Lumber Futures Fade From Two Year High As Recovery Stalls

Tyler Durden

Wed, 07/22/2020 – 19:00

Lumber futures have more than doubled since the lows in April as consumers ramped up renovations on homes during the pandemic, and others exited cities for suburbs while timber shortages developed.

In 15 weeks, or from the start of April 1, CME lumber futures climbed from $255 to $583, a 128% increase, hitting a two-year high.

Demand for lumber surged in April as consumers during the pandemic renovated their homes. Others took advantage of low-interest rates and escaped the socio-economic implosion in cities and quickly moved to rural communities. The surge in demand appears to be temporary and seasonal.

Bloomberg quoted RBC Capital Markets analyst Paul Quinn as saying the virus-induced recession was initially supposed to damage housing but instead sparked a boom.

Massive production cuts at sawmills in April (due to virus lockdowns) with low inventory were several factors leading to the rise in lumber futures.

“Inventories are still very low,” Quinn said. “Significant permanent capacity closures have led to widespread shortages.”

Optimism in housing and the economy have been a byproduct of the Federal Reserve and US government pumping trillions of dollars into the economy. The rise in lumber futures should not be confused with a V-shaped recovery in the economy.

“The perfect storm of stimulus, liquidity, supply chain constraints, and seasonality have benefited lumber. Looking forward, all of the above go away,” said Teddy Vallee, CIO of Pervalle Global.

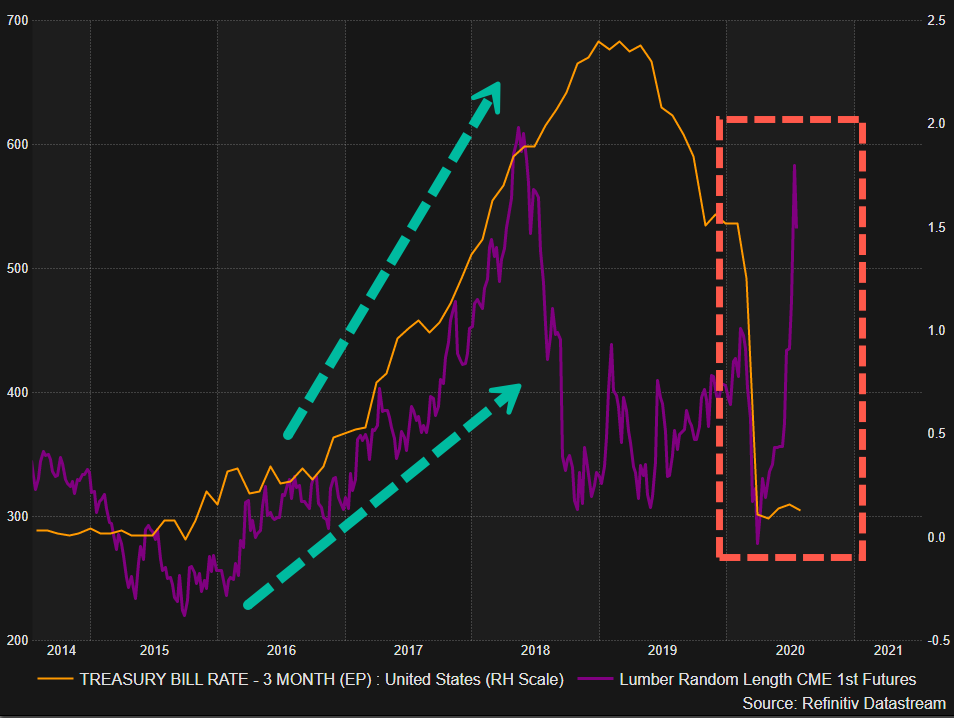

3-Month Treasury bill rate didn’t follow lumber futures higher as in past recoveries, suggesting timber prices will come back down to Earth as the economy is far from a robust recovery.

There are significant headwinds in the housing market, including 4.1 million loans in forbearance, high unemployment, a quarter of personal income is derived from the government, and housing prices are expected to slump in major cities.

With the recovery stalling, lumber futures might be introduced to our friend named gravity.