Two More Problems For The Bulls: Market Liquidity And Short Interest Are At All Time Lows

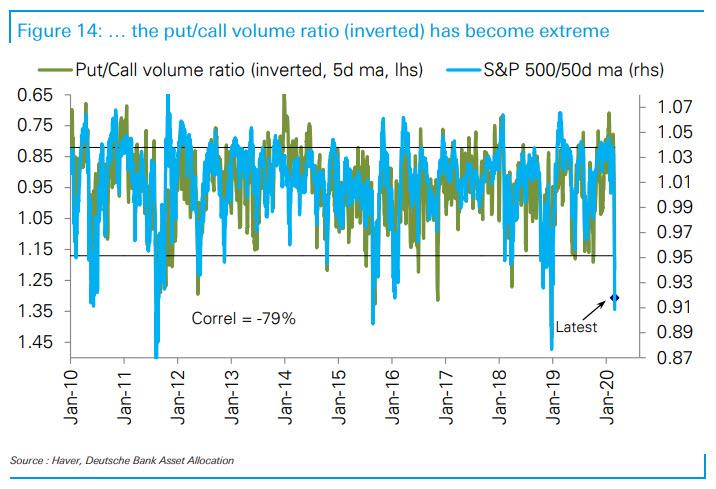

While on any other occasion last week’s selloff, which as we detailed extensively on Saturday included the puking by virtually every investor class which until recently was “all-in” risk assets, and has pushed the market to record oversold with the Put/Call ratio surging to a level that traditionally suggests a near-term bottom has arrived…

… this time it may be a more difficult for the oversold bounce to emerge, for two main reasons.

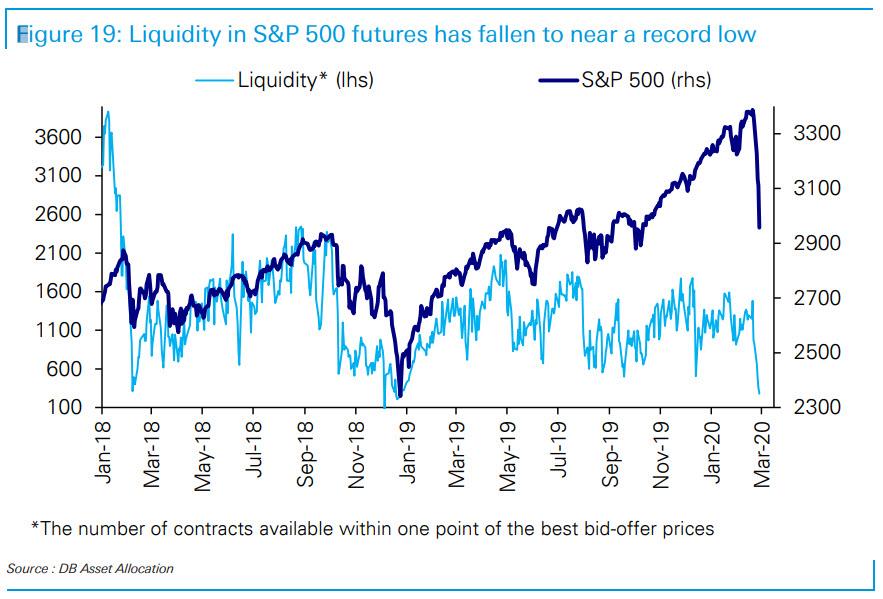

First, as the following chart from Deutsche Bank shows, overall liquidity for S&P500 futures has fallen to all time lows even though the S&P was trading near all time highs as recently as a week ago. As such, the recent melt up levitation was nothing more than a mirage, propelled mostly by stock buybacks among the Top 5 tech stocks and fickle retail investors, and once these were removed, the market entered the proverbial “trapdoor opening” formation. The problem is that virtually no liquidity, extreme moves to the downside are now very likely which in turn creates a reflexive relationship with risk sentiment, as the lower the liquidity and greater the selloff, the higher volatility surges leading to even lower liquidity, even more selling and so on. In short: absent central bank intervention, it will be virtually impossible for any major player to arrest the market’s collapse.

The second reason why the market will find it difficult to rebound from its extremely oversold state is that short interest is also near all time lows. While normally shorts provide a convenient speed break when stocks are plunging, as they tend to take profits and cover existing shorts, in the process bidding up risk, this time the Fed and corporate buyback orders had pushed the market so high that virtually no shorts are left. Of course, it is ironic: the forced extinction of shorts will now make sure many more longs also go extinct…

… unless of course, the Fed steps in as it always does when the market has had a 10% correction, and somehow makes everything better. On the other hand, if Powell disappoints longs who are literally praying for – if not divine – then monetary intervention at this moment, what few shorts are left are about to have the party of their lives.

Tyler Durden

Sun, 03/01/2020 – 17:37