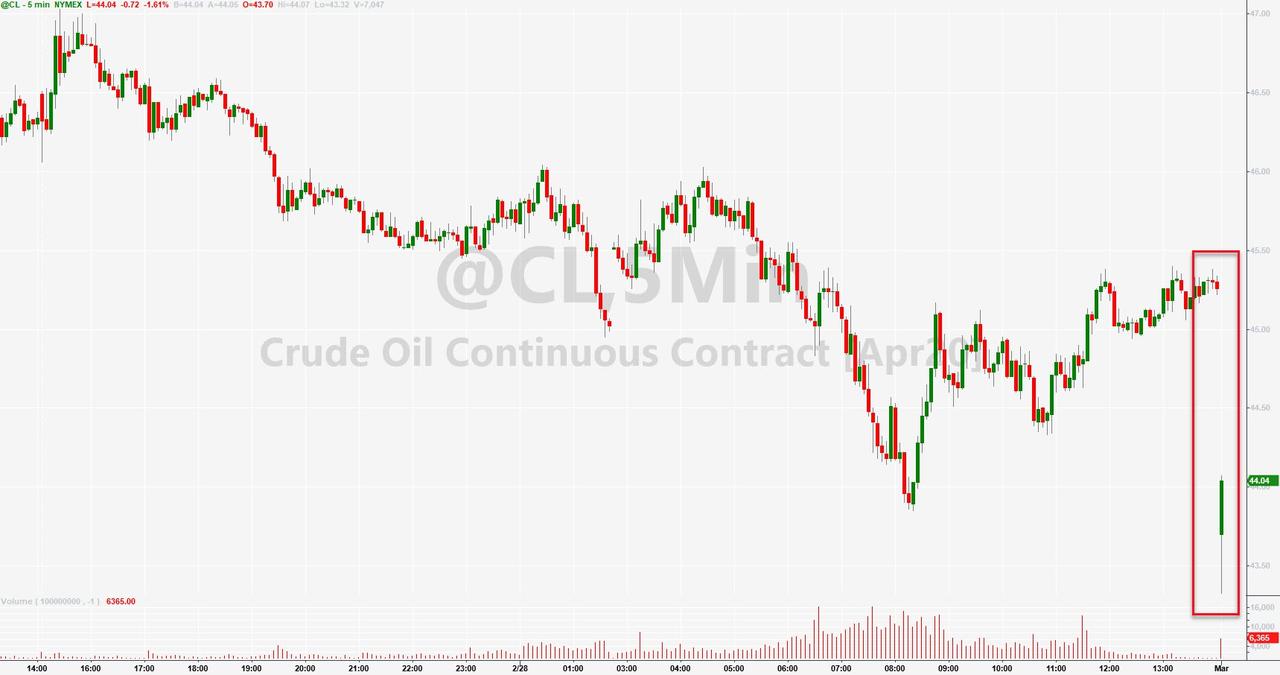

Oil is also collapsing with WTI at a $43 handle…

And gold is bid…

And bond prices have hit a new high, erasing the late-Friday spike in yields…

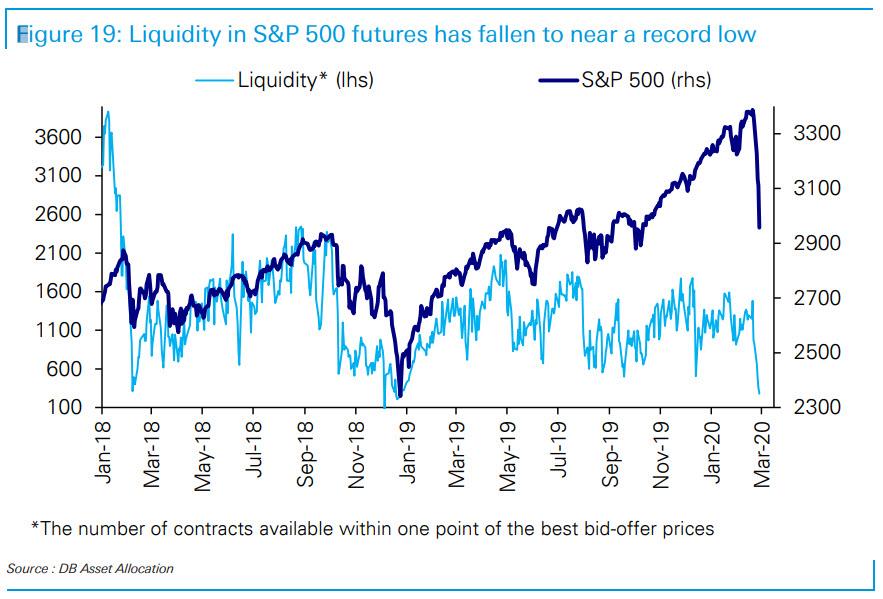

Additionally, we detailed earlier, the following chart from Deutsche Bank shows, overall liquidity for S&P500 futures has fallen to all time lows even though the S&P was trading near all time highs as recently as a week ago. As such, the recent melt up levitation was nothing more than a mirage, propelled mostly by stock buybacks among the Top 5 tech stocks and fickle retail investors, and once these were removed, the market entered the proverbial “trapdoor opening” formation.

The problem is that virtually no liquidity, extreme moves to the downside are now very likely which in turn creates a reflexive relationship with risk sentiment, as the lower the liquidity and greater the selloff, the higher volatility surges leading to even lower liquidity, even more selling and so on.

In short: absent central bank intervention, it will be virtually impossible for any major player to arrest the market’s collapse.

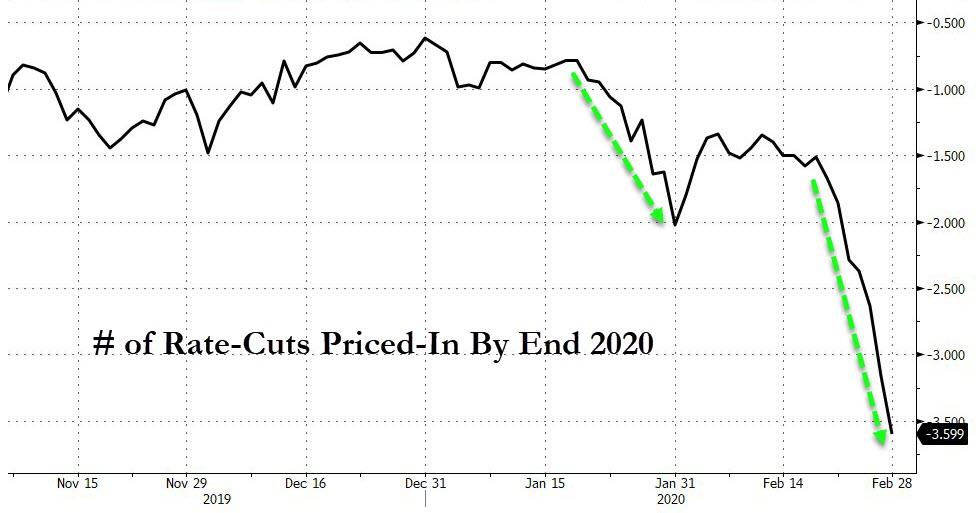

Of course, that is a big ask the market is already pricing in almost 4 rate-cuts in 2020…

And almost completely priced-in 2 rate-cuts in March…

That’s a lot to expect from a Fed that doesn’t want to signal panic and burn through its ammunition so fast without evidence of economic disruption.

Tyler Durden

Sun, 03/01/2020 – 18:06